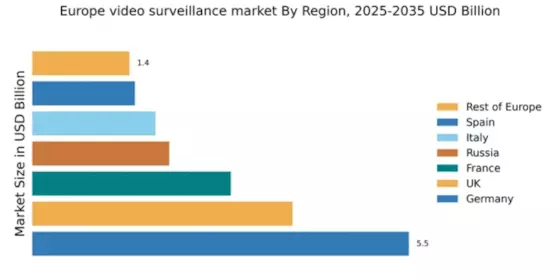

Germany : Strong Demand and Innovation Drive Growth

Germany holds a dominant market share of 5.5% in the European video surveillance sector, valued at approximately €1.5 billion. Key growth drivers include increasing security concerns, advancements in AI technology, and government initiatives promoting smart city projects. The demand for integrated security solutions is rising, supported by regulatory frameworks that encourage investment in surveillance infrastructure. Additionally, the country's robust industrial base fosters innovation in surveillance technologies.

UK : Evolving Regulations Shape Market Dynamics

The UK video surveillance market accounts for 3.8% of the European share, valued at around €1 billion. Growth is driven by heightened security needs in urban areas and the adoption of smart technologies. Regulatory changes, including GDPR, have influenced data handling practices, prompting businesses to invest in compliant surveillance systems. The increasing focus on public safety and crime prevention further fuels demand for advanced video solutions.

France : Strong Demand Across Multiple Sectors

France's video surveillance market represents 2.9% of the European total, valued at approximately €750 million. Key growth drivers include rising urbanization, security threats, and government support for public safety initiatives. The demand for surveillance in sectors like retail, transportation, and critical infrastructure is on the rise, supported by favorable regulatory policies that promote technological adoption and investment in security systems.

Russia : Government Initiatives Boost Surveillance Adoption

Russia holds a 2.0% share of the European video surveillance market, valued at around €500 million. The market is driven by government initiatives aimed at enhancing national security and urban safety. Increased investment in infrastructure projects and smart city developments is also contributing to growth. Demand for surveillance solutions is particularly strong in urban centers like Moscow and St. Petersburg, where security concerns are paramount.

Italy : Focus on Urban Safety and Compliance

Italy's video surveillance market accounts for 1.8% of the European share, valued at approximately €450 million. Growth is driven by rising security needs in urban areas and compliance with EU regulations. The Italian government has implemented policies to enhance public safety, leading to increased investments in surveillance technologies. Demand is particularly strong in cities like Milan and Rome, where crime prevention is a priority.

Spain : Urbanization Fuels Surveillance Growth

Spain represents 1.5% of the European video surveillance market, valued at around €400 million. The growth is driven by rapid urbanization and increasing security concerns in metropolitan areas. Government initiatives aimed at improving public safety and urban infrastructure are also key factors. Major cities like Madrid and Barcelona are seeing heightened demand for advanced surveillance solutions across various sectors, including retail and transportation.

Rest of Europe : Diverse Needs Across Multiple Countries

The Rest of Europe accounts for 1.42% of the video surveillance market, valued at approximately €350 million. This sub-region includes a mix of developed and developing markets, each with unique growth drivers. Factors such as local regulations, economic conditions, and security needs vary significantly. Countries like Belgium and the Netherlands are investing in smart surveillance technologies, while Eastern European nations are focusing on basic security infrastructure.