Increasing Regulatory Pressure

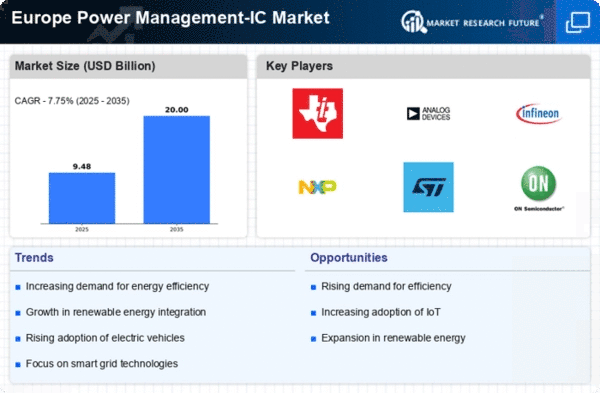

The The market in Europe is experiencing heightened regulatory pressure. aimed at reducing carbon emissions and enhancing energy efficiency. The European Union has implemented stringent regulations, such as the EU Green Deal, which mandates significant reductions in greenhouse gas emissions by 2030. This regulatory environment compels manufacturers to innovate and adopt advanced power management solutions. As a result, the demand for power management-ICs is projected to grow, with an estimated market value reaching €5 billion by 2026. Companies are increasingly investing in research and development to comply with these regulations, thereby driving the growth of the power management-ic market.

Advancements in IoT Applications

The power management-ic market in Europe is being driven by advancements in Internet of Things (IoT) applications. As IoT devices proliferate across various sectors, including healthcare, agriculture, and smart homes, the need for efficient power management solutions becomes paramount. In 2025, the European IoT market is projected to exceed €200 billion, highlighting the potential for power management-ICs to enhance device performance and energy efficiency. This growth suggests that manufacturers will increasingly focus on developing ICs that cater specifically to the unique power requirements of IoT devices, thereby fostering market growth.

Growth of Smart Grid Technologies

The power management-ic market in Europe is significantly influenced by the growth of smart grid technologies. As utilities and governments invest in modernizing electrical grids, the demand for efficient power management solutions is increasing. Smart grids facilitate better energy distribution and consumption monitoring, which requires advanced power management-ICs to optimize performance. The European smart grid market is projected to reach €30 billion by 2027, indicating a robust growth trajectory. This trend suggests that power management-ICs will play a crucial role in enhancing grid reliability and efficiency, thereby driving market expansion.

Rising Consumer Electronics Demand

The power management-ic market in Europe is benefiting from the rising demand for consumer electronics. As consumers increasingly seek energy-efficient devices, manufacturers are compelled to integrate advanced power management solutions into their products. The consumer electronics sector is expected to grow at a CAGR of 5% through 2026, with power management-ICs being essential for optimizing energy usage in devices such as smartphones, laptops, and home appliances. This trend indicates a strong correlation between consumer preferences for energy efficiency and the growth of the power management-ic market.

Surge in Electric Vehicle Adoption

The The market in Europe is witnessing a surge in demand due to the rapid adoption of electric vehicles (EVs).. With the European automotive industry transitioning towards electrification, the need for efficient power management solutions is becoming critical. In 2025, it is anticipated that EV sales will account for approximately 30% of total vehicle sales in Europe. This shift necessitates advanced power management-ICs to optimize battery performance and energy consumption. Consequently, manufacturers are focusing on developing specialized ICs tailored for EV applications, which is likely to propel the growth of the power management-ic market.