Increased Healthcare Expenditure

Japan's rising healthcare expenditure is a crucial driver for the coronary angiography-devices market. The country allocates a significant portion of its GDP to healthcare, with expenditures reaching approximately 10% in recent years. This financial commitment facilitates the procurement of advanced medical technologies, including coronary angiography devices. As hospitals and clinics invest in state-of-the-art equipment, the demand for these devices is likely to increase. Moreover, the emphasis on preventive healthcare and early diagnosis aligns with the growing need for effective coronary imaging solutions. Consequently, the coronary angiography-devices market is poised for growth, supported by the robust healthcare funding landscape in Japan.

Innovations in Imaging Technology

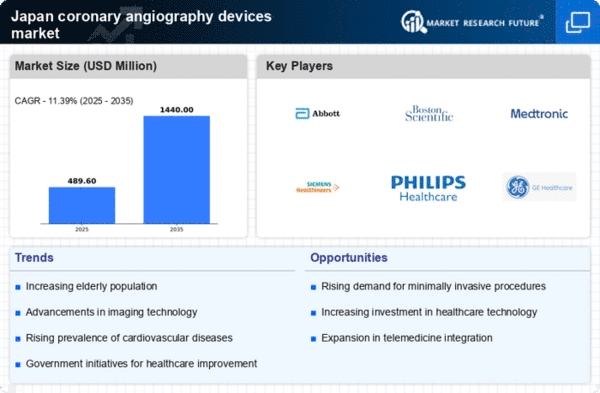

Innovations in imaging technology are significantly influencing the coronary angiography-devices market. The introduction of advanced imaging modalities, such as 3D imaging and high-resolution angiography, enhances the accuracy and efficiency of coronary procedures. These technological advancements allow for better visualization of coronary arteries, leading to improved diagnostic capabilities. In Japan, the market for these innovative devices is projected to grow at a CAGR of around 8% over the next five years. As healthcare facilities adopt these cutting-edge technologies, the demand for sophisticated coronary angiography devices is expected to rise, thereby propelling market growth. The integration of artificial intelligence in imaging analysis further indicates a transformative shift in the coronary angiography landscape.

Growing Awareness of Preventive Healthcare

The growing awareness of preventive healthcare among the Japanese population is driving the coronary angiography-devices market. As individuals become more informed about the risks associated with cardiovascular diseases, there is a heightened demand for diagnostic procedures that can identify potential issues early. Public health campaigns and educational initiatives have contributed to this awareness, encouraging individuals to seek regular check-ups and screenings. This trend is likely to increase the utilization of coronary angiography devices, as healthcare providers respond to the demand for preventive measures. The shift towards proactive healthcare management is expected to bolster the market, as more patients opt for angiographic evaluations to ensure their cardiovascular health.

Regulatory Support for Medical Innovations

Regulatory support for medical innovations in Japan plays a pivotal role in shaping the coronary angiography-devices market. The Pharmaceuticals and Medical Devices Agency (PMDA) has streamlined the approval process for new medical technologies, fostering an environment conducive to innovation. This regulatory framework encourages manufacturers to develop and introduce advanced coronary angiography devices, enhancing the overall market landscape. As a result, the availability of cutting-edge devices is likely to increase, meeting the growing demand from healthcare providers. Furthermore, the collaboration between regulatory bodies and industry stakeholders may lead to the establishment of guidelines that promote the safe and effective use of these technologies, further supporting market growth.

Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases in Japan is a primary driver for the coronary angiography-devices market. According to recent health statistics, cardiovascular diseases account for approximately 30% of all deaths in the country. This alarming trend necessitates advanced diagnostic tools, including coronary angiography devices, to facilitate early detection and treatment. The demand for these devices is expected to rise as healthcare providers seek to improve patient outcomes. Furthermore, the Japanese government has been investing in healthcare infrastructure, which may lead to enhanced access to these technologies. As a result, the coronary angiography devices market is likely to experience substantial growth, driven by the urgent need for effective cardiovascular disease management.