Expansion of E-Learning Platforms

The enterprise video market is growing due to the expansion of e-learning platforms in the GCC region. As educational institutions and corporate training programs increasingly adopt online learning methodologies, the demand for video content has surged. E-learning platforms are integrating video solutions to deliver high-quality educational content, making learning more accessible and engaging for users. Recent statistics indicate that the e-learning market in the GCC is expected to reach $1 billion by 2026, with video content playing a pivotal role in this growth. This trend presents a significant opportunity for the enterprise video market, as businesses and educational institutions seek to invest in video technologies that enhance the learning experience and facilitate knowledge sharing.

Rising Demand for Remote Collaboration Tools

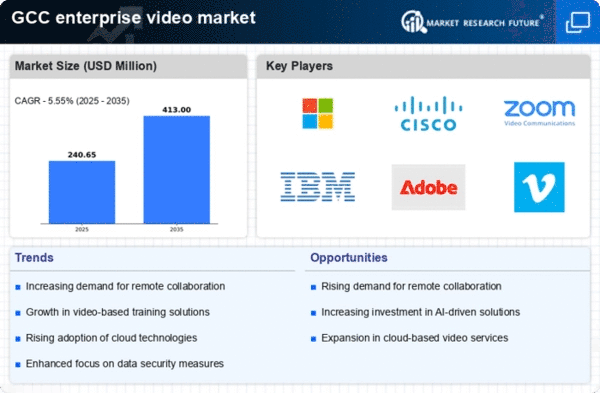

The enterprise video market is experiencing a notable surge in demand for remote collaboration tools. This surge is driven by the need for effective communication in geographically dispersed teams. As organizations in the GCC region increasingly adopt hybrid work models, the reliance on video conferencing and collaboration platforms has intensified. Recent data indicates that the market for video conferencing solutions is projected to grow at a CAGR of approximately 15% over the next five years. This growth is largely attributed to the necessity for seamless interaction among employees, clients, and stakeholders, thereby enhancing productivity and operational efficiency. The enterprise video market is thus positioned to benefit from this trend, as businesses seek to invest in robust video solutions that facilitate real-time collaboration and engagement, ultimately transforming workplace dynamics.

Investment in Digital Transformation Initiatives

The enterprise video market is significantly influenced by ongoing investments in digital transformation initiatives across various sectors in the GCC. Organizations are increasingly recognizing the importance of integrating advanced technologies to enhance their operational capabilities. As part of this transformation, video solutions are being adopted to improve customer engagement, training, and internal communications. Reports suggest that companies are allocating upwards of 30% of their IT budgets towards digital transformation efforts, which include the implementation of video technologies. This trend indicates a strong potential for growth in the enterprise video market, as businesses seek to leverage video content for marketing, training, and customer support, thereby driving demand for innovative video solutions.

Increased Focus on Customer Engagement Strategies

The enterprise video market is propelled by an increased focus on customer engagement strategies among businesses in the GCC. Organizations are recognizing the value of video content in enhancing customer interactions and building brand loyalty. Video marketing campaigns, product demonstrations, and customer testimonials are becoming essential tools for businesses aiming to connect with their audience effectively. Data suggests that video content can lead to a 120% increase in engagement rates compared to static content. As companies strive to differentiate themselves in a competitive landscape, the enterprise video market is likely to see a rise in demand for video solutions that enable personalized and impactful customer engagement, ultimately driving sales and customer satisfaction.

Growing Emphasis on Employee Training and Development

The enterprise video market benefits from a growing emphasis on employee training and development within organizations in the GCC. Companies are increasingly utilizing video-based training programs to enhance learning experiences and improve knowledge retention among employees. This shift towards video learning is supported by research indicating that video content can increase information retention rates by up to 80%. As organizations strive to upskill their workforce in a competitive market, the demand for video training solutions is expected to rise. Consequently, the enterprise video market is likely to see a substantial increase in the adoption of platforms that offer interactive and engaging video training modules, thereby fostering a culture of continuous learning and development.