Expansion of Retail Channels

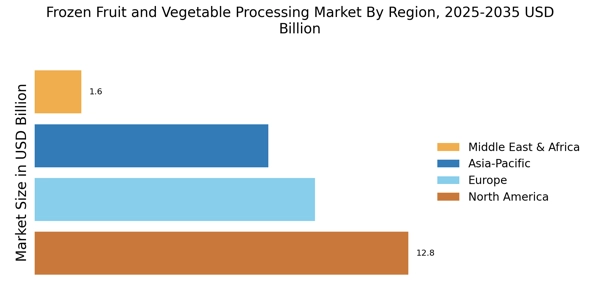

The expansion of retail channels, including online grocery shopping and specialty stores, is significantly influencing the Frozen Fruit and Vegetable Processing Market. As e-commerce continues to grow, consumers are finding it easier to access a wider variety of frozen products from the comfort of their homes. This shift is particularly evident in the rise of online grocery platforms, which have reported increased sales of frozen fruits and vegetables. Additionally, specialty health food stores are also expanding their frozen sections to meet the demand for organic and non-GMO options. This diversification in retail channels is likely to enhance the visibility and availability of frozen products, thereby driving sales and contributing to the overall growth of the Frozen Fruit and Vegetable Processing Market.

Innovations in Freezing Technology

Innovations in freezing technology are playing a crucial role in shaping the Frozen Fruit and Vegetable Processing Market. Advanced freezing methods, such as flash freezing and cryogenic freezing, are being adopted to preserve the quality and freshness of produce. These technologies not only enhance the texture and flavor of frozen fruits and vegetables but also extend their shelf life, making them more appealing to consumers. As a result, manufacturers are increasingly investing in state-of-the-art freezing equipment to improve their processing capabilities. This trend is expected to drive market growth, as higher quality products are likely to attract more consumers. Furthermore, the adoption of these technologies may lead to cost efficiencies in production, which could positively impact the pricing strategies within the Frozen Fruit and Vegetable Processing Market.

Rising Demand for Convenience Foods

The increasing consumer preference for convenience foods is a notable driver in the Frozen Fruit and Vegetable Processing Market. Busy lifestyles and the need for quick meal solutions have led to a surge in demand for frozen fruits and vegetables, which offer ease of preparation without compromising nutritional value. According to recent data, the convenience food sector is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years. This trend indicates that consumers are increasingly opting for frozen options that can be easily incorporated into meals, thereby driving the growth of the Frozen Fruit and Vegetable Processing Market. As a result, manufacturers are focusing on enhancing their product offerings to cater to this demand, which may further stimulate market expansion.

Growing Popularity of Plant-Based Diets

The growing popularity of plant-based diets is emerging as a significant driver for the Frozen Fruit and Vegetable Processing Market. As more consumers adopt vegetarian and vegan lifestyles, the demand for frozen fruits and vegetables is likely to increase. These products serve as essential components in plant-based meals, providing necessary nutrients and variety. Market data suggests that the plant-based food sector is experiencing rapid growth, with projections indicating a potential increase in sales by over 20% in the coming years. This trend not only reflects changing dietary preferences but also highlights the importance of frozen produce in meeting the needs of health-conscious consumers. Consequently, the Frozen Fruit and Vegetable Processing Market is expected to benefit from this shift, as manufacturers adapt their offerings to cater to the rising demand for plant-based options.

Increased Awareness of Nutritional Benefits

There is a growing awareness among consumers regarding the nutritional benefits of frozen fruits and vegetables, which serves as a significant driver for the Frozen Fruit and Vegetable Processing Market. Research indicates that frozen produce retains most of its vitamins and minerals, making it a healthy alternative to fresh options that may lose nutrients over time. This awareness is leading to a shift in consumer purchasing behavior, with many opting for frozen varieties to ensure they are consuming nutrient-rich foods. The market for frozen fruits and vegetables is expected to witness a steady growth rate, as health-conscious consumers increasingly prioritize nutrition in their dietary choices. This trend not only supports the expansion of the Frozen Fruit and Vegetable Processing Market but also encourages producers to innovate and improve their processing techniques to maintain the quality of their products.