Expansion of the Beverage Sector

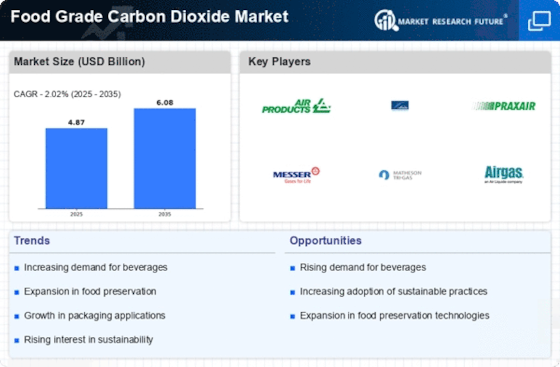

The Food Grade Carbon Dioxide Market is significantly influenced by the expansion of the beverage sector. With the increasing popularity of carbonated drinks, the demand for food grade carbon dioxide is on the rise. Market data suggests that the beverage industry represents a major portion of the food grade carbon dioxide consumption, particularly in soft drinks and sparkling water. As consumers continue to seek innovative beverage options, manufacturers are compelled to enhance their production processes, which often involves the use of food grade carbon dioxide for carbonation. This trend is expected to sustain the growth trajectory of the market, as beverage companies invest in new product development and marketing strategies.

Health Conscious Consumer Trends

The Food Grade Carbon Dioxide Market is also being shaped by the rising health consciousness among consumers. As individuals become more aware of their dietary choices, there is a growing preference for beverages and foods that are perceived as healthier. This trend has led to an increase in the production of low-calorie and naturally flavored carbonated drinks, which often utilize food grade carbon dioxide for carbonation. Market data suggests that the shift towards healthier options is influencing manufacturers to reformulate their products, thereby increasing the demand for food grade carbon dioxide. This evolving consumer behavior is likely to create new opportunities within the market, as companies adapt to meet these changing preferences.

Rising Demand in Food Processing

The Food Grade Carbon Dioxide Market is experiencing a notable increase in demand from the food processing sector. This surge is primarily attributed to the growing need for efficient preservation techniques and enhanced product quality. Food grade carbon dioxide is utilized in various applications, including carbonation of beverages and as a preservative in packaged foods. The market data indicates that the food processing segment accounts for a substantial share of the overall market, driven by consumer preferences for fresh and high-quality products. As manufacturers seek to extend shelf life and maintain flavor integrity, the reliance on food grade carbon dioxide is likely to intensify, thereby propelling market growth.

Regulatory Support for Food Safety

Regulatory support for food safety is a crucial driver for the Food Grade Carbon Dioxide Market. Governments and food safety authorities are increasingly emphasizing the importance of safe food handling and preservation methods. Food grade carbon dioxide is recognized for its efficacy in inhibiting microbial growth and extending shelf life, making it a preferred choice among food manufacturers. Market data indicates that compliance with stringent food safety regulations is driving the adoption of food grade carbon dioxide in various applications. As regulatory frameworks continue to evolve, the demand for food grade carbon dioxide is expected to rise, as manufacturers seek to ensure product safety and quality.

Technological Advancements in Carbonation

Technological advancements in carbonation processes are playing a pivotal role in shaping the Food Grade Carbon Dioxide Market. Innovations in equipment and techniques have led to more efficient and sustainable carbonation methods, which are increasingly adopted by manufacturers. These advancements not only improve the quality of carbonated beverages but also reduce operational costs. Market data indicates that companies investing in state-of-the-art carbonation technology are likely to gain a competitive edge, as they can offer superior products while minimizing waste. As the industry evolves, the integration of advanced carbonation technologies is expected to drive the demand for food grade carbon dioxide, further enhancing market dynamics.