Increased Demand for Automation

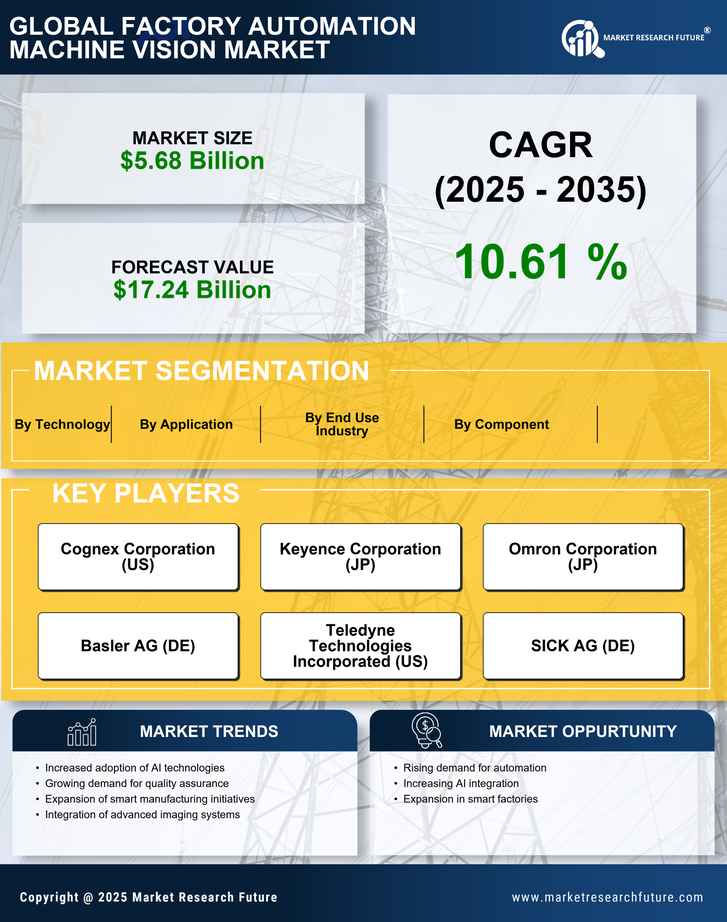

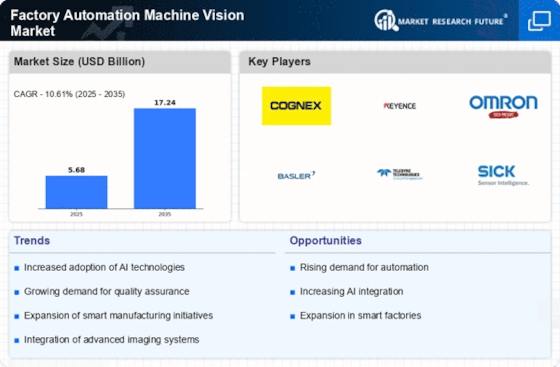

The Factory Automation Machine Vision Market is experiencing a surge in demand for automation solutions across various sectors. Industries are increasingly adopting automated systems to enhance productivity and reduce operational costs. According to recent data, the automation market is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is driven by the need for efficiency and precision in manufacturing processes. As companies strive to remain competitive, the integration of machine vision systems becomes essential. These systems facilitate real-time monitoring and quality assurance, thereby minimizing errors and waste. Consequently, the rising demand for automation is a pivotal driver for the Factory Automation Machine Vision Market.

Advancements in Imaging Technologies

Technological advancements in imaging technologies are significantly influencing the Factory Automation Machine Vision Market. Innovations such as high-resolution cameras, 3D imaging, and hyperspectral imaging are enhancing the capabilities of machine vision systems. These advancements enable more accurate inspections and analyses, which are crucial for maintaining quality standards in manufacturing. The market for imaging technologies is expected to expand, with projections indicating a growth rate of around 12% annually. As manufacturers seek to implement more sophisticated inspection processes, the demand for advanced imaging solutions will likely increase. This trend underscores the importance of technological evolution as a key driver in the Factory Automation Machine Vision Market.

Growing Emphasis on Quality Assurance

Quality assurance remains a critical focus within the Factory Automation Machine Vision Market. As industries face increasing pressure to deliver high-quality products, the role of machine vision systems in quality control becomes paramount. These systems provide precise measurements and defect detection, ensuring that products meet stringent quality standards. Recent statistics indicate that companies utilizing machine vision for quality assurance report a reduction in defects by up to 30%. This emphasis on quality not only enhances customer satisfaction but also reduces costs associated with rework and returns. Therefore, the growing focus on quality assurance is a significant driver for the Factory Automation Machine Vision Market.

Rising Labor Costs and Skills Shortages

Rising labor costs and a shortage of skilled labor are compelling factors driving the Factory Automation Machine Vision Market. As wages continue to increase, manufacturers are seeking ways to optimize their operations and reduce reliance on manual labor. Machine vision systems offer a viable solution by automating inspection and quality control processes, thereby mitigating the impact of labor shortages. Data suggests that automation can lead to a reduction in labor costs by up to 20%. Furthermore, the difficulty in finding skilled workers in certain regions is prompting companies to invest in automation technologies. This trend indicates that labor market dynamics are a significant driver for the Factory Automation Machine Vision Market.

Regulatory Compliance and Safety Standards

The Factory Automation Machine Vision Market is also influenced by stringent regulatory compliance and safety standards. As industries are required to adhere to various regulations, the implementation of machine vision systems becomes essential for ensuring compliance. These systems assist in monitoring processes and maintaining safety protocols, thereby reducing the risk of accidents and legal liabilities. The increasing complexity of regulations across sectors such as food and beverage, pharmaceuticals, and automotive is driving the adoption of machine vision technologies. Companies are investing in these systems to not only meet compliance requirements but also to enhance operational safety. Thus, regulatory compliance serves as a vital driver for the Factory Automation Machine Vision Market.