Aging Population

The demographic shift towards an aging population in Europe is significantly impacting the vitamins market. As the population ages, there is an increasing prevalence of age-related health issues, which drives the demand for vitamins and dietary supplements. Older adults are more likely to seek products that support bone health, cognitive function, and overall vitality. This demographic trend is projected to contribute to a market growth rate of around 6% annually. The vitamins market is responding by developing specialized formulations that address the unique nutritional needs of older consumers. This focus on age-specific products not only enhances market offerings but also aligns with the broader trend of personalized health solutions, thereby fostering further growth in the sector.

Growing Health Consciousness

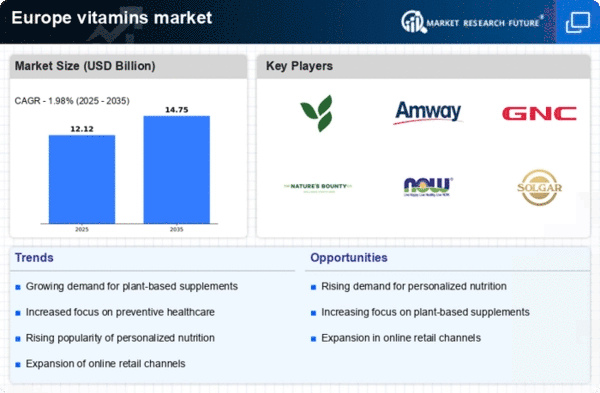

The increasing awareness of health and wellness among consumers is a pivotal driver in the vitamins market. As individuals become more informed about the benefits of vitamins and supplements, there is a noticeable shift towards preventive health measures. This trend is reflected in the rising sales of vitamin products, which have seen an annual growth rate of approximately 8% in Europe. Consumers are actively seeking products that enhance their overall well-being, leading to a surge in demand for multivitamins and specific nutrient supplements. The vitamins market is adapting to this shift by offering a diverse range of products that cater to various health needs, including immunity support and energy enhancement. This growing health consciousness is likely to continue influencing purchasing decisions, thereby propelling the market forward.

Rise of E-commerce Platforms

The expansion of e-commerce platforms is transforming the vitamins market landscape in Europe. With the convenience of online shopping, consumers are increasingly turning to digital channels to purchase vitamins and supplements. This shift is evidenced by a reported increase of over 30% in online sales of health products in recent years. E-commerce allows for a wider selection of products, competitive pricing, and easy access to customer reviews, which enhances consumer confidence. The vitamins market is capitalizing on this trend by investing in online marketing strategies and optimizing their digital presence. As more consumers embrace online shopping, the industry is likely to see sustained growth, driven by the accessibility and convenience that e-commerce provides.

Innovative Product Development

Innovation in product development is a crucial driver for the vitamins market. Companies are increasingly focusing on creating unique formulations that cater to specific health concerns, such as stress relief, digestive health, and skin care. This trend is supported by consumer demand for products that offer targeted benefits, leading to the introduction of new delivery formats, such as gummies and effervescent tablets. The vitamins market is witnessing a surge in research and development investments, with an estimated increase of 15% in R&D spending over the past year. This commitment to innovation not only enhances product offerings but also helps companies differentiate themselves in a competitive market, ultimately driving sales and market share.

Regulatory Support and Standards

Regulatory support and the establishment of quality standards are vital drivers in the vitamins market. In Europe, stringent regulations ensure that vitamin products meet safety and efficacy standards, which fosters consumer trust. The European Food Safety Authority (EFSA) plays a significant role in this regard, providing guidelines that help maintain product quality. This regulatory framework is beneficial for both consumers and manufacturers, as it encourages the development of high-quality products. The vitamins market is likely to benefit from this supportive regulatory environment, as it enhances consumer confidence and encourages market growth. As companies comply with these standards, they are better positioned to capture market share and meet the evolving demands of health-conscious consumers.