Emergence of 5G Technology

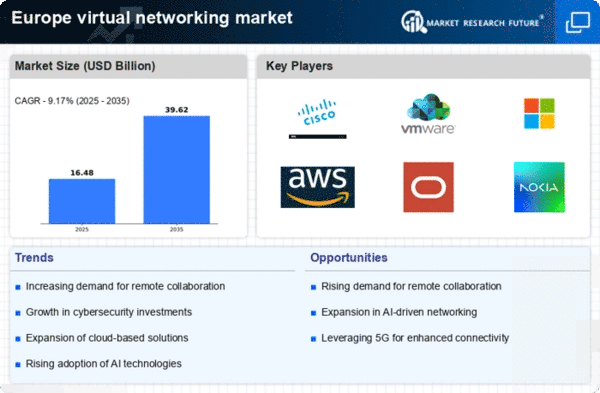

The advent of 5G technology is poised to revolutionize the virtual networking market in Europe. With its promise of ultra-fast data speeds and low latency, 5G enables more efficient and reliable virtual networking solutions. As of 2025, it is projected that 5G coverage will reach approximately 80% of urban areas in Europe, facilitating the deployment of advanced networking applications. This technological advancement not only enhances connectivity but also supports the growing demand for IoT devices and smart applications, which rely on robust virtual networking capabilities. Consequently, the virtual networking market is likely to witness substantial growth as businesses leverage 5G to optimize their operations and improve customer experiences.

Growth of Remote Work Culture

The virtual networking market is significantly impacted by the growth of remote work culture across Europe. As organizations embrace flexible work arrangements, the need for reliable virtual networking solutions becomes paramount. Recent studies indicate that around 50% of the European workforce engages in remote work, necessitating secure and efficient networking tools to facilitate collaboration and communication. This shift has led to an increased investment in virtual networking technologies, as companies seek to maintain productivity and connectivity among distributed teams. The demand for virtual private networks (VPNs) and other secure networking solutions is expected to rise, further propelling the growth of the virtual networking market in Europe.

Rising Adoption of Cloud Solutions

The virtual networking market in Europe experiences a notable surge due to the increasing adoption of cloud solutions. Organizations are migrating their operations to cloud-based platforms, which necessitates robust virtual networking capabilities. As of 2025, it is estimated that around 70% of European enterprises utilize cloud services, driving demand for virtual networking solutions that ensure seamless connectivity and data transfer. This trend is further supported by the European Union's initiatives to enhance digital infrastructure, which aim to bolster cloud adoption across various sectors. Consequently, the virtual networking market is poised for growth as businesses seek to optimize their cloud environments, enhance collaboration, and improve operational efficiency.

Regulatory Compliance and Data Privacy

In the context of the virtual networking market, regulatory compliance and data privacy concerns are increasingly influencing market dynamics in Europe. The implementation of stringent regulations, such as the General Data Protection Regulation (GDPR), compels organizations to adopt secure networking solutions that protect sensitive data. As of 2025, approximately 60% of European companies prioritize compliance with data protection laws, which drives the demand for virtual networking solutions that offer enhanced security features. This regulatory landscape not only shapes the purchasing decisions of enterprises but also encourages innovation within the virtual networking market, as providers develop solutions that align with compliance requirements while ensuring data integrity and confidentiality.

Increased Investment in Digital Transformation

The virtual networking market in Europe is experiencing a surge in investment driven by the ongoing digital transformation initiatives across various sectors. Organizations are increasingly recognizing the importance of digital technologies in enhancing operational efficiency and customer engagement. As of 2025, it is estimated that European companies will allocate over €200 billion towards digital transformation efforts, which includes upgrading their networking infrastructure. This investment trend is likely to bolster the demand for advanced virtual networking solutions that support seamless integration of digital tools and platforms. As businesses strive to remain competitive in a rapidly evolving landscape, the virtual networking market is expected to benefit from this influx of capital aimed at fostering innovation and improving connectivity.