Aging Population

Germany's demographic shift towards an aging population significantly influences the over-the-counter-healthcare market. With a substantial portion of the population aged 65 and older, there is an increasing demand for OTC products that address age-related health issues. This demographic is more likely to self-medicate for common ailments such as pain relief, digestive issues, and cold symptoms. In 2025, it is estimated that nearly 22% of the population will fall into this age category, creating a robust market for OTC solutions tailored to their needs. The over-the-counter-healthcare market is thus adapting to cater to this demographic, focusing on products that are easy to use and effective for older adults.

E-commerce Growth

The rapid expansion of e-commerce platforms in Germany is reshaping the landscape of the over-the-counter-healthcare market. Consumers increasingly prefer the convenience of purchasing OTC products online, which has led to a surge in online sales. In 2024, online sales of OTC products accounted for approximately 30% of total sales, reflecting a significant shift in consumer behavior. This trend is likely to continue, as more consumers appreciate the ease of access and the ability to compare products and prices from the comfort of their homes. The over-the-counter-healthcare market is responding by enhancing online presence and optimizing supply chains to meet this growing demand for digital shopping experiences.

Increasing Health Awareness

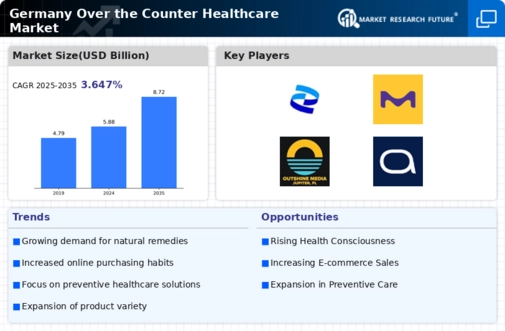

The growing awareness of health and wellness among the German population is a pivotal driver for the over-the-counter-healthcare market. As individuals become more informed about health issues, they are increasingly inclined to seek preventive care and self-medication options. This trend is reflected in the rising sales of OTC products, which reached approximately €3.5 billion in 2024. Consumers are now more proactive in managing their health, often opting for OTC solutions for minor ailments rather than visiting healthcare professionals. This shift not only empowers consumers but also stimulates market growth, as companies respond to this demand by expanding their product lines. The over-the-counter-healthcare market is thus experiencing a transformation, with a focus on products that cater to health-conscious consumers.

Innovative Product Development

Innovation in product development is a crucial driver for the over-the-counter-healthcare market. Companies are increasingly investing in research and development to create new and improved OTC products that meet evolving consumer needs. This includes the introduction of natural and organic options, as well as formulations that cater to specific health concerns. In 2025, it is projected that the market for herbal and natural OTC products will grow by 15%, indicating a shift towards more holistic health solutions. The over-the-counter-healthcare market is thus witnessing a wave of innovation, with brands striving to differentiate themselves through unique offerings that resonate with health-conscious consumers.

Regulatory Support for OTC Products

The regulatory environment in Germany is becoming increasingly supportive of the over-the-counter-healthcare market. Recent changes in regulations have streamlined the approval process for OTC products, making it easier for companies to bring new solutions to market. This regulatory flexibility encourages innovation and competition, ultimately benefiting consumers with a wider range of options. As of 2025, the market is expected to see a 10% increase in new product launches, driven by this favorable regulatory landscape. The over-the-counter-healthcare market is thus positioned for growth, as companies leverage these regulatory changes to introduce effective and safe OTC products.