Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are becoming increasingly stringent across various industries, thereby impacting the Finite Element Analysis Software Market. Companies are required to adhere to rigorous testing and validation processes to ensure product safety and reliability. FEA software provides essential tools for conducting simulations that help organizations meet these regulatory requirements effectively. As industries such as automotive and aerospace face heightened scrutiny regarding safety, the demand for FEA solutions that facilitate compliance is likely to increase. Recent reports suggest that the market for FEA software tailored for regulatory compliance is expected to grow by approximately 12% annually. This trend underscores the importance of FEA in supporting organizations in navigating complex regulatory landscapes while maintaining high safety standards.

Increased Investment in Research and Development

Investment in research and development (R&D) within the Finite Element Analysis Software Market is on the rise, as companies seek to enhance their competitive edge. Organizations are allocating substantial resources to develop cutting-edge software solutions that incorporate the latest technological advancements. This trend is particularly evident in sectors such as biomedical engineering and materials science, where the need for precise modeling and analysis is paramount. According to recent data, R&D spending in the engineering software sector has increased by over 15% in the past year, reflecting a commitment to innovation. As a result, the market is likely to witness the introduction of more sophisticated features and functionalities, catering to the evolving needs of engineers and researchers.

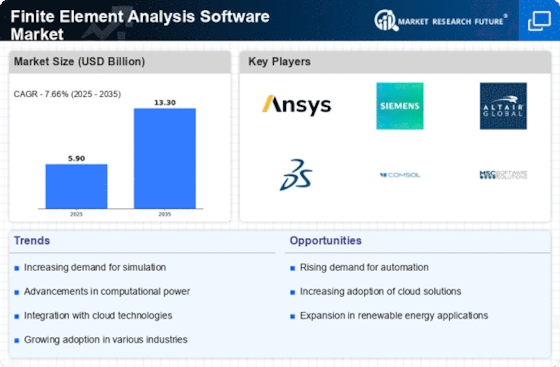

Rising Demand for Advanced Simulation Techniques

The Finite Element Analysis Software Market is experiencing a notable surge in demand for advanced simulation techniques. Industries such as aerospace, automotive, and civil engineering are increasingly adopting these software solutions to enhance product design and optimize performance. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years, driven by the need for accurate simulations that reduce development time and costs. As organizations strive for innovation, the integration of sophisticated simulation tools becomes essential, allowing engineers to predict how products will behave under various conditions. This trend indicates a shift towards more complex modeling capabilities, which are crucial for meeting the rigorous standards of modern engineering applications.

Emergence of Industry 4.0 and Smart Manufacturing

The emergence of Industry 4.0 and smart manufacturing is significantly influencing the Finite Element Analysis Software Market. As manufacturers adopt IoT technologies and automation, the need for advanced simulation tools becomes increasingly critical. FEA software plays a vital role in optimizing production processes and ensuring product quality by enabling real-time monitoring and predictive analysis. The market is projected to benefit from this trend, as companies seek to leverage data-driven insights to enhance operational efficiency. Furthermore, the integration of FEA with smart manufacturing systems is likely to create new opportunities for innovation, allowing for more responsive and adaptive manufacturing environments. This shift towards smart manufacturing is expected to drive substantial growth in the FEA software market.

Growing Adoption of Simulation in Product Lifecycle Management

The Finite Element Analysis Software Market is witnessing a growing adoption of simulation tools within product lifecycle management (PLM) processes. Companies are increasingly recognizing the value of integrating FEA software into their PLM strategies to enhance collaboration and streamline workflows. This integration allows for real-time analysis and feedback during the design phase, significantly reducing the time to market for new products. Recent studies indicate that organizations utilizing simulation in their PLM processes can achieve up to a 30% reduction in development time. As industries strive for efficiency and agility, the demand for FEA software that seamlessly integrates with PLM systems is expected to rise, further propelling market growth.