Growing Aging Population

The aging population in the GCC region is a significant driver for the coronary angiography-devices market. As individuals age, the risk of developing cardiovascular diseases increases, leading to a higher demand for diagnostic and treatment options. The demographic shift towards an older population is prompting healthcare systems to adapt and expand their services, particularly in cardiology. Recent demographic studies indicate that the proportion of individuals aged 65 and above is expected to rise by over 20% in the next decade. This trend suggests a growing need for effective cardiovascular care, including the use of coronary angiography devices. Consequently, the market is likely to benefit from this demographic change, as healthcare providers seek to address the needs of an aging population.

Government Healthcare Investments

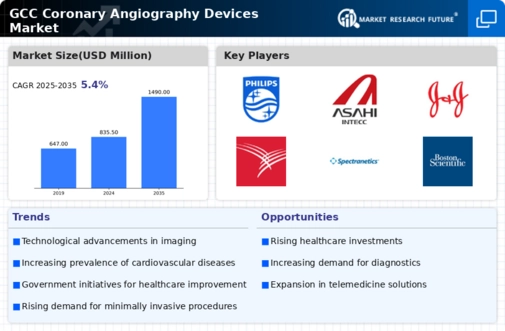

Government investments in healthcare infrastructure are playing a crucial role in the expansion of the coronary angiography-devices market. In the GCC, various governments are prioritizing healthcare spending to improve medical facilities and access to advanced diagnostic tools. Initiatives aimed at enhancing cardiovascular care are likely to lead to increased procurement of angiography devices. For instance, budget allocations for healthcare have seen a notable increase, with some countries committing over 10% of their national budgets to health services. This financial support is expected to facilitate the acquisition of state-of-the-art coronary angiography devices, thereby driving market growth. As public health initiatives focus on reducing the burden of cardiovascular diseases, the demand for these devices is projected to rise significantly.

Rising Health Awareness and Preventive Care

There is a notable increase in health awareness and preventive care initiatives within the GCC region, which is positively impacting the coronary angiography-devices market. As the population becomes more informed about cardiovascular health, there is a growing emphasis on early detection and preventive measures. Public health campaigns and educational programs are encouraging individuals to undergo regular screenings, including angiography, to identify potential heart issues before they escalate. This shift towards proactive health management is likely to drive demand for coronary angiography devices, as more people seek diagnostic services. The increasing focus on preventive care is expected to create a favorable environment for market growth, as healthcare providers respond to the rising demand for effective cardiovascular diagnostics.

Technological Innovations in Medical Devices

Technological advancements in medical devices are significantly influencing the coronary angiography-devices market. Innovations such as 3D imaging, enhanced visualization techniques, and minimally invasive procedures are transforming the landscape of cardiovascular diagnostics. These advancements not only improve the accuracy of diagnoses but also enhance patient outcomes, leading to increased adoption of angiography devices. The integration of artificial intelligence and machine learning in imaging technologies is expected to further streamline procedures and reduce recovery times. As healthcare facilities in the GCC region increasingly adopt these cutting-edge technologies, the demand for sophisticated coronary angiography devices is anticipated to rise. This trend suggests a shift towards more efficient and effective diagnostic solutions, thereby propelling market growth.

Increasing Prevalence of Cardiovascular Diseases

The rising incidence of cardiovascular diseases in the GCC region is a primary driver for the coronary angiography-devices market. As lifestyle-related health issues become more prevalent, the demand for diagnostic tools such as angiography devices is expected to surge. According to recent health statistics, cardiovascular diseases account for a significant portion of mortality rates in the GCC, prompting healthcare providers to invest in advanced diagnostic technologies. This trend indicates a growing need for effective screening and treatment options, thereby enhancing the market's growth potential. The increasing burden of heart diseases necessitates the adoption of innovative coronary angiography devices, which are crucial for timely diagnosis and intervention. Consequently, the market is likely to experience robust growth as healthcare systems prioritize cardiovascular health management.