Expansion of Smart City Projects

The expansion of smart city projects across Japan is poised to drive the visual positioning system market significantly. Urban areas are increasingly adopting smart technologies to enhance infrastructure, improve public services, and promote sustainability. The Japanese government has earmarked substantial investments for smart city initiatives, with a focus on integrating visual positioning systems to facilitate efficient urban planning and management. For example, cities like Tokyo and Osaka are implementing smart traffic management systems that rely on accurate positioning data. This trend may lead to a projected market growth of approximately 10% annually, as municipalities seek to leverage visual positioning systems to create more livable and efficient urban environments.

Integration with IoT Technologies

The integration of Internet of Things (IoT) technologies within the Japan visual positioning system market appears to be a pivotal driver. As smart devices proliferate, the demand for seamless connectivity and real-time data exchange intensifies. This integration facilitates enhanced location-based services, enabling businesses to optimize operations and improve customer experiences. For instance, the Japanese government has been actively promoting IoT initiatives, which could potentially lead to a market growth rate of approximately 15% annually. The synergy between IoT and visual positioning systems may result in innovative applications across various sectors, including retail, logistics, and urban planning, thereby reinforcing the industry's relevance in a rapidly evolving technological landscape.

Rising Demand for Autonomous Vehicles

The rising demand for autonomous vehicles is likely to serve as a significant driver for the Japan visual positioning system market. As Japan continues to advance its automotive technologies, the need for precise navigation and positioning systems becomes increasingly critical. The government has set ambitious targets for the deployment of autonomous vehicles, with projections indicating that the market for such vehicles could reach 1.5 million units by 2030. This surge in demand necessitates the integration of advanced visual positioning systems to ensure safety and efficiency. Consequently, the industry may experience substantial growth, as automotive manufacturers seek to incorporate cutting-edge positioning technologies into their vehicles.

Government Support and Policy Frameworks

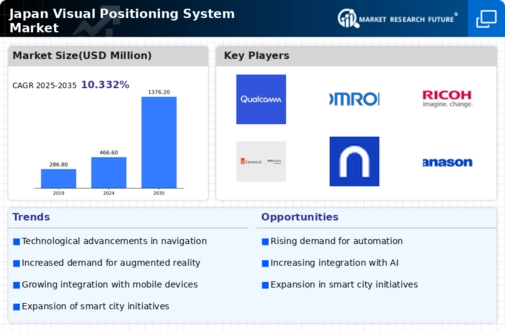

Government support and robust policy frameworks significantly influence the Japan visual positioning system market. The Japanese government has been investing in advanced technologies, including visual positioning systems, to enhance urban infrastructure and public safety. Initiatives such as the 'Society 5.0' vision aim to integrate digital technologies into everyday life, which may bolster the adoption of visual positioning systems. Furthermore, funding programs and incentives for research and development in this sector could potentially accelerate innovation and market penetration. As a result, the industry may witness a compound annual growth rate (CAGR) of around 12% over the next five years, driven by favorable governmental policies and strategic investments.

Increased Focus on Retail and Consumer Experience

An increased focus on enhancing retail and consumer experiences is emerging as a key driver in the Japan visual positioning system market. Retailers are increasingly utilizing visual positioning systems to provide personalized shopping experiences, optimize store layouts, and improve inventory management. The rise of e-commerce and changing consumer behaviors necessitate innovative solutions that can bridge the gap between online and offline shopping. According to recent market analyses, the retail sector in Japan is expected to grow by 8% annually, with visual positioning systems playing a crucial role in this transformation. As businesses strive to create engaging and efficient shopping environments, the demand for advanced positioning technologies is likely to surge.