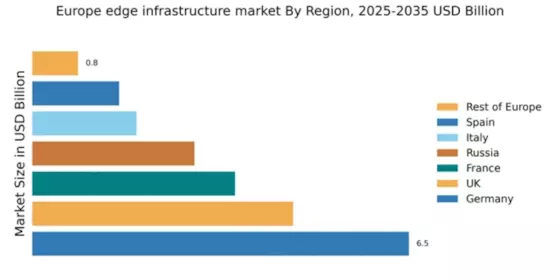

Germany : Strong Growth Driven by Innovation

Germany holds a commanding 6.5% market share in the European edge infrastructure sector, valued at approximately €2.5 billion. Key growth drivers include the rapid digital transformation across industries, increased demand for low-latency applications, and robust government initiatives promoting smart city projects. Regulatory frameworks are supportive, with policies aimed at enhancing data privacy and security, which further stimulate market growth. The country’s advanced infrastructure and industrial capabilities bolster its position as a leader in edge computing.

UK : Innovation and Investment Surge

The UK edge infrastructure market accounts for 4.5% of the European total, valued at around €1.8 billion. Growth is driven by increasing investments in 5G technology and the rise of IoT applications. Demand for real-time data processing is surging, particularly in sectors like finance and healthcare. The UK government has introduced initiatives to enhance digital infrastructure, including funding for tech startups and innovation hubs, which are crucial for market expansion. Regulatory support for data protection also plays a significant role in shaping the landscape.

France : Strategic Investments and Growth

France's edge infrastructure market holds a 3.5% share, valued at approximately €1.4 billion. The market is propelled by strategic investments in digital infrastructure and a growing emphasis on cloud services. Demand is particularly strong in urban areas like Paris and Lyon, where smart city initiatives are underway. The French government is actively promoting digital transformation through various funding programs and regulatory frameworks that encourage innovation. This supportive environment is fostering a competitive landscape with numerous local startups entering the market.

Russia : Growth Amidst Challenges

Russia's edge infrastructure market represents 2.8% of the European share, valued at about €1.1 billion. Key growth drivers include the increasing demand for localized data processing and government initiatives aimed at enhancing digital sovereignty. Despite regulatory challenges, the market is witnessing a rise in investments, particularly in major cities like Moscow and St. Petersburg. The competitive landscape features both local and international players, with a focus on sectors such as telecommunications and energy, which are rapidly adopting edge solutions.

Italy : Innovation in Key Sectors

Italy's edge infrastructure market accounts for 1.8% of the European total, valued at approximately €700 million. Growth is driven by the increasing adoption of IoT and smart manufacturing technologies. Key cities like Milan and Turin are at the forefront of this transformation, supported by government initiatives aimed at digital innovation. The competitive landscape includes both established players and emerging startups, particularly in the automotive and fashion industries, which are leveraging edge computing for enhanced operational efficiency.

Spain : Investment and Digital Transformation

Spain's edge infrastructure market holds a 1.5% share, valued at around €600 million. The market is experiencing growth due to rising investments in digital infrastructure and the expansion of 5G networks. Demand is particularly strong in urban centers like Madrid and Barcelona, where smart city projects are gaining traction. The Spanish government is actively promoting digital transformation through various initiatives, creating a favorable business environment. Major players in the market include both local firms and international giants, focusing on sectors like tourism and logistics.

Rest of Europe : Emerging Trends Across Regions

The Rest of Europe accounts for 0.79% of the edge infrastructure market, valued at approximately €300 million. This segment includes various countries with unique growth drivers, such as increasing digitalization and local government initiatives. Demand trends vary significantly, with some regions focusing on agricultural technology while others emphasize healthcare solutions. The competitive landscape is fragmented, featuring a mix of local startups and established players. The business environment is evolving, with regulatory frameworks adapting to support innovation and investment in edge technologies.