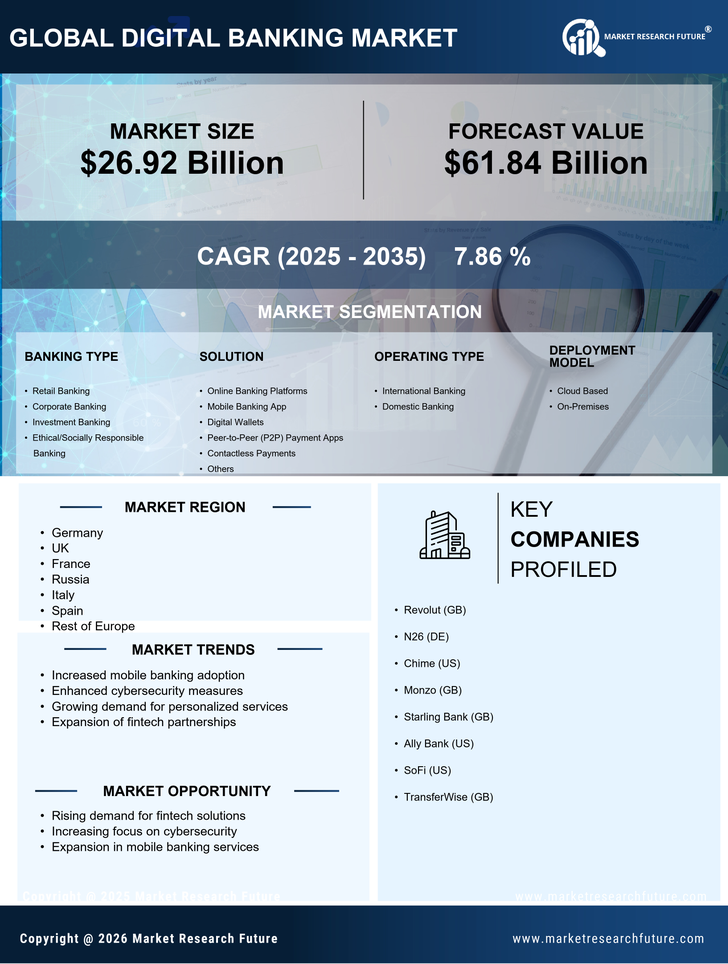

The digital banking market in Europe is characterized by a rapidly evolving competitive landscape, driven by technological advancements and changing consumer preferences. Key players such as Revolut (GB), N26 (DE), and Monzo (GB) are at the forefront, each adopting distinct strategies to enhance their market positioning. Revolut (GB) focuses on continuous innovation, expanding its product offerings to include cryptocurrency trading and stock trading, thereby appealing to a broader demographic. N26 (DE), on the other hand, emphasizes user experience and simplicity, leveraging its mobile-first approach to attract tech-savvy consumers. Monzo (GB) has carved a niche by prioritizing customer engagement and community building, which fosters loyalty and enhances its brand image. Collectively, these strategies contribute to a competitive environment that is increasingly defined by innovation and customer-centricity.

The business tactics employed by these companies reflect a nuanced understanding of market dynamics. For instance, localizing services to meet regional needs and optimizing digital platforms for seamless user experiences are common practices. The competitive structure of the market appears moderately fragmented, with numerous players vying for market share. However, the influence of major players like Revolut (GB) and N26 (DE) is substantial, as they set benchmarks for service quality and technological integration that smaller entities strive to emulate.

In October 2025, Revolut (GB) announced a strategic partnership with a leading fintech firm to enhance its AI-driven customer service capabilities. This move is likely to improve customer satisfaction and operational efficiency, positioning Revolut (GB) as a leader in customer service innovation within the digital banking sector. The integration of AI technology not only streamlines operations but also provides personalized experiences, which are increasingly demanded by consumers.

In September 2025, N26 (DE) launched a new feature that allows users to manage their subscriptions directly through the app. This initiative reflects a growing trend towards financial management tools that empower users to take control of their finances. By offering such features, N26 (DE) enhances its value proposition, potentially increasing user retention and attracting new customers who seek comprehensive financial solutions.

In August 2025, Monzo (GB) expanded its services to include a savings account with competitive interest rates, aiming to attract users looking for better returns on their deposits. This strategic move not only diversifies Monzo's offerings but also positions it favorably against traditional banks, which may struggle to compete on interest rates. By appealing to the savings-conscious consumer, Monzo (GB) strengthens its market presence and enhances customer loyalty.

As of November 2025, the competitive trends in the digital banking market are increasingly shaped by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in enhancing service offerings and operational capabilities. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This shift underscores the importance of adaptability and forward-thinking strategies in maintaining a competitive edge in the digital banking landscape.