The enterprise video market in France is characterized by a dynamic competitive landscape, driven by rapid technological advancements and an increasing demand for digital communication solutions. Key players such as Microsoft (US), Cisco (US), and Zoom (US) are strategically positioned to leverage their extensive resources and innovative capabilities. Microsoft (US) focuses on integrating its video solutions with its broader suite of productivity tools, enhancing user experience and collaboration. Cisco (US), on the other hand, emphasizes security and reliability in its offerings, catering to enterprises with stringent compliance requirements. Zoom (US) continues to expand its market presence through user-friendly interfaces and robust customer support, appealing to a diverse range of businesses. Collectively, these strategies foster a competitive environment that prioritizes innovation and customer-centric solutions.

In terms of business tactics, companies are increasingly localizing their operations to better serve the French market. This includes optimizing supply chains and establishing regional partnerships to enhance service delivery. The competitive structure of the market appears moderately fragmented, with several players vying for market share. However, the influence of major companies remains substantial, as they set industry standards and drive technological advancements that smaller firms often follow.

In October 2025, Microsoft (US) announced the launch of a new AI-driven feature within its Teams platform, aimed at enhancing video conferencing capabilities. This strategic move underscores Microsoft's commitment to integrating artificial intelligence into its offerings, potentially improving user engagement and productivity. The introduction of such features may position Microsoft (US) as a leader in innovation within the enterprise video sector, appealing to organizations seeking cutting-edge solutions.

In September 2025, Cisco (US) unveiled a partnership with a leading cybersecurity firm to bolster the security of its video conferencing solutions. This collaboration is particularly significant given the increasing concerns around data privacy and security in digital communications. By enhancing its security protocols, Cisco (US) not only strengthens its market position but also addresses the growing demand for secure enterprise solutions, which could attract more clients from regulated industries.

In August 2025, Zoom (US) expanded its services by introducing a new tier of subscription that includes advanced analytics and reporting tools for enterprise users. This strategic enhancement reflects Zoom's focus on providing value-added services that help organizations optimize their video communication strategies. By offering deeper insights into user engagement and performance metrics, Zoom (US) is likely to differentiate itself in a crowded market, appealing to data-driven enterprises.

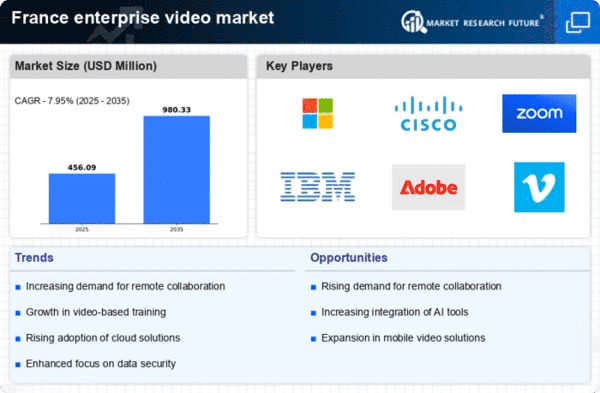

As of November 2025, the enterprise video market is witnessing trends that emphasize digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the competitive landscape, as companies collaborate to enhance their service offerings and expand their market reach. Looking ahead, competitive differentiation is expected to evolve, with a shift from price-based competition towards innovation, technological advancements, and supply chain reliability. This transition may redefine how companies position themselves in the market, ultimately benefiting those that prioritize sustainable and innovative practices.