Supportive Government Policies

The Germany visual positioning system market benefits from a range of supportive government policies aimed at fostering innovation and technological advancement. The German government has implemented various initiatives to promote the development of smart technologies, including visual positioning systems. For instance, funding programs and grants are available for research and development projects that focus on enhancing navigation technologies. Additionally, the government's commitment to improving infrastructure, particularly in urban areas, is likely to create a conducive environment for the adoption of visual positioning systems. This supportive regulatory framework may encourage investments in the industry, leading to further advancements and market growth.

Advancements in Sensor Technology

Advancements in sensor technology are significantly influencing the Germany visual positioning system market. The development of high-resolution cameras, LiDAR, and other sensor technologies has enhanced the accuracy and reliability of visual positioning systems. These advancements enable more precise mapping and navigation capabilities, which are essential for applications in autonomous vehicles, robotics, and industrial automation. The German automotive industry, a key player in the global market, is increasingly investing in sensor technologies to improve vehicle navigation systems. With the automotive sector projected to grow at a rate of 3% annually, the demand for advanced visual positioning systems is likely to rise, further propelling market growth.

Growing Demand for Precision Navigation

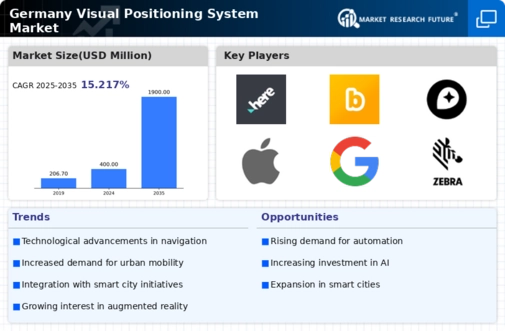

The Germany visual positioning system market is experiencing a notable surge in demand for precision navigation solutions. This growth is largely driven by the increasing need for accurate location data across various sectors, including logistics, transportation, and autonomous vehicles. As businesses seek to enhance operational efficiency, the integration of visual positioning systems has become essential. According to recent data, the logistics sector in Germany is projected to grow at a compound annual growth rate of 4.5% through 2026, further fueling the demand for advanced navigation technologies. The ability to provide real-time, precise positioning information is likely to be a key differentiator for companies operating in this competitive landscape.

Rising Interest in Smart City Developments

The Germany visual positioning system market is poised to benefit from the rising interest in smart city developments. As urban areas in Germany continue to grow, there is an increasing emphasis on creating efficient, sustainable, and technologically advanced cities. Visual positioning systems play a crucial role in smart city initiatives by enabling precise location tracking for various applications, including traffic management, public safety, and urban planning. The German government has allocated substantial funding for smart city projects, with an estimated investment of EUR 1 billion over the next five years. This investment is likely to drive the adoption of visual positioning systems, as cities seek to leverage technology for improved urban living.

Integration with Augmented Reality Applications

The integration of visual positioning systems with augmented reality (AR) applications is emerging as a significant driver in the Germany visual positioning system market. As AR technology continues to evolve, its applications in sectors such as retail, tourism, and education are becoming increasingly prevalent. Visual positioning systems enhance AR experiences by providing accurate spatial data, enabling users to interact with their environment in real-time. The German AR market is expected to reach a valuation of approximately EUR 1.5 billion by 2026, indicating a strong potential for collaboration between AR and visual positioning technologies. This synergy could lead to innovative solutions that cater to diverse consumer needs.