Growing Demand for Sustainable Solutions

The increasing consumer awareness regarding sustainability is a significant driver for the led lighting market. As individuals and organizations strive to reduce their carbon footprints, the demand for eco-friendly lighting solutions has surged. LED lights are recognized for their lower energy consumption and longer lifespans, making them a preferred choice for environmentally conscious consumers. In Europe, the market is responding to this trend, with a notable increase in the adoption of LED lighting in residential, commercial, and industrial sectors. The led lighting market is likely to experience robust growth as sustainability becomes a core value for consumers. Market data suggests that the share of LED lighting in the overall lighting market could reach 70% by 2025, reflecting the shift towards greener alternatives.

Regulatory Support for Energy Efficiency

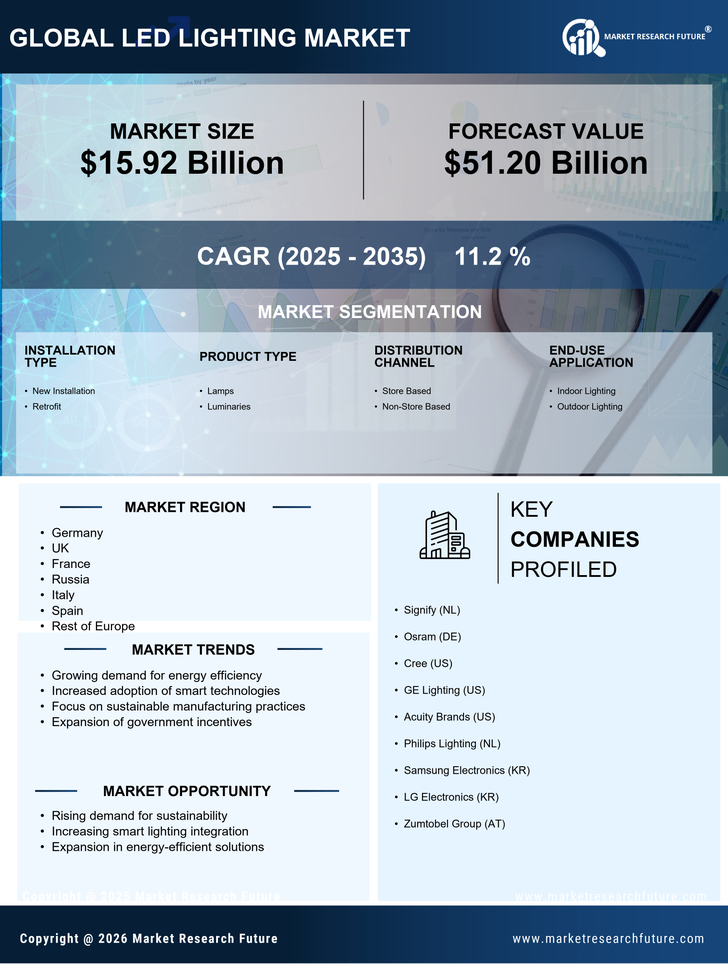

The regulatory landscape in Europe increasingly emphasizes energy efficiency, which significantly influences the led lighting market. Governments are implementing stringent regulations aimed at reducing energy consumption and greenhouse gas emissions. For instance, the European Union has set ambitious targets to cut energy use by 32.5% by 2030. This regulatory support encourages the adoption of energy-efficient technologies, including LED lighting solutions. As a result, manufacturers are compelled to innovate and enhance their product offerings to comply with these regulations. The led lighting market is likely to benefit from these initiatives, as consumers and businesses seek compliant solutions that not only meet legal requirements but also reduce operational costs. This trend is expected to drive market growth, with projections indicating a compound annual growth rate (CAGR) of around 10% in the coming years.

Economic Incentives and Financial Support

Economic incentives provided by European governments are significantly impacting the led lighting market. Various financial support programs, including subsidies and tax rebates, are designed to encourage the transition to energy-efficient lighting solutions. These incentives lower the initial investment costs associated with LED lighting installations, making them more accessible to a broader range of consumers and businesses. The led lighting market is likely to see increased adoption rates as these financial mechanisms facilitate the shift from traditional lighting to LED solutions. Furthermore, market analysts indicate that the cumulative savings from reduced energy bills and maintenance costs could lead to a return on investment within a few years, further motivating consumers to make the switch.

Technological Advancements in Lighting Solutions

Technological advancements play a pivotal role in shaping the led lighting market. Innovations in LED technology, such as improved lumens per watt efficiency and longer lifespans, are driving consumer interest and adoption. The integration of smart technologies, including IoT capabilities, allows for enhanced control and customization of lighting systems. In Europe, the market is witnessing a shift towards intelligent lighting solutions that can be remotely managed and optimized for energy savings. This evolution is supported by a growing demand for smart homes and buildings, where energy efficiency is paramount. The led lighting market is expected to see a surge in demand for these advanced solutions, with market analysts estimating that smart lighting could account for over 30% of the total market share by 2027.

Rising Urbanization and Infrastructure Development

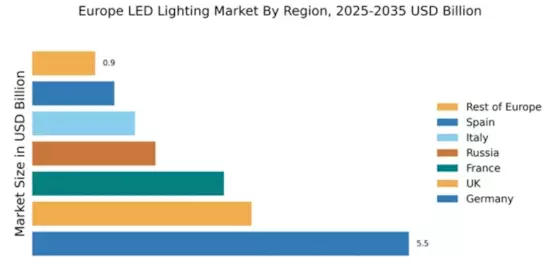

The trend of urbanization in Europe is a crucial driver for the led lighting market. As cities expand and infrastructure develops, there is a growing need for efficient and effective lighting solutions. Urban areas are increasingly adopting LED lighting for streetlights, public spaces, and commercial buildings due to their energy efficiency and longevity. This shift not only enhances public safety but also contributes to the aesthetic appeal of urban environments. The led lighting market is poised for growth as municipalities and private developers prioritize LED solutions in their projects. Projections suggest that urban areas could see a 50% increase in LED adoption by 2030, driven by the need for sustainable and cost-effective lighting solutions.