Shifts in Dietary Preferences

The palm oil market in Europe is witnessing shifts in dietary preferences, particularly with the rise of plant-based diets. As consumers increasingly adopt vegetarian and vegan lifestyles, the demand for palm oil as a key ingredient in various food products is expected to grow. In 2025, the market for palm oil in food applications is projected to increase by 10%, driven by its versatility and functional properties. Additionally, palm oil is often perceived as a healthier alternative to trans fats, which further enhances its appeal. This shift in dietary preferences is prompting food manufacturers to reformulate products to include palm oil, thereby expanding its market presence. Consequently, the palm oil market is likely to benefit from these evolving consumer trends, leading to increased sales and market penetration.

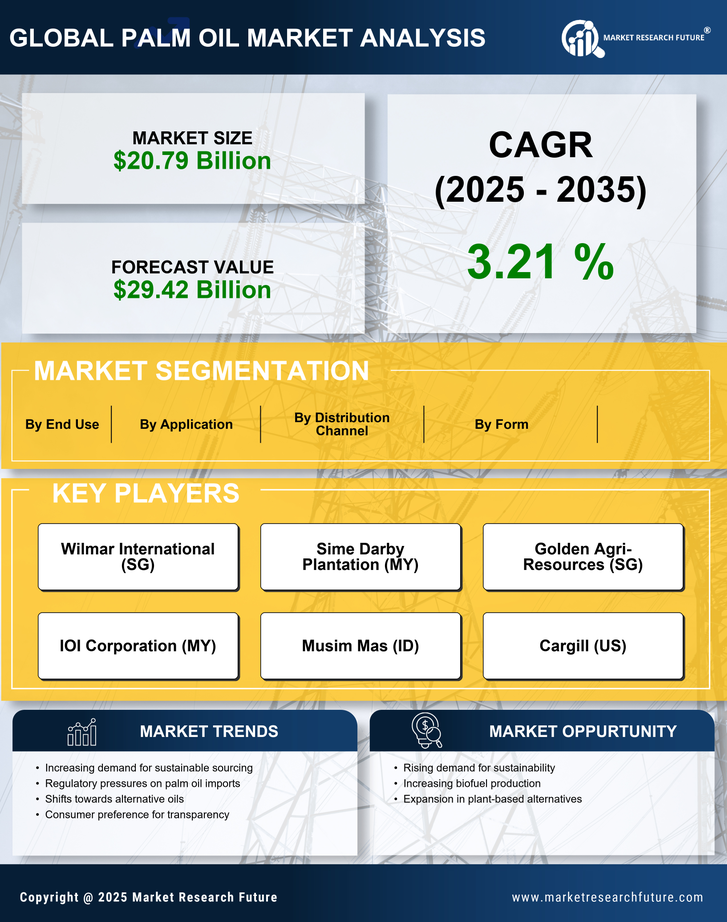

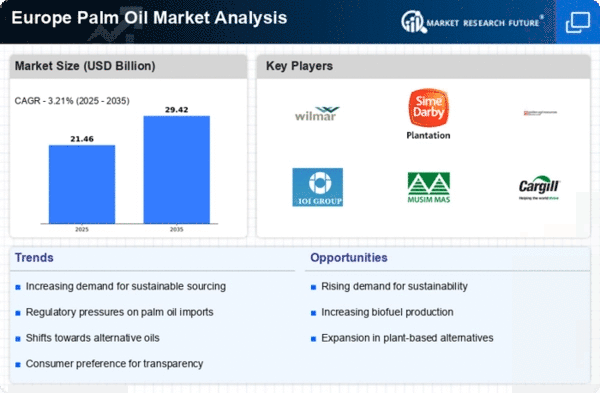

Rising Demand for Sustainable Products

The palm oil market in Europe is experiencing a notable shift towards sustainable products. As consumers become increasingly aware of environmental issues, there is a growing demand for sustainably sourced palm oil. This trend is reflected in the European Union's commitment to sustainability, which aims to reduce deforestation linked to palm oil production. In 2025, the EU's market for certified sustainable palm oil is projected to grow by approximately 15%, indicating a significant shift in consumer preferences. Retailers and manufacturers are responding by sourcing palm oil from certified suppliers, thereby enhancing their brand image and meeting regulatory requirements. This rising demand for sustainable products is likely to drive innovation within the palm oil market, as companies seek to develop new products that align with consumer values.

Technological Advancements in Production

Technological advancements are playing a crucial role in shaping the palm oil market in Europe. Innovations in agricultural practices, such as precision farming and biotechnology, are enhancing yield efficiency and reducing environmental impact. For instance, the adoption of satellite technology and drones for monitoring palm oil plantations is becoming more prevalent. These technologies enable farmers to optimize resource use, leading to a potential increase in yield by up to 20% while minimizing the use of fertilizers and pesticides. Furthermore, advancements in processing technologies are improving the quality and shelf life of palm oil products. As these technologies become more accessible, they are likely to attract investment and drive growth within the palm oil market, positioning Europe as a leader in sustainable palm oil production.

Increased Competition from Alternative Oils

The palm oil market in Europe is facing increased competition from alternative oils, such as sunflower and rapeseed oil. As consumers become more health-conscious and environmentally aware, they are exploring various oil options that may be perceived as more sustainable or healthier. This trend is reflected in the rising market share of alternative oils, which is projected to grow by 8% in 2025. Consequently, palm oil producers are under pressure to differentiate their products and emphasize the sustainability of their sourcing practices. In response, the palm oil market is likely to invest in marketing strategies that highlight the benefits of palm oil, such as its high yield and versatility. This competitive landscape may drive innovation and improvements in sustainability practices within the palm oil market.

Regulatory Support for Sustainable Practices

Regulatory support for sustainable practices is becoming increasingly influential in the palm oil market in Europe. The European Union has implemented various policies aimed at promoting sustainable agriculture and reducing the environmental impact of palm oil production. For instance, the EU's Green Deal emphasizes the importance of sustainable sourcing and aims to eliminate deforestation from supply chains by 2030. This regulatory framework is encouraging companies to adopt sustainable practices, which may lead to a more transparent supply chain. As a result, businesses that comply with these regulations are likely to gain a competitive advantage in the palm oil market. Furthermore, the financial incentives provided by the EU for sustainable practices could stimulate investment in sustainable palm oil production, fostering growth and innovation.