Focus on Enhanced User Experience

In the enterprise video market, there is a pronounced focus on enhancing user experience. Italian companies are increasingly prioritizing platforms that offer intuitive interfaces and seamless integration with existing tools. By 2025, it is projected that user experience will be a key differentiator for video solutions, with over 65% of enterprises considering ease of use as a critical factor in their purchasing decisions. The enterprise video market is responding to this demand by developing user-friendly platforms that cater to diverse organizational needs. Features such as customizable layouts, interactive elements, and mobile accessibility are becoming essential for attracting and retaining users. This emphasis on user experience is likely to drive innovation within the market, as providers strive to create solutions that meet the evolving expectations of businesses.

Investment in Training and Development

In Italy, organizations are increasingly recognizing the importance of investing in training and development programs that leverage video technology. The enterprise video market is witnessing a shift as companies allocate resources towards creating engaging training content. By 2025, it is projected that around 60% of Italian firms will incorporate video-based training solutions to enhance employee skills and knowledge retention. This approach not only streamlines the onboarding process but also allows for continuous learning opportunities. The ability to access training materials on-demand through video platforms empowers employees to learn at their own pace, ultimately contributing to a more skilled workforce. As a result, the enterprise video market is likely to see a rise in demand for platforms that offer robust training capabilities.

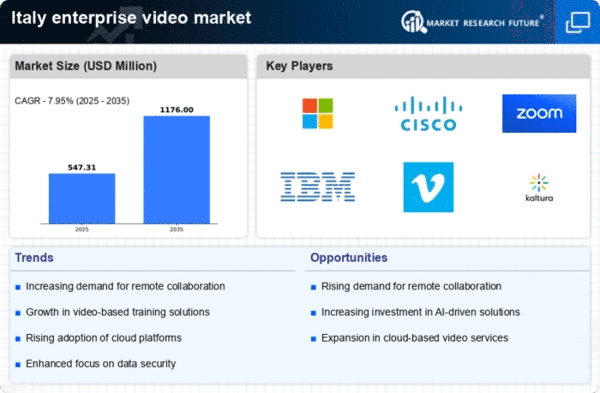

Expansion of Cloud-Based Video Solutions

The enterprise video market in Italy is experiencing a significant expansion of cloud-based video solutions. As businesses increasingly migrate to cloud infrastructures, the demand for scalable and flexible video platforms grows. By 2025, it is expected that approximately 75% of Italian enterprises will adopt cloud-based video solutions to enhance their communication capabilities. This transition not only reduces the need for on-premises hardware but also allows for seamless updates and maintenance. The enterprise video market is thus poised for growth, as companies seek solutions that offer reliability and ease of use. Additionally, the ability to access video content from any device enhances collaboration and productivity, making cloud-based solutions an attractive option for organizations.

Rising Importance of Visual Communication

The enterprise video market in Italy is increasingly influenced by the rising importance of visual communication. As businesses strive to convey messages more effectively, video content emerges as a powerful tool for engagement. In 2025, it is anticipated that over 50% of marketing and internal communications will utilize video formats. This trend indicates a shift in how organizations approach communication strategies, with a focus on creating visually appealing content that resonates with audiences. The enterprise video market is thus adapting to meet this demand, offering solutions that enable companies to produce high-quality video content easily. Furthermore, the integration of analytics tools within video platforms allows organizations to measure engagement and optimize their communication efforts.

Growing Demand for Remote Collaboration Tools

The enterprise video market in Italy experiences a notable surge in demand for remote collaboration tools. As organizations increasingly adopt hybrid work models, the need for effective communication solutions becomes paramount. In 2025, it is estimated that approximately 70% of Italian enterprises will utilize video conferencing tools to facilitate remote collaboration. This shift not only enhances productivity but also fosters a culture of inclusivity, allowing teams to connect seamlessly regardless of their physical location. The enterprise video market is thus positioned to benefit from this trend, as companies seek reliable platforms that support real-time communication and collaboration. Furthermore, the integration of features such as screen sharing and virtual whiteboards is likely to enhance user experience, making these tools indispensable for modern businesses.