Innovation in Product Development

Innovation plays a pivotal role in the evolution of the ivd contract-manufacturing market. In France, there is a growing emphasis on the development of novel diagnostic products that cater to specific healthcare needs. This focus on innovation is driven by advancements in technology and a better understanding of disease mechanisms. Contract manufacturers are increasingly collaborating with biotech firms and research institutions to bring cutting-edge diagnostic solutions to market. For instance, the introduction of point-of-care testing devices has revolutionized the way diagnostics are conducted, allowing for quicker results and improved patient management. As the demand for innovative products continues to rise, the ivd contract-manufacturing market is expected to adapt, fostering an environment where creativity and technological advancements thrive.

Regulatory Landscape and Compliance

The regulatory environment in France significantly influences the ivd contract-manufacturing market. Stringent regulations imposed by health authorities necessitate that manufacturers adhere to high standards of quality and safety. This compliance is crucial for ensuring that diagnostic products are reliable and effective. As regulations evolve, contract manufacturers must stay abreast of changes to maintain their competitive edge. The cost of non-compliance can be substantial, potentially leading to fines or product recalls. Therefore, many companies are investing in robust quality management systems to ensure adherence to regulatory requirements. This focus on compliance not only enhances product quality but also builds trust with healthcare providers and patients, ultimately shaping the dynamics of the ivd contract-manufacturing market.

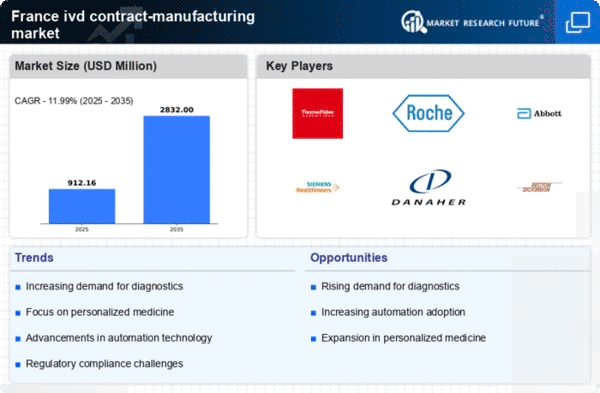

Rising Demand for Diagnostic Testing

The increasing prevalence of chronic diseases and the aging population in France are driving the demand for diagnostic testing. This trend is reflected in the ivd contract-manufacturing market, where the need for efficient and reliable diagnostic solutions is paramount. According to recent data, the market for in vitro diagnostics in France is projected to grow at a CAGR of approximately 5.5% over the next few years. This growth is likely to spur contract manufacturers to enhance their capabilities, ensuring they can meet the rising demand for innovative diagnostic products. As healthcare providers seek to improve patient outcomes, the reliance on contract manufacturing services for the development and production of diagnostic tests is expected to increase, thereby shaping the future landscape of the ivd contract-manufacturing market.

Growing Focus on Personalized Medicine

The shift towards personalized medicine is reshaping the ivd contract-manufacturing market in France. As healthcare moves towards more tailored treatment approaches, the demand for diagnostic tests that can provide specific insights into individual patient profiles is increasing. This trend is prompting contract manufacturers to develop specialized assays and tests that cater to the unique needs of patients. The market for personalized diagnostics is expected to expand significantly, with projections indicating a growth rate of around 7% annually. This evolution not only enhances patient care but also presents new opportunities for contract manufacturers to innovate and diversify their product offerings. As the healthcare landscape continues to evolve, the ivd contract-manufacturing market is likely to adapt to these changes, focusing on the development of personalized solutions.

Cost Efficiency and Resource Optimization

In the competitive landscape of the ivd contract-manufacturing market, cost efficiency has emerged as a critical driver. Many companies in France are opting to outsource their manufacturing processes to specialized contract manufacturers to reduce operational costs. This strategy allows firms to focus on core competencies while leveraging the expertise of contract manufacturers. By outsourcing, companies can potentially save up to 30% on production costs, which is particularly appealing in a market where margins are often tight. Furthermore, this trend enables manufacturers to optimize their resources, ensuring that they can scale production according to market demands without incurring significant capital expenditures. As a result, the ivd contract-manufacturing market is likely to witness a shift towards more strategic partnerships aimed at enhancing cost efficiency.

Leave a Comment