Aging Population

France's aging population significantly influences the peripheral neuropathy market. As individuals age, the risk of developing neuropathic conditions increases, with older adults being more susceptible to various forms of neuropathy. Current demographic data indicates that by 2030, nearly 25% of the French population will be over 65 years old. This demographic shift is likely to result in a higher incidence of age-related neuropathies, thus driving demand for specialized treatments and care. The peripheral neuropathy market must adapt to cater to this growing segment, potentially leading to innovations in treatment options and increased healthcare spending. The market could witness a surge in demand for both pharmacological and non-pharmacological interventions aimed at this aging cohort.

Rising Healthcare Expenditure

The increase in healthcare expenditure in France is a significant driver for the peripheral neuropathy market. With the French government prioritizing healthcare funding, there is a growing allocation of resources towards the treatment of chronic conditions, including neuropathy. Reports indicate that healthcare spending in France is projected to rise by approximately 3% annually, which may enhance access to innovative treatments and therapies for peripheral neuropathy. This trend suggests that the peripheral neuropathy market could experience a boost in demand for both existing and novel treatment options. As patients gain better access to healthcare services, the market may see an influx of new therapies aimed at improving quality of life for those affected by neuropathic conditions.

Increasing Incidence of Diabetes

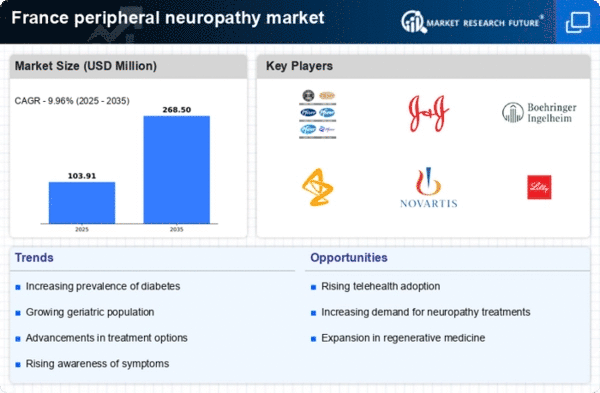

The rising incidence of diabetes in France is a critical driver for the peripheral neuropathy market. Diabetes is known to be a leading cause of peripheral neuropathy, with studies indicating that approximately 50% of diabetic patients may develop some form of neuropathy. This alarming statistic suggests a growing patient population that requires effective management and treatment options. As the prevalence of diabetes continues to escalate, healthcare providers are likely to focus more on diagnosing and treating peripheral neuropathy, thereby expanding the market. The peripheral neuropathy market is expected to see increased demand for medications, therapies, and support services tailored to this demographic, potentially leading to a market growth rate of around 6% annually over the next few years.

Increased Focus on Pain Management

The heightened focus on pain management in France is likely to impact the peripheral neuropathy market positively. As awareness of chronic pain conditions grows, healthcare providers are increasingly seeking effective strategies to manage neuropathic pain. This shift in focus may lead to the development and adoption of new pain management therapies specifically designed for peripheral neuropathy. The peripheral neuropathy market could see a rise in demand for both pharmacological treatments, such as anticonvulsants and antidepressants, and non-pharmacological approaches, including physical therapy and cognitive behavioral therapy. This comprehensive approach to pain management may enhance patient outcomes and satisfaction, thereby driving market growth.

Advancements in Diagnostic Techniques

Recent advancements in diagnostic techniques are poised to enhance the peripheral neuropathy market. Improved methods such as nerve conduction studies and skin biopsy techniques allow for more accurate and timely diagnoses of neuropathic conditions. This is particularly relevant in France, where early detection can lead to better management of symptoms and improved patient outcomes. The peripheral neuropathy market stands to benefit from these innovations, as healthcare providers are likely to invest in advanced diagnostic tools. This could lead to an increase in the number of diagnosed cases, thereby expanding the market. Furthermore, the integration of telemedicine in diagnostic processes may facilitate access to specialized care, further driving market growth.