France Real Time Payment Market

France Real-Time Payment Market Size, Share and Research Report By Technology (Blockchain, Artificial Intelligence, Mobile Payment Solutions, Card Payment Systems), By Application (Retail Payments, Business Payments, Peer-to-Peer Payments, Government Payments), By End Use (Consumer, Businesses, Financial Institutions) and By Payment Mode (Remote, In-Store, Online)- Industry Forecast Till 2035

France Real-Time Payment Market Overview

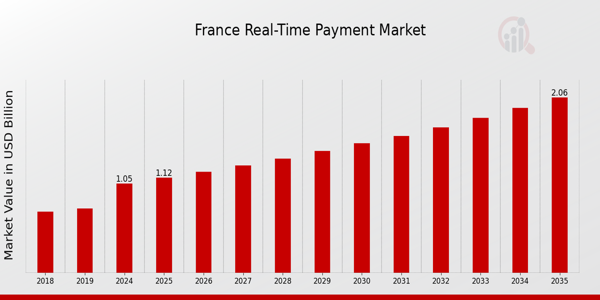

As per MRFR analysis, the France Real-Time Payment Market Size was estimated at 0.98 (USD Billion) in 2023.The France Real-Time Payment Market is expected to grow from 1.05(USD Billion) in 2024 to 2.05 (USD Billion) by 2035. The France Real-Time Payment Market CAGR (growth rate) is expected to be around 6.314% during the forecast period (2025 - 2035).

Key France Real-Time Payment Market Trends Highlighted

The France Real-Time Payment Market is experiencing significant growth driven by several key market drivers, including the increasing demand for fast and efficient payment solutions. As consumers continue to seek seamless transaction experiences, financial institutions and payment providers are adapting by enhancing their real-time payment capabilities. The integration of digital wallets and mobile payment applications is also fueling this growth, reflecting a shift in consumer behavior towards digital financial services.

Additionally, the French government has been supportive of this transition, promoting initiatives that encourage digitization within the financial sector.The France Real-Time Payment Market has a lot of potential. For example, using new payment technologies like blockchain could make transactions safer and faster. Also, meeting the needs of small and medium-sized businesses (SMEs) is a big opportunity because many businesses are looking for ways to make payments more quickly and easily to improve cash flow and operational efficiency.

Real-time payment solutions are also becoming more common in France because e-commerce is becoming more popular. Fast transaction speeds can greatly improve the customer experience. Recent trends show that more and more people and businesses are using instant payment services.

The popularity of services like SEPA Instant Credit Transfer in France has gained traction, enabling individuals and businesses to complete transactions within seconds, even outside regular banking hours. The emphasis on financial inclusion is also notable, as the French government works to ensure that real-time payment solutions reach all demographics, including the unbanked and underbanked populations. Overall, the landscape of the real-time payment market in France is evolving rapidly, driven by technological advancements and changing consumer preferences.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

France Real-Time Payment Market Drivers

Increasing Digital Payment Adoption in France

The growth of the digital economy in France is significantly driving the France Real-Time Payment Market. According to the French Government, digital payments accounted for approximately 80% of all consumer transactions by 2023. This trend is supported by initiatives such as the Digital Republic Act, which promotes digital innovation and the use of electronic payment systems.

Major companies, such as La Banque Postale and Société Générale, have invested heavily in enhancing their digital banking services, making real-time payments more accessible to consumers.The European Central Bank also reports a steady increase in electronic payment transactions throughout Europe, further emphasizing the shift towards real-time payment systems in France. Given this landscape, the inclusion of instant payment services is becoming essential for financial institutions in order to meet consumer demands for speed and convenience in transactions.

Regulatory Support for Instant Payments

The regulatory environment in France is becoming increasingly supportive of real-time payment systems, contributing to the growth of the France Real-Time Payment Market. The European Union's Payment Services Directive 2 (PSD2) requires banks to implement open banking systems, which facilitate innovative payment solutions.

The French government, through regulatory bodies like the Autorité de Contrôle Prudentiel et de Résolution, encourages the development of instant payment solutions to enhance competition and consumer choice.This regulatory shift has led to an increase in startups focused on digital payment solutions, as well as established banks broadening their service offerings. The support for regulatory measures indicates a strong future prospect for the adoption and integration of real-time payments in various sectors across France.

Rising Demand for Instant Transactions

There is an increasing demand for instant transaction capabilities among consumers and businesses in France, propelling the France Real-Time Payment Market. A recent survey by the French Online Payment Association indicated that 65% of consumers prefer utilizing immediate payment methods for online purchases, driven by convenience and real-time account balancing.

Additionally, small and medium enterprises (SMEs) in France have reported that 58% of their transactions now require instant payment solutions to manage cash flow more effectively.As consumer behavior shifts towards instantaneous gratification, stakeholders in the financial sector are compelled to innovate and offer real-time payment solutions that cater to these growing expectations. Notable organizations like BNP Paribas and credit institutions are actively addressing market needs by launching and refining their real-time payment services.

France Real-Time Payment Market Segment Insights

Real-Time Payment Market Technology Insights

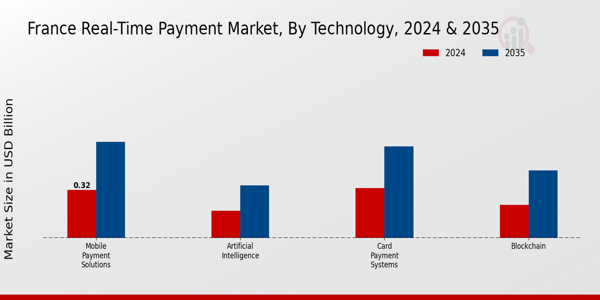

The France Real-Time Payment Market is experiencing a noteworthy evolution, particularly within the Technology segment, which encompasses varied facets such as Blockchain, Artificial Intelligence, Mobile Payment Solutions, and Card Payment Systems. This market has been significantly shaped by growing consumer demand for instant transaction capabilities, driving the implementation of innovative technologies.

Blockchain stands out for enhancing transaction security and transparency, making it a robust choice in building trust among users and financial institutions alike.The advent of Artificial Intelligence further transforms payment processing by automating decision-making processes and providing personalized customer experiences through predictive analytics, which optimizes financial services. Mobile Payment Solutions have gained traction due to the proliferation of smartphones and the changing consumer preferences towards cashless transactions, contributing to a seamless and convenient user experience while ensuring accessibility for all demographics.

Card Payment Systems continue to play a dominant role in the market as well, integrating with dynamic technology to facilitate real-time transactions, thus promoting efficiency in everyday transactions.Collectively, these aspects of the Technology segment highlight a trend towards greater efficiency, security, and convenience in the France Real-Time Payment Market, reflecting the shifting landscape of how payments are processed and managed in an increasingly digital society. The integration of these technologies fosters a competitive edge for financial service providers, providing significant opportunities for growth and adoption as consumer behaviors evolve alongside technological advancements.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Real-Time Payment Market Application Insights

The Application segment of the France Real-Time Payment Market focuses on various forms of payments that enable instantaneous transactions across different sectors. Retail Payments play a crucial role as they cater to everyday consumer transactions, enhancing convenience and customer satisfaction. Business Payments are essential for streamlining operations among enterprises, allowing for quick settlements and improved cash flow management. Peer-to-Peer Payments have gained traction, especially among younger generations, as they facilitate seamless monetary transfers between individuals.

Government Payments also showcase significant importance, as they support public service payments, taxes, and benefits distribution, fostering efficiency in governmental financial operations. The landscape of these applications is driven by growing consumer demand for immediacy in financial transactions, adoption of digital payment solutions, and increasing smartphone penetration across France.

Additionally, regulatory support and increased investment in payment infrastructure contribute to the expansion and sophistication of these payment applications, ensuring they meet the evolving needs of users.As such, understanding the dynamics within this segment can provide valuable insights into the broader France Real-Time Payment Market statistics and trends.

Real-Time Payment Market End Use Insights

The France Real-Time Payment Market has witnessed steady growth across its various end-use segments, driven by the increasing demand for instant transactions. In the consumer segment, the preference for mobile and online payment solutions has surged, fostering greater convenience and efficiency in personal finance management.

Businesses, especially small and medium enterprises, are increasingly adopting real-time payment solutions to streamline operations and enhance cash flow management, which is crucial for sustainability and growth. Financial institutions play a pivotal role in this landscape, as they develop and adopt innovative technologies to facilitate seamless real-time payment integration.

This segment not only supports regulatory compliance and security but also enhances customer satisfaction and loyalty. The overall market trends suggest a continuous upward trajectory, with the rise of e-commerce and digital wallets serving as significant growth drivers. As consumers and businesses in France become more accustomed to real-time payment capabilities, the industry is poised for transformation, presenting numerous opportunities for stakeholders to innovate and improve service delivery.

This evolving landscape reflects the broader shift towards digitization in France's financial ecosystem, underpinned by government initiatives aimed at fostering a cashless society and enhancing economic efficiency.

Real-Time Payment Market Payment Mode Insights

The France Real-Time Payment Market is experiencing a transformative phase, especially in the Payment Mode segment, which encompasses various methods like Remote, In-Store, and Online payments. As digitalization continues to rise, Remote payments have gained traction, allowing consumers to perform transactions conveniently from their homes or on-the-go through mobile and internet platforms.

Meanwhile, In-Store payments remain essential as physical retail continues to hold a significant place in consumer habits, bolstered by contactless technologies that enhance efficiency and security.Online payments, driven by e-commerce growth and increasing internet penetration, are becoming a dominant force as more consumers prefer seamless digital transactions. The convergence of these Payment Modes is fueled by a shift towards cashless societies supported by government initiatives encouraging electronic payments, aligning with broader trends in technological innovation and consumer preferences.

Collectively, these insights highlight the dynamic nature of the France Real-Time Payment Market, reflecting changing consumer behaviors and preferences, and present significant opportunities for growth and adaptation among market participants seeking to enhance their offerings and capture a larger market share.

France Real-Time Payment Market Key Players and Competitive Insights

The France Real-Time Payment Market has been evolving rapidly, with various players vying for dominance in a landscape characterized by technological advancements and changing consumer preferences. This market supports the increasing demand for instant transactions, enabling businesses and consumers to execute payments without delays. The competitive insights reveal that key factors influencing this market include innovation in payment technologies, the regulatory environment, and customer engagement strategies.

With the rise of digital banking, traditional banks are increasingly integrating real-time payment systems to retain their market share against emerging fintech players. The collaborative nature of partnerships among financial institutions and technology firms is also shaping the competitive dynamics, allowing for improved service offerings and enhanced user experiences.

Crédit Agricole stands out in the France Real-Time Payment Market as a major player with a solid market presence. The bank has made significant investments in digital infrastructure, which has strengthened its capability to offer real-time payment services. One of its main strengths lies in its extensive network of local branches, which enhances customer trust and enables personalized service. Furthermore, Crédit Agricole's focus on security and compliance ensures that its real-time payments are not only efficient but also align with regulations, providing added assurance to users.

The institution has embraced technological updates and agile operational methodologies, contributing to its ability to meet the demands of a rapidly changing market while catering to diverse customer groups, from personal banking clients to businesses.On the other hand, Orange Bank has also made notable strides in the France Real-Time Payment Market, leveraging its telecommunications heritage to provide innovative banking solutions.

It offers key services including instant money transfers, online banking, and mobile payment options tailored for a tech-savvy audience. Orange Bank has positioned itself uniquely by focusing on the seamless integration of telecommunications and banking services, capitalizing on the growing trend of mobile banking among consumers.

The company has reported a strong user acquisition strategy, resulting in significant growth in its customer base. Additionally, its competitive edge is enhanced through partnerships with fintech firms that allow for the incorporation of advanced payment solutions. As part of its growth strategy, Orange Bank has engaged in collaborations and potential mergers aimed at expanding its service portfolio and market reach within France, cementing its position in the real-time payment ecosystem.

Key Companies in the France Real-Time Payment Market Include:

- Crédit Agricole

- Orange Bank

- Moneytis

- BNP Paribas

- Lyf Pay

- Société Générale

- Worldline

- Revolut

- PayPal

- Sapnac

- Natixis

- SEPA Payments

- La Banque Postale

- Lydia

- ClearBank

France Real-Time Payment Market Developments

The France Real-Time Payment Market has recently seen a surge in developments, particularly with notable growth among key players such as Crédit Agricole, BNP Paribas, and Société Générale, leading to an increase in overall market valuation. In August 2023, Worldline announced a partnership with La Banque Postale to enhance digital payment solutions, which is expected to foster increased usage and efficiency in real-time transactions.

Additionally, as of June 2023, PayPal expanded its instant transfer capabilities for account holders in France, improving the user experience and convenience for customers utilizing real-time payments. The market has experienced an uptick in digital engagement, driven by innovations from companies such as Orange Bank and Lyf Pay, catering to the evolving preferences of consumers.

In terms of mergers and acquisitions, there have been discussions regarding Natixis potentially acquiring stakes in fintech companies to boost its payment portfolio, which could reshape competitive dynamics in the market. Major developments in the last two to three years have established France as a leader in European real-time payments, indicating a robust infrastructure and regulatory support in place to further this growth.

France Real-Time Payment Market Segmentation Insights

Real-Time Payment Market Technology Outlook

- Blockchain

- Artificial Intelligence

- Mobile Payment Solutions

- Card Payment Systems

Real-Time Payment Market Application Outlook

- Retail Payments

- Business Payments

- Peer-to-Peer Payments

- Government Payments

Real-Time Payment Market End Use Outlook

- Consumer

- Businesses

- Financial Institutions

Real-Time Payment Market Payment Mode Outlook

- Remote

- In-Store

- Online

FAQs

What is the expected market size of the France Real-Time Payment Market in 2024?

The France Real-Time Payment Market is expected to be valued at 1.05 USD Billion in 2024.

What will be the projected market value of the France Real-Time Payment Market by 2035?

By 2035, the France Real-Time Payment Market is projected to reach a market value of 2.05 USD Billion.

What is the expected CAGR for the France Real-Time Payment Market from 2025 to 2035?

The expected CAGR for the France Real-Time Payment Market from 2025 to 2035 is 6.314%.

Which technology segments dominate the France Real-Time Payment Market?

The market is divided into segments such as Blockchain, Artificial Intelligence, Mobile Payment Solutions, and Card Payment Systems.

What is the anticipated market value for the Mobile Payment Solutions segment in 2024?

The Mobile Payment Solutions segment is anticipated to be valued at 0.32 USD Billion in 2024.

Which companies are considered key players in the France Real-Time Payment Market?

Key players include Crédit Agricole, Orange Bank, Moneytis, BNP Paribas, and Lyf Pay among others.

What will be the market value for Blockchain technology in the France Real-Time Payment Market by 2035?

The market value for Blockchain technology in this sector is projected to reach 0.45 USD Billion by 2035.

How much is the Card Payment Systems segment expected to be valued at in 2024?

The Card Payment Systems segment is expected to be valued at 0.33 USD Billion in 2024.

What growth opportunities exist for the France Real-Time Payment Market?

Emerging trends in technology and increasing consumer demand for instant transaction capabilities create substantial growth opportunities.

What impact do global economic factors have on the France Real-Time Payment Market?

Current global economic factors and conflicts can potentially influence transaction volumes and technological investments within the market.

Kindly complete the form below to receive a free sample of this Report

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”