Adoption of Functional Foods

The rise of functional foods is significantly influencing the food inclusions market in Europe. Consumers are increasingly seeking products that offer health benefits beyond basic nutrition, such as enhanced immunity or digestive health. This trend is reflected in the growing popularity of inclusions like probiotics, fiber-rich ingredients, and superfoods. Recent studies indicate that the functional food market in Europe is expected to grow at a CAGR of 8% over the next five years. This growth presents opportunities for the food inclusions market to innovate and develop new products that meet these health-oriented demands, thereby attracting a broader consumer base.

Expansion of Snack Food Segment

The snack food segment is a significant driver for the food inclusions market in Europe, as it continues to grow rapidly. With the increasing trend of on-the-go snacking, manufacturers are incorporating various inclusions to enhance flavor and texture. Data suggests that the snack food market in Europe is projected to reach €30 billion by 2026, with inclusions such as chocolate chips, dried fruits, and flavored nuts becoming increasingly popular. This expansion is prompting companies to explore innovative combinations of inclusions that cater to diverse consumer tastes. The food inclusions market is thus benefiting from this trend, as brands seek to differentiate their products in a competitive landscape.

Growing Interest in Ethnic Flavors

The food inclusions market in Europe is witnessing a growing interest in ethnic flavors, driven by the increasing diversity of the population and a desire for unique culinary experiences. Consumers are exploring flavors from various cultures, leading to a demand for inclusions that reflect these preferences, such as spices, herbs, and exotic fruits. Market analysis indicates that the ethnic food segment is expected to grow by 10% annually, which is likely to influence the types of inclusions used in products. The food inclusions market is responding to this trend by developing innovative products that cater to the evolving tastes of consumers, thereby enhancing the overall appeal of food offerings.

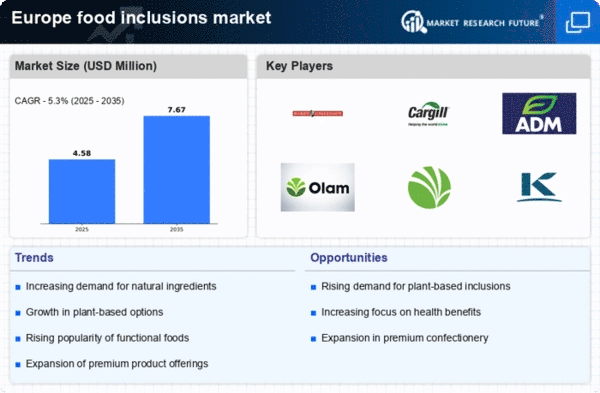

Rising Demand for Natural Ingredients

The food inclusions market in Europe is experiencing a notable shift towards natural ingredients, driven by consumer preferences for clean label products. This trend indicates a growing awareness of health and wellness, with consumers increasingly scrutinizing ingredient lists. According to recent data, approximately 65% of European consumers express a preference for products containing natural inclusions, such as fruits, nuts, and seeds. This demand is compelling manufacturers to innovate and reformulate their offerings, ensuring that they align with consumer expectations. The food inclusions market is thus adapting to these preferences, leading to an increase in the availability of products that emphasize natural and organic inclusions, which are perceived as healthier alternatives.

Regulatory Support for Healthier Options

Regulatory frameworks in Europe are increasingly supporting the development of healthier food options, which is positively impacting the food inclusions market. Initiatives aimed at reducing sugar and fat content in food products are encouraging manufacturers to explore alternative inclusions that align with these guidelines. For instance, the European Commission has set targets for reducing sugar in processed foods, which has led to a surge in demand for natural sweeteners and healthier inclusions. This regulatory environment is fostering innovation within the food inclusions market, as companies strive to comply with these standards while still delivering appealing products to consumers.