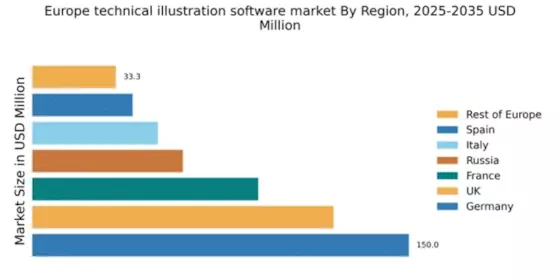

Germany : Innovation Drives Germany's Software Growth

Germany holds a dominant position in the European technical illustration software market, with a market value of $150.0 million, representing a significant share. Key growth drivers include a robust manufacturing sector, increasing demand for digital design tools, and government initiatives promoting digital transformation. The country’s strong infrastructure and industrial development further support software adoption, particularly in engineering and design sectors.

UK : UK's Software Demand on the Rise

London and Manchester are key markets, with a competitive landscape featuring major players like Adobe and Autodesk. The UK benefits from a vibrant tech ecosystem, with numerous startups and established firms driving innovation. The local business environment is conducive to software development, particularly in sectors like advertising, education, and engineering, where technical illustration is essential.

France : France's Market Thrives on Innovation

Paris and Lyon are significant markets, with a competitive landscape featuring local players like Dassault Systèmes. The presence of major international firms enhances competition, fostering innovation. The business environment is dynamic, with a focus on creative industries, where technical illustration plays a crucial role in product design and marketing.

Russia : Russia's Software Landscape Expanding

Moscow and St. Petersburg are key markets, with a competitive landscape featuring both local and international players. Major firms like Autodesk and Corel have a significant presence, contributing to market dynamics. The local business environment is evolving, with increasing investments in technology and a focus on sectors like manufacturing and design.

Italy : Italy's Market Focuses on Aesthetics

Milan and Turin are pivotal markets, with a competitive landscape featuring both local and international players. Companies like Adobe and Corel are well-established, contributing to a vibrant business environment. The focus on design and aesthetics in sectors like fashion, architecture, and automotive makes technical illustration software essential for local industries.

Spain : Spain's Market Adapts to Trends

Barcelona and Madrid are key markets, with a competitive landscape featuring major players like Adobe and Autodesk. The local business environment is supportive of tech innovation, with a focus on sectors such as advertising, education, and engineering. The demand for user-friendly software is rising, reflecting changing market dynamics and consumer preferences.

Rest of Europe : Varied Demand Across Europe

Countries like Belgium, Netherlands, and Switzerland are significant contributors, with a competitive landscape featuring both local and international players. Major firms like Adobe and Siemens have a presence, enhancing competition. The local business environment varies, with a focus on sectors like manufacturing, design, and education, where technical illustration software is increasingly essential.