Growing Adoption of Industry 4.0

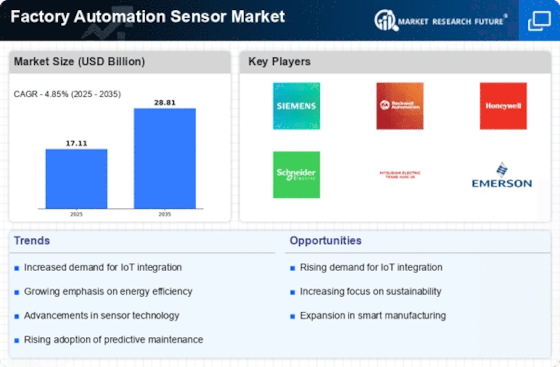

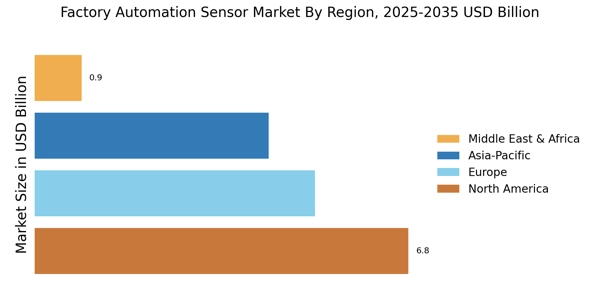

The Factory Automation Sensor Market is being significantly influenced by the growing adoption of Industry 4.0 principles. This paradigm shift towards smart manufacturing emphasizes the interconnectivity of machines, systems, and processes. Sensors are integral to this transformation, as they enable data collection and communication between devices. The increasing implementation of cyber-physical systems and the Internet of Things (IoT) is expected to drive the demand for advanced sensors. Market analysts predict that the Industry 4.0 trend will lead to a substantial increase in sensor deployment, with estimates indicating a potential market growth of 20% in the coming years. As manufacturers embrace this digital revolution, the Factory Automation Sensor Market is likely to expand in tandem with the rise of smart factories.

Advancements in Sensor Technology

Technological advancements in sensor technology are significantly influencing the Factory Automation Sensor Market. Innovations such as enhanced accuracy, miniaturization, and improved connectivity are enabling sensors to perform more complex tasks. For instance, the development of smart sensors equipped with artificial intelligence capabilities allows for better data analysis and decision-making. This evolution is expected to drive the market, as industries increasingly rely on sophisticated sensors to monitor processes and ensure quality control. Furthermore, the introduction of wireless sensors is likely to reduce installation costs and improve flexibility in manufacturing environments. As a result, the Factory Automation Sensor Market is poised for growth, driven by the continuous evolution of sensor technologies that meet the demands of modern manufacturing.

Increased Focus on Safety and Compliance

Safety and compliance regulations are becoming increasingly stringent across various industries, thereby impacting the Factory Automation Sensor Market. Manufacturers are compelled to implement advanced safety measures to protect workers and ensure compliance with regulatory standards. Sensors play a crucial role in this context, as they can detect hazardous conditions and provide real-time alerts. The market for safety sensors is projected to grow significantly, with estimates suggesting a rise of over 15% in the next few years. This heightened focus on safety not only enhances workplace conditions but also drives the adoption of automation technologies. Consequently, the Factory Automation Sensor Market is likely to benefit from the growing need for safety solutions that integrate seamlessly with automated systems.

Emphasis on Cost Reduction and Efficiency

Cost reduction and operational efficiency remain paramount concerns for manufacturers, thereby influencing the Factory Automation Sensor Market. Companies are increasingly seeking solutions that not only lower production costs but also enhance overall efficiency. The integration of automation sensors allows for streamlined processes, reduced waste, and improved resource management. Recent studies indicate that organizations implementing automation technologies can achieve cost savings of up to 30%. This focus on efficiency is driving the demand for advanced sensors that provide real-time data and insights. As manufacturers strive to optimize their operations, the Factory Automation Sensor Market is expected to witness robust growth, fueled by the ongoing quest for cost-effective and efficient manufacturing solutions.

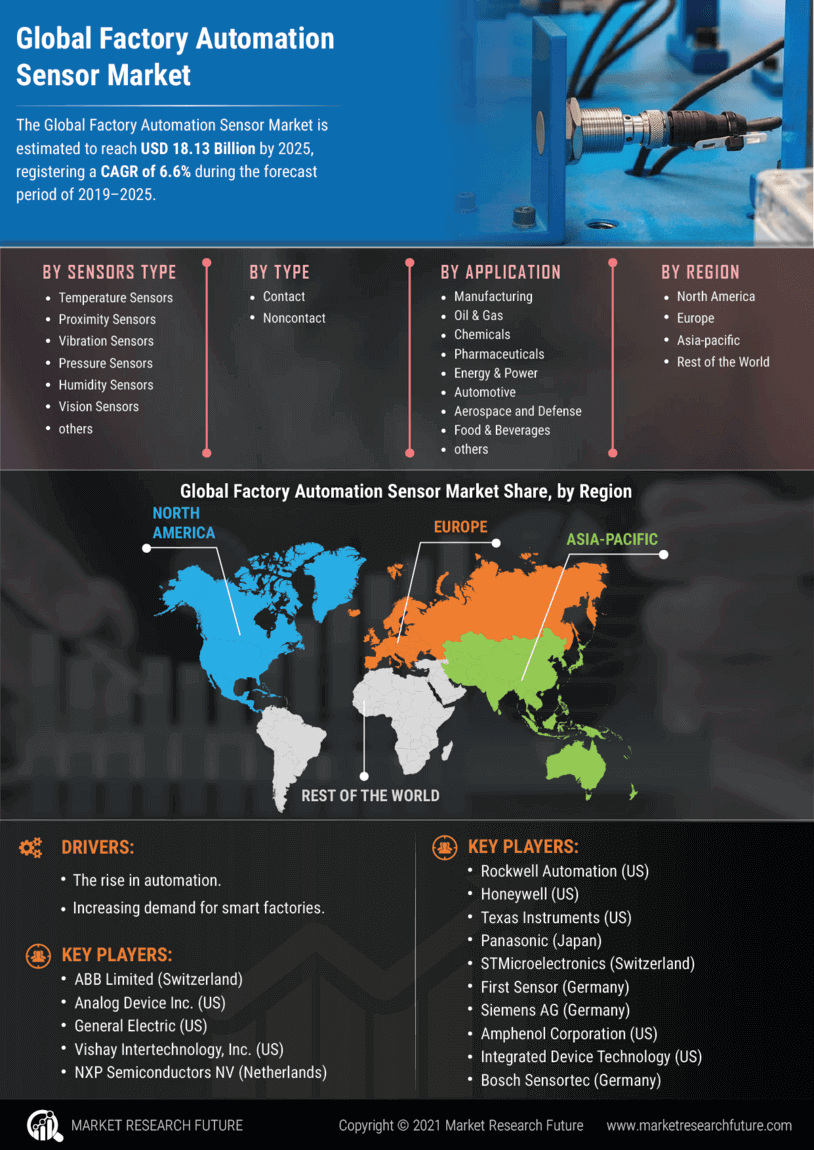

Rising Demand for Automation in Manufacturing

The Factory Automation Sensor Market is experiencing a notable surge in demand as manufacturers increasingly adopt automation technologies to enhance productivity and efficiency. This trend is driven by the need to reduce operational costs and improve product quality. According to recent data, the automation market is projected to grow at a compound annual growth rate of approximately 10% over the next five years. As industries strive for greater competitiveness, the integration of advanced sensors into manufacturing processes becomes essential. These sensors facilitate real-time monitoring and control, enabling manufacturers to optimize their operations. Consequently, the growing emphasis on automation is likely to propel the Factory Automation Sensor Market forward, as companies seek to leverage technology to meet evolving consumer demands.