Government Initiatives

Government initiatives play a pivotal role in shaping the France visual positioning system market. The French government has been actively promoting smart city projects, which necessitate advanced positioning systems for efficient urban management. Policies aimed at enhancing digital infrastructure and supporting innovation are likely to bolster market growth. For example, the French National Strategy for Artificial Intelligence emphasizes the importance of positioning technologies in various applications, including transportation and logistics. This strategic focus is expected to attract investments and foster collaborations between public and private sectors. As a result, the France visual positioning system market is poised to benefit from increased funding and resources, facilitating the development of more sophisticated solutions.

Technological Advancements

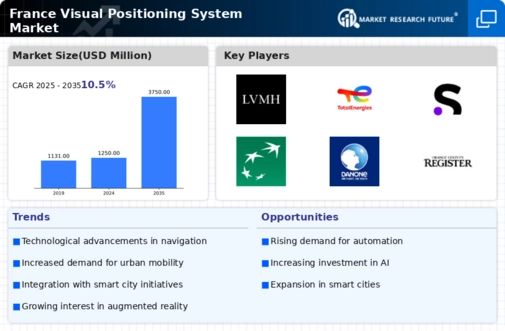

The France visual positioning system market is experiencing a surge in technological advancements, particularly in the fields of artificial intelligence and machine learning. These technologies enhance the accuracy and efficiency of visual positioning systems, making them more appealing to various sectors. For instance, the integration of AI algorithms allows for real-time data processing, which is crucial for applications in autonomous vehicles and robotics. As of 2025, the market is projected to grow at a compound annual growth rate of 15%, driven by these innovations. Companies are increasingly investing in R&D to develop cutting-edge solutions that cater to the evolving needs of consumers and businesses alike. This trend indicates a robust future for the France visual positioning system market, as technological integration continues to redefine operational capabilities.

Increased Adoption in Retail

The retail sector in France is increasingly adopting visual positioning systems to enhance customer experience and streamline operations. The France visual positioning system market is benefiting from this trend as retailers seek to leverage technology for better inventory management and personalized shopping experiences. For instance, the integration of visual positioning systems allows retailers to track customer movements within stores, enabling targeted marketing strategies and improved layout designs. As of 2025, the retail technology market is expected to grow by 12%, with visual positioning systems playing a crucial role in this transformation. This shift indicates a promising future for the France visual positioning system market, as retailers continue to invest in innovative solutions to stay competitive.

Emerging Applications in Healthcare

Emerging applications of visual positioning systems in the healthcare sector are contributing to the growth of the France visual positioning system market. Hospitals and healthcare facilities are increasingly utilizing these systems for asset tracking, patient navigation, and operational efficiency. The integration of visual positioning technologies can significantly enhance patient care by ensuring that medical equipment is readily available and that patients can easily find their way within complex hospital environments. As the healthcare sector in France continues to evolve, the demand for innovative positioning solutions is likely to rise. This trend suggests a substantial opportunity for growth within the France visual positioning system market, as healthcare providers seek to improve service delivery and operational effectiveness.

Growing Demand in Logistics and Transportation

The logistics and transportation sectors are witnessing a growing demand for visual positioning systems, significantly impacting the France visual positioning system market. With the rise of e-commerce and the need for efficient supply chain management, companies are increasingly adopting advanced positioning technologies to optimize their operations. According to recent data, the logistics sector in France is projected to grow by 10% annually, creating a substantial market for visual positioning solutions. These systems enable real-time tracking and navigation, enhancing operational efficiency and reducing costs. As businesses strive to meet consumer expectations for faster delivery times, the demand for innovative positioning solutions is likely to escalate, further driving growth in the France visual positioning system market.