Expansion of Retail Channels

The retail landscape in France is evolving, with a significant expansion of channels for purchasing over-the-counter healthcare products. Traditional pharmacies are now complemented by supermarkets, online platforms, and health-focused stores, providing consumers with greater access to OTC products. This diversification of retail channels is likely to enhance the visibility and availability of over-the-counter healthcare options. Data suggests that online sales of OTC products have increased by approximately 25% in the past year, indicating a shift in consumer purchasing behavior. The over-the-counter-healthcare market stands to gain from this trend, as more consumers turn to various retail formats for their healthcare needs.

Growing Demand for Self-Medication

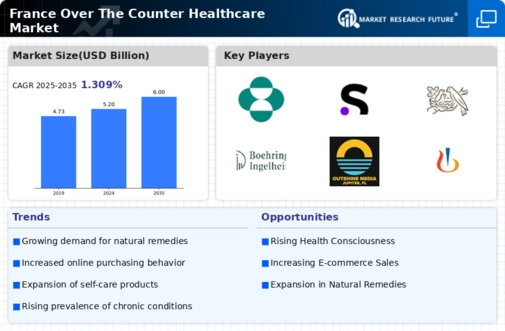

The over-the-counter-healthcare market in France is experiencing a notable increase in self-medication practices among consumers. This trend is driven by a growing awareness of health issues and the desire for convenience. According to recent data, approximately 60% of French adults prefer to manage minor ailments without consulting healthcare professionals. This shift towards self-care is likely to bolster the market, as consumers seek accessible solutions for common health concerns. The over-the-counter-healthcare market is thus positioned to benefit from this demand, with a projected growth rate of around 5% annually. As more individuals opt for self-medication, the industry may see an expansion in product offerings, catering to a diverse range of health needs.

Regulatory Support for OTC Products

The regulatory environment in France is becoming increasingly favorable for the over-the-counter-healthcare market. Recent initiatives by health authorities aim to streamline the approval process for OTC products, thereby encouraging innovation and market entry. This regulatory support is expected to enhance consumer access to a wider range of healthcare solutions. The over-the-counter-healthcare market may benefit from these changes, as companies can bring new products to market more efficiently. Furthermore, the French government has been promoting the use of OTC medications as a cost-effective alternative to prescription drugs, which could further stimulate market growth.

Rising Health Awareness and Education

There is a growing trend of health awareness and education among the French population, which is positively impacting the over-the-counter-healthcare market. Consumers are increasingly informed about health issues and the benefits of preventive care. This heightened awareness is likely to drive demand for OTC products that promote wellness and disease prevention. Recent surveys indicate that over 70% of French consumers actively seek information about health products before making a purchase. As a result, the over-the-counter-healthcare market is expected to see an increase in sales, as educated consumers are more likely to invest in preventive health solutions.

Aging Population and Chronic Conditions

France's demographic landscape is shifting, with an increasing proportion of the population aged 65 and older. This demographic change is accompanied by a rise in chronic health conditions, which often necessitate ongoing management. The over-the-counter-healthcare market is likely to see heightened demand for products that address these chronic conditions, such as pain relief and allergy medications. Data indicates that nearly 30% of older adults in France regularly use over-the-counter medications to manage their health. This trend suggests a significant opportunity for growth within the market, as companies develop targeted products that cater to the specific needs of this aging population.