Growing Demand for Customization

The Factory Industrial Automation SME SMB Market is witnessing a growing demand for customized automation solutions. As small and medium enterprises increasingly seek to differentiate themselves, they require tailored automation systems that can adapt to specific production needs. This trend is supported by data indicating that approximately 70% of SMEs are prioritizing customization in their operational strategies. The ability to offer unique products and services is becoming a competitive advantage, prompting automation providers to innovate and develop flexible solutions. Consequently, this driver is likely to enhance the market's growth trajectory, as SMEs invest in technologies that allow for greater personalization and responsiveness to market demands.

Integration of Advanced Robotics

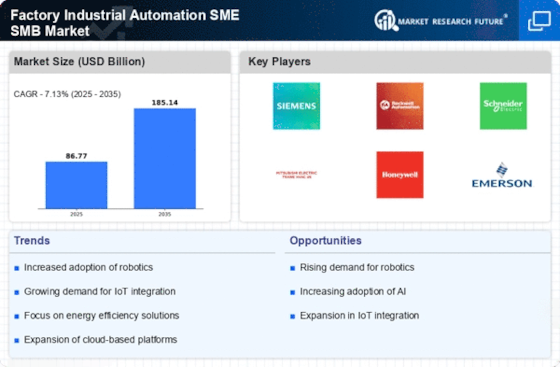

The integration of advanced robotics is a pivotal driver in the Factory Industrial Automation SME SMB Market. SMEs are increasingly adopting robotic solutions to enhance productivity and streamline operations. The market for industrial robots is projected to grow at a compound annual growth rate of 15% over the next five years. This growth is attributed to the ability of robots to perform repetitive tasks with precision and efficiency, allowing human workers to focus on more complex activities. As SMEs recognize the benefits of robotic automation, the demand for these technologies is likely to surge, further propelling the market forward.

Advancements in Artificial Intelligence

Advancements in artificial intelligence (AI) are significantly influencing the Factory Industrial Automation SME SMB Market. AI technologies are being integrated into automation systems, enabling predictive maintenance, quality control, and enhanced decision-making processes. Reports suggest that the implementation of AI in manufacturing can lead to a 20% increase in productivity. As SMEs adopt these technologies, they are likely to experience improved operational efficiency and reduced downtime. This trend indicates a shift towards more intelligent automation solutions, which could reshape the competitive landscape of the industry, as businesses leverage AI to optimize their manufacturing processes.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are becoming increasingly critical in the Factory Industrial Automation SME SMB Market. Governments and regulatory bodies are enforcing stricter safety regulations, compelling SMEs to invest in automation solutions that ensure compliance. This trend is evident in sectors such as food and beverage, where adherence to safety standards is paramount. Data indicates that non-compliance can result in significant financial penalties, prompting SMEs to prioritize automation as a means to meet these requirements. As a result, the demand for automation technologies that enhance safety and compliance is expected to rise, driving growth in the market.

Focus on Sustainability and Green Practices

A focus on sustainability and green practices is emerging as a significant driver in the Factory Industrial Automation SME SMB Market. SMEs are increasingly adopting automation solutions that minimize waste and energy consumption, aligning with global sustainability goals. Data suggests that companies implementing sustainable practices can reduce operational costs by up to 30%. This trend is prompting automation providers to develop eco-friendly technologies that not only enhance efficiency but also contribute to environmental conservation. As SMEs prioritize sustainability, the demand for innovative automation solutions that support these initiatives is expected to grow, influencing the overall market landscape.