Growing Demand for Self-Medication

The over the-counter-healthcare market is experiencing a notable increase in the demand for self-medication among consumers in the UK. This trend is driven by a growing awareness of personal health management and the desire for convenience. As individuals seek to manage minor ailments without the need for a prescription, the market is projected to expand significantly. According to recent data, the self-medication segment is expected to account for approximately 60% of the total market share by 2026. This shift towards self-care is likely to be influenced by the increasing availability of OTC products in retail outlets and online platforms, making it easier for consumers to access necessary medications. Consequently, the over the-counter-healthcare market is poised for growth as more individuals opt for self-treatment options.

Aging Population and Chronic Conditions

The demographic shift towards an aging population in the UK is a critical driver for the over the-counter-healthcare market. As the population ages, there is a corresponding rise in chronic health conditions, which often necessitate ongoing management. Older adults are increasingly turning to OTC products for relief from common ailments such as arthritis, hypertension, and diabetes-related issues. It is estimated that by 2030, nearly 25% of the UK population will be over 65 years old, further propelling the demand for accessible healthcare solutions. This demographic trend suggests that the over the-counter-healthcare market will need to adapt its product offerings to cater to the specific needs of older consumers, thereby enhancing market growth opportunities.

Increased Retail Availability and Accessibility

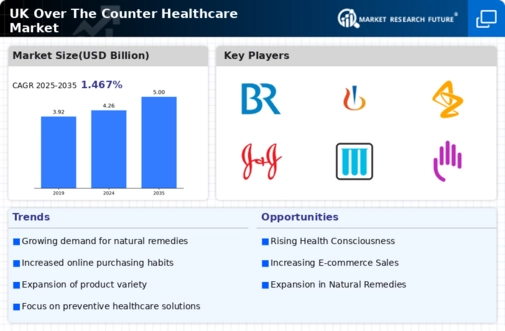

The expansion of retail channels is significantly impacting the over the-counter-healthcare market in the UK. With the rise of supermarkets, pharmacies, and online platforms, consumers now have greater access to a wide range of OTC products. This increased availability is likely to drive sales as consumers prefer the convenience of purchasing healthcare products during routine shopping trips. Additionally, the growth of e-commerce has made it easier for consumers to compare prices and access a broader selection of products. Recent statistics indicate that online sales of OTC products have surged by 30% in the past year, highlighting the importance of retail accessibility in driving market growth. As a result, the over the-counter-healthcare market is expected to continue expanding as retail options diversify.

Rising Health Consciousness and Preventative Care

There is a discernible shift towards health consciousness among consumers in the UK, which is influencing the over the-counter-healthcare market. As individuals become more proactive about their health, there is an increasing focus on preventative care and wellness products. This trend is reflected in the growing sales of vitamins, supplements, and other health-related OTC products. Market data suggests that the preventative care segment is projected to grow by 12% annually, as consumers seek to enhance their overall well-being. This heightened awareness of health and wellness is likely to drive innovation within the over the-counter-healthcare market, as companies strive to meet the evolving needs of health-conscious consumers.

Technological Advancements in Product Development

Technological innovations are playing a pivotal role in shaping the over the-counter-healthcare market. Advances in formulation technologies and delivery systems are enabling the development of more effective and user-friendly OTC products. For instance, the introduction of transdermal patches and fast-dissolving tablets has improved the convenience and efficacy of self-medication. Furthermore, the integration of digital health technologies, such as mobile health applications, is enhancing consumer engagement and education regarding OTC products. This trend is likely to attract a tech-savvy consumer base, thereby expanding the market. The over the-counter-healthcare market is expected to witness a growth rate of around 8% annually, driven by these technological advancements.