Growth of Co-working Spaces

The rise of co-working spaces is significantly impacting the office furniture market in Europe. As more professionals seek flexible work arrangements, the demand for adaptable and multifunctional furniture is increasing. Co-working spaces require furniture that can easily be reconfigured to accommodate various activities, from meetings to collaborative work. This trend is driving innovation in furniture design, with an emphasis on versatility and space efficiency. In 2025, the co-working segment is expected to contribute to a 20% increase in office furniture sales, highlighting the shift towards shared work environments. This growth indicates that the office furniture market is evolving to meet the needs of a diverse workforce, fostering collaboration and creativity.

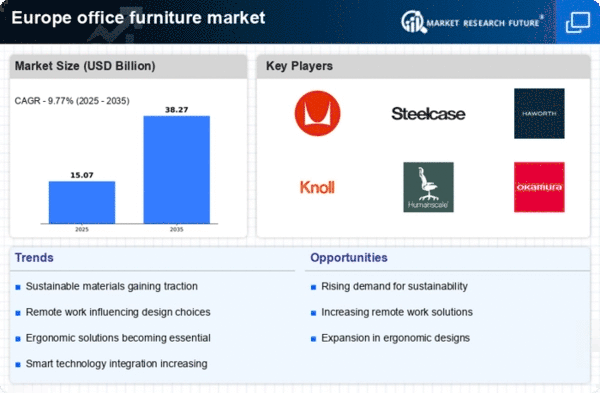

Increased Focus on Employee Well-being

The office furniture market in Europe is witnessing a heightened emphasis on employee well-being. Companies are increasingly recognizing the importance of creating a conducive work environment that promotes health and productivity. This has led to a surge in demand for ergonomic furniture, which is designed to reduce physical strain and enhance comfort. Research indicates that investing in ergonomic office furniture can lead to a 20% increase in employee productivity. As organizations strive to attract and retain talent, the focus on well-being is likely to drive significant growth in the office furniture market. By prioritizing employee comfort, businesses are not only improving workplace satisfaction but also fostering a culture of health and wellness.

Rising Demand for Customizable Solutions

The office furniture market in Europe is experiencing a notable shift towards customizable solutions. As businesses seek to create unique workspaces that reflect their brand identity, the demand for tailored office furniture is on the rise. Customization allows companies to select materials, colors, and designs that align with their corporate culture. This trend is particularly evident in the growing popularity of modular furniture systems, which offer flexibility and adaptability. In 2025, the market for customizable office furniture is expected to account for approximately 30% of total sales, indicating a significant transformation in consumer preferences. This shift suggests that the office furniture market is evolving to meet the diverse needs of modern organizations.

Sustainability as a Competitive Advantage

Sustainability is becoming a crucial driver in the office furniture market in Europe. As environmental concerns gain prominence, companies are increasingly prioritizing eco-friendly materials and production processes. The demand for sustainable office furniture is projected to grow by 25% in the coming years, as businesses aim to reduce their carbon footprint. This trend is not only driven by regulatory pressures but also by consumer preferences for environmentally responsible products. Manufacturers are responding by offering furniture made from recycled materials and sustainable wood sources. By adopting sustainable practices, companies can enhance their brand image and appeal to environmentally conscious consumers, thereby gaining a competitive edge in the office furniture market.

Technological Advancements in Office Furniture

The office furniture market in Europe is increasingly influenced by technological advancements. Innovations such as smart desks and integrated charging stations are becoming prevalent, catering to the needs of modern workplaces. The integration of technology into furniture design not only enhances functionality but also improves user experience. For instance, the rise of remote work has led to a demand for adaptable furniture solutions that can accommodate various work styles. In 2025, the market for technologically integrated office furniture is projected to grow by approximately 15%, reflecting the industry's response to evolving workplace dynamics. This trend indicates a shift towards multifunctional office furniture that supports both collaboration and individual productivity, thereby reshaping the office furniture market in Europe.