Rising Awareness and Education on Heart Health

Rising awareness and education regarding heart health are pivotal in driving the coronary angiography-devices market. Public health campaigns in France have been instrumental in informing citizens about the risks associated with cardiovascular diseases and the importance of early detection. This heightened awareness is leading to an increase in preventive screenings and diagnostic procedures, including coronary angiography. As more individuals seek medical advice and intervention, the demand for advanced angiography devices is likely to rise. The market could see an annual growth rate of approximately 5% as a result of these educational initiatives. Furthermore, collaboration between healthcare providers and educational institutions may enhance the understanding of heart health, further propelling the coronary angiography-devices market.

Technological Innovations in Imaging Techniques

Technological innovations play a crucial role in shaping the coronary angiography-devices market. The introduction of advanced imaging techniques, such as 3D imaging and enhanced fluoroscopy, has significantly improved diagnostic accuracy and procedural outcomes. In France, the integration of artificial intelligence (AI) in imaging systems is emerging as a transformative factor, potentially increasing the efficiency of coronary angiography procedures. These innovations not only enhance the visualization of coronary arteries but also reduce the radiation exposure for patients and healthcare professionals. As a result, the market is expected to expand, with a projected growth rate of around 7% annually. The continuous evolution of imaging technologies is likely to attract investments and drive the development of new devices in the coronary angiography-devices market.

Increasing Demand for Minimally Invasive Procedures

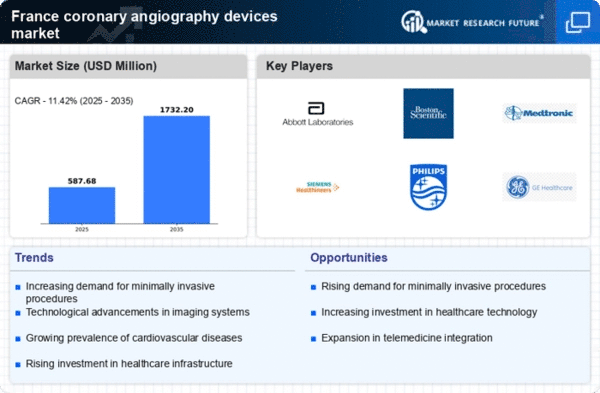

The rising preference for minimally invasive procedures is a notable driver in the coronary angiography-devices market. Patients and healthcare providers in France are increasingly opting for techniques that reduce recovery time and minimize surgical risks. This trend is reflected in the growing adoption of advanced coronary angiography devices, which facilitate less invasive interventions. the market is projected to witness a compound annual growth rate (CAGR) of approximately 6.5% from 2025 to 2035, driven by this demand.. Furthermore, The efficiency and effectiveness of these devices in diagnosing and treating coronary artery diseases enhance their popularity.. As healthcare systems continue to evolve, the emphasis on patient-centric care is likely to further bolster the growth of the coronary angiography-devices market in France.

Aging Population and Increased Healthcare Expenditure

The aging population in France is a significant driver of the coronary angiography-devices market. As individuals age, the incidence of cardiovascular diseases tends to rise, leading to a higher demand for diagnostic and therapeutic interventions. the French government has been increasing healthcare expenditure, which is projected to reach approximately €200 billion by 2026.. This financial commitment is likely to enhance access to advanced coronary angiography devices and improve healthcare infrastructure. Consequently, the market is expected to benefit from the growing number of elderly patients requiring coronary interventions. The demographic shift towards an older population, combined with increased healthcare funding, suggests a robust growth trajectory for the coronary angiography-devices market in the coming years.

Government Initiatives and Funding for Cardiovascular Health

Government initiatives and funding aimed at improving cardiovascular health are significant drivers of the coronary angiography-devices market. In France, various health policies have been implemented to enhance the quality of care for patients with cardiovascular conditions. These initiatives often include financial support for the acquisition of advanced medical technologies, including coronary angiography devices. The French government has allocated substantial resources to combat cardiovascular diseases, with funding expected to exceed €150 million in the next fiscal year. Such investments are likely to facilitate the adoption of innovative devices and improve patient outcomes. As a result, the coronary angiography-devices market is anticipated to experience steady growth, driven by these supportive government measures.