Growth of the Snack Food Sector

The snack food sector in Germany is witnessing robust growth, which is significantly impacting the food inclusions market. As consumers increasingly seek convenient and on-the-go snack options, the demand for innovative inclusions in snack products is rising. In 2025, the snack food segment is expected to represent around 40% of the food inclusions market. This growth is attributed to changing lifestyles and the desire for healthier snack alternatives, prompting manufacturers to incorporate inclusions such as protein bars, granola, and fruit pieces. The integration of these inclusions not only enhances the nutritional profile of snacks but also adds texture and flavor, appealing to a broader consumer base. Consequently, the food inclusions market is likely to benefit from this trend, as companies strive to meet the evolving preferences of health-conscious snackers.

Expansion of E-commerce Channels

The rise of e-commerce is significantly influencing the food inclusions market in Germany. As online shopping becomes increasingly popular, consumers are seeking convenient ways to purchase food products, including inclusions. In 2025, it is anticipated that e-commerce will account for around 20% of the food inclusions market. This shift is prompting manufacturers to enhance their online presence and develop strategies to reach consumers through digital platforms. The convenience of online shopping, coupled with the ability to access a wider variety of products, is likely to drive sales in the food inclusions market. Additionally, e-commerce allows for targeted marketing and personalized shopping experiences, which can further enhance consumer engagement. As the digital landscape continues to evolve, the food inclusions market is expected to adapt, leveraging e-commerce to meet the changing preferences of consumers.

Increased Focus on Sustainability

Sustainability is becoming a pivotal concern within the food inclusions market in Germany. As consumers become more environmentally conscious, there is a growing demand for sustainably sourced ingredients. This trend is influencing manufacturers to adopt eco-friendly practices in their sourcing and production processes. In 2025, it is estimated that around 25% of the food inclusions market will be driven by sustainably sourced products. This shift not only addresses consumer concerns but also aligns with broader industry goals of reducing carbon footprints and promoting ethical sourcing. Companies that prioritize sustainability are likely to gain a competitive edge in the food inclusions market, as consumers increasingly favor brands that demonstrate a commitment to environmental stewardship. This focus on sustainability may also lead to innovations in product development, as manufacturers explore new ways to create inclusions that are both appealing and environmentally friendly.

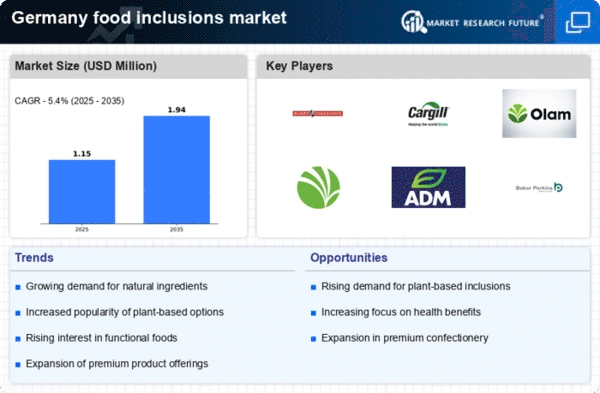

Rising Demand for Natural Ingredients

The food inclusions market in Germany is experiencing a notable shift towards natural ingredients, driven by consumer preferences for clean label products. As health awareness increases, consumers are gravitating towards food items that contain fewer artificial additives. This trend is reflected in the market, where natural inclusions such as nuts, seeds, and dried fruits are gaining traction. In 2025, the market for natural food inclusions is projected to account for approximately 35% of the total food inclusions market. This shift not only aligns with consumer health trends but also encourages manufacturers to innovate and diversify their product offerings, thereby enhancing the overall appeal of the food inclusions market. Furthermore, regulatory pressures regarding food labeling are likely to reinforce this trend, pushing companies to adopt more transparent practices in their ingredient sourcing.

Technological Innovations in Production

Technological advancements are playing a crucial role in shaping the food inclusions market in Germany. Innovations in processing techniques and ingredient formulation are enabling manufacturers to create more diverse and appealing inclusions. For instance, advancements in freeze-drying and extrusion technologies are enhancing the quality and shelf-life of inclusions, making them more attractive to consumers. In 2025, it is projected that technological innovations will contribute to approximately 30% of the growth in the food inclusions market. These advancements not only improve product quality but also allow for greater customization, catering to specific consumer preferences. As companies invest in research and development, the food inclusions market is likely to see a surge in unique and innovative products that meet the demands of a dynamic consumer landscape.