E-commerce Growth

The rapid growth of e-commerce is significantly impacting the Food And Beverage Packaging Market, necessitating adaptations in packaging strategies. As online shopping becomes more prevalent, the demand for packaging that ensures product integrity during transit is increasing. This shift is prompting manufacturers to develop packaging solutions that are not only protective but also visually appealing to enhance the unboxing experience. Data indicates that e-commerce sales in the food and beverage sector are projected to grow by over 20% in the coming years, driving the need for innovative packaging designs. Companies are focusing on lightweight and durable materials that can withstand shipping challenges while minimizing environmental impact. The evolution of e-commerce is likely to continue shaping packaging trends, as businesses strive to meet the expectations of online consumers.

Sustainability Initiatives

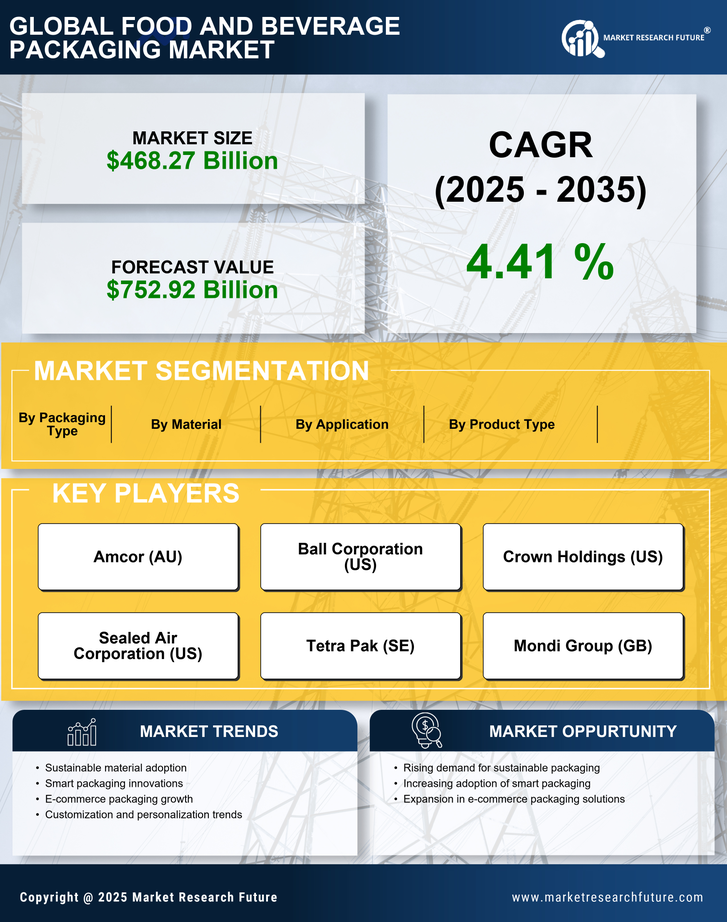

The increasing emphasis on sustainability is a pivotal driver in the Food And Beverage Packaging Market. Consumers are becoming more environmentally conscious, leading to a demand for eco-friendly packaging solutions. This trend is reflected in the rise of biodegradable and recyclable materials, which are gaining traction among manufacturers. According to recent data, the market for sustainable packaging is projected to grow at a compound annual growth rate of approximately 7% over the next five years. Companies are investing in innovative materials and processes to reduce their carbon footprint, which not only meets consumer expectations but also aligns with regulatory requirements. As a result, businesses that prioritize sustainability in their packaging strategies are likely to enhance their market position and appeal to a broader customer base.

Technological Advancements

Technological advancements are reshaping the Food And Beverage Packaging Market, driving efficiency and innovation. The integration of automation and smart technologies in packaging processes is enhancing production capabilities and reducing costs. For instance, the adoption of advanced printing techniques and digital technologies allows for more personalized packaging solutions, catering to diverse consumer preferences. Furthermore, the use of smart packaging technologies, such as QR codes and NFC tags, is becoming increasingly prevalent, enabling brands to engage with consumers directly. This trend is expected to contribute to a market growth rate of around 5% annually, as companies leverage technology to improve product visibility and traceability. The ongoing evolution of packaging technology is likely to create new opportunities for businesses to differentiate themselves in a competitive landscape.

Health and Safety Regulations

Health and safety regulations are a critical driver in the Food And Beverage Packaging Market, influencing packaging design and materials. Stringent regulations regarding food safety and hygiene are compelling manufacturers to adopt safer packaging solutions. Compliance with these regulations not only ensures consumer safety but also enhances brand reputation. The market is witnessing a shift towards materials that are free from harmful chemicals and additives, as consumers increasingly demand transparency in product labeling. According to industry reports, the packaging sector is expected to invest significantly in research and development to meet these regulatory standards. This focus on health and safety is likely to propel market growth, as companies that prioritize compliance can gain a competitive edge and foster consumer trust.

Consumer Preferences for Convenience

Consumer preferences for convenience are a driving force in the Food And Beverage Packaging Market, influencing packaging design and functionality. Busy lifestyles are prompting consumers to seek ready-to-eat and easy-to-use products, which in turn drives demand for packaging that enhances convenience. This trend is reflected in the growing popularity of single-serve and portion-controlled packaging, which caters to on-the-go consumption. Market analysis suggests that the convenience packaging segment is expected to witness a growth rate of approximately 6% annually, as manufacturers respond to changing consumer habits. Additionally, the rise of meal kits and pre-packaged foods is further fueling this demand. Companies that prioritize convenience in their packaging strategies are likely to capture a larger share of the market, appealing to time-conscious consumers.