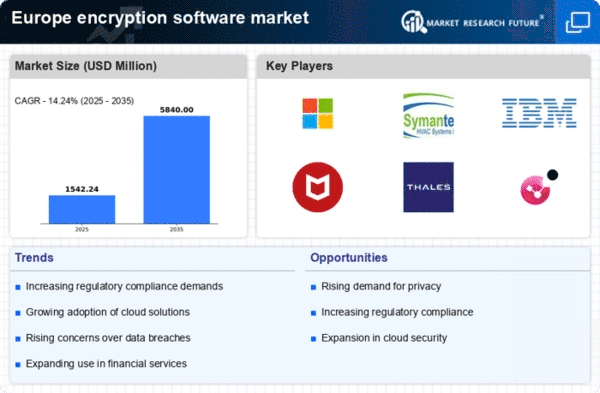

Increased Cloud Adoption

The shift towards cloud computing is significantly impacting the encryption software market in Europe. As more businesses migrate their operations to the cloud, the need for secure data transmission and storage becomes paramount. Encryption solutions are essential for protecting data in transit and at rest within cloud environments. In 2025, it is projected that the cloud services market in Europe will exceed €200 billion, driving the demand for encryption software to secure these services. This trend indicates a growing recognition of the importance of encryption in safeguarding sensitive information stored in the cloud. The encryption software market is thus poised for growth as organizations seek to implement comprehensive encryption strategies to protect their cloud-based assets.

Rising Cybersecurity Threats

The encryption software market in Europe is experiencing growth due to the escalating threats posed by cybercriminals. As organizations face increasing incidents of data breaches and ransomware attacks, the demand for robust encryption solutions intensifies. In 2025, it is estimated that the cost of cybercrime in Europe could reach €1 trillion, prompting businesses to invest in encryption technologies to safeguard sensitive information. This trend indicates a heightened awareness of the need for data protection, driving the encryption software market forward. Companies are prioritizing encryption as a critical component of their cybersecurity strategies, leading to a surge in adoption across various sectors, including finance, healthcare, and government. The encryption software market is thus positioned to benefit from this growing emphasis on cybersecurity measures.

Emerging Compliance Standards

The encryption software market in Europe is influenced by the emergence of new compliance standards that mandate the use of encryption for data protection. Regulatory bodies are increasingly recognizing the importance of encryption in safeguarding sensitive information, leading to the establishment of stricter compliance requirements. In 2025, it is expected that over 60% of European organizations will be subject to new data protection regulations, necessitating the adoption of encryption solutions. This trend highlights the critical role of encryption in achieving compliance and mitigating risks associated with data breaches. The encryption software market is likely to benefit from this regulatory landscape, as organizations invest in encryption technologies to meet compliance standards and protect their data assets.

Growing Demand for Data Privacy

The encryption software market in Europe is being propelled by the rising demand for data privacy among consumers and businesses alike. With the implementation of regulations such as the General Data Protection Regulation (GDPR), organizations are compelled to adopt encryption solutions to protect personal data. In 2025, it is anticipated that over 70% of European companies will prioritize data privacy, leading to increased investments in encryption technologies. This trend underscores the importance of encryption in maintaining customer trust and compliance with legal requirements. As data breaches continue to make headlines, the encryption software market is likely to see sustained growth as organizations strive to enhance their data protection measures and ensure compliance with evolving privacy standards.

Advancements in Encryption Technologies

Technological advancements are significantly influencing the encryption software market in Europe. Innovations such as quantum encryption and advanced cryptographic algorithms are enhancing the effectiveness of encryption solutions. As organizations seek to protect their data against sophisticated threats, the demand for cutting-edge encryption technologies is likely to rise. In 2025, the market for encryption software is projected to grow at a CAGR of 12%, reflecting the increasing reliance on advanced encryption methods. This growth is driven by the need for organizations to comply with stringent data protection regulations and to ensure the confidentiality of sensitive information. The encryption software market is thus evolving rapidly, with new technologies emerging to meet the demands of a dynamic digital landscape.