Expansion of 5G Networks

The rollout of 5G networks across North America significantly influences the edge infrastructure market. With 5G technology offering enhanced speed and connectivity, it enables a plethora of applications that require high bandwidth and low latency. The edge infrastructure market is expected to benefit from the anticipated 5G penetration, which is projected to reach over 50% of the population by 2026. This expansion facilitates the deployment of edge computing solutions, allowing businesses to process data closer to end-users. Consequently, industries such as healthcare, entertainment, and transportation are likely to leverage 5G capabilities to enhance service delivery and operational efficiency. The integration of edge infrastructure with 5G networks appears to be a critical driver for innovation and growth in the market.

Adoption of Smart City Initiatives

The edge infrastructure market in North America is significantly influenced by the adoption of smart city initiatives. Municipalities are increasingly investing in technologies that enhance urban living through improved infrastructure, transportation, and public services. Edge computing plays a crucial role in these initiatives by enabling real-time data processing for applications such as traffic management, waste management, and public safety. As cities aim to become more efficient and sustainable, the demand for edge infrastructure solutions is expected to rise. Reports indicate that investments in smart city projects could exceed $100 billion by 2026, further propelling the edge infrastructure market. This trend highlights the potential for collaboration between public and private sectors to drive innovation and improve urban environments.

Increased Focus on Data Sovereignty

In North America, the edge infrastructure market is increasingly shaped by the emphasis on data sovereignty. Organizations are becoming more aware of the legal and regulatory implications of data storage and processing, particularly in light of privacy laws such as the California Consumer Privacy Act (CCPA). This focus on data sovereignty drives companies to adopt edge computing solutions that allow them to retain control over their data. By processing data locally, businesses can comply with regional regulations while also enhancing data security. The edge infrastructure market is likely to see a rise in demand for solutions that prioritize data sovereignty, as organizations seek to mitigate risks associated with data breaches and non-compliance. This trend suggests a growing intersection between technology and regulatory frameworks, influencing market dynamics.

Rising Demand for Low Latency Solutions

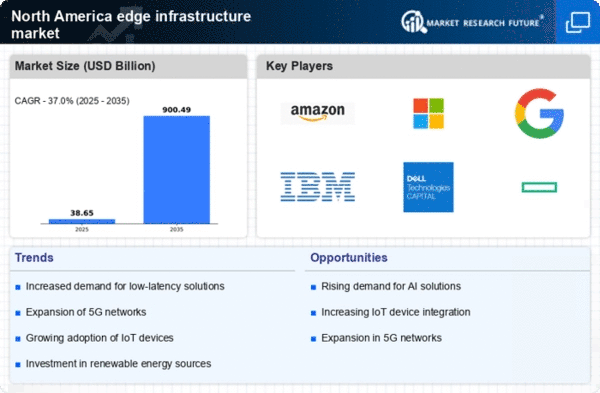

The edge infrastructure market in North America experiences a notable surge in demand for low latency solutions. As industries increasingly rely on real-time data processing, the need for reduced latency becomes paramount. Applications such as autonomous vehicles, smart manufacturing, and augmented reality require instantaneous data transmission. According to recent estimates, the edge infrastructure market is projected to grow at a CAGR of approximately 25% through 2026, driven by this demand. Companies are investing heavily in edge computing technologies to ensure that data is processed closer to the source, thereby minimizing delays. This trend indicates a shift towards decentralized computing, where data is processed at the edge rather than in centralized data centers, enhancing overall efficiency and responsiveness in various sectors.

Growth of Remote Work and Digital Transformation

The edge infrastructure market in North America is experiencing growth driven by the rise of remote work and ongoing digital transformation efforts. As organizations adapt to new work models, there is an increasing reliance on cloud services and edge computing to support distributed teams. This shift necessitates robust infrastructure that can handle increased data traffic and provide seamless connectivity. The market is projected to expand as businesses invest in edge solutions to enhance collaboration and productivity. According to industry forecasts, the edge infrastructure market could reach a valuation of $30 billion by 2027, reflecting the growing importance of digital tools in the workplace. This trend underscores the need for scalable and efficient edge infrastructure to support evolving business needs.