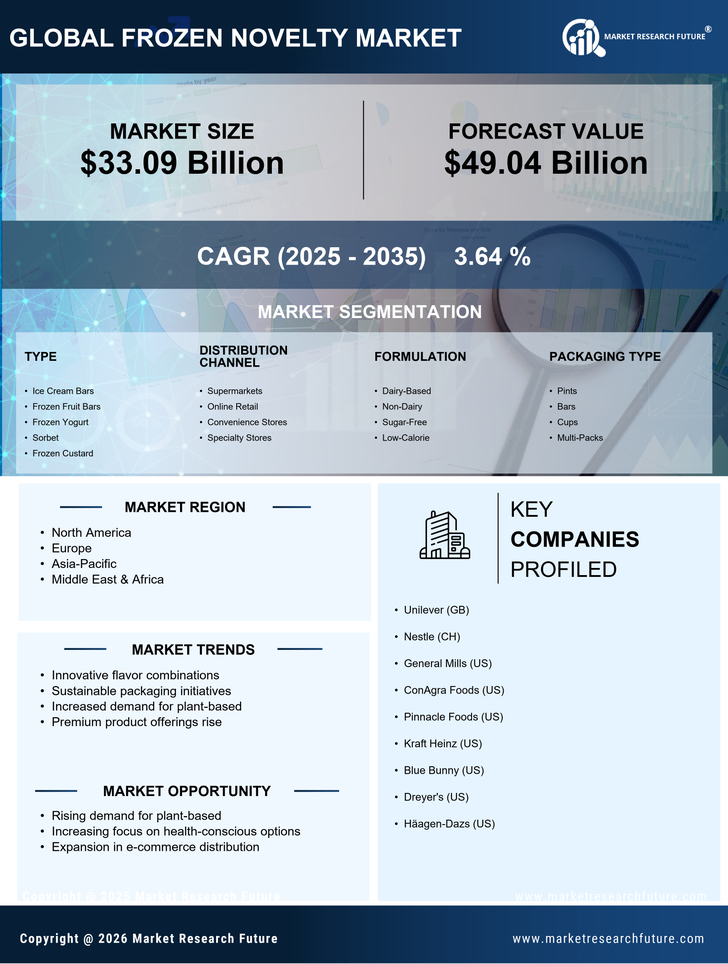

Health and Wellness Trends

The increasing focus on health and wellness significantly influences the frozen novelty Market, as consumers become more discerning about their food choices. There is a growing demand for frozen novelties that align with health-conscious lifestyles, such as low-calorie, low-sugar, and organic options. Market Research Future indicates that products labeled as healthy or functional are experiencing a growth rate of approximately 5% annually. This trend reflects a broader societal shift towards healthier eating habits, prompting manufacturers to reformulate existing products and develop new offerings that cater to these preferences. The Frozen Novelty Market must navigate this evolving landscape by balancing indulgence with health, ensuring that consumers can enjoy their favorite treats without compromising their wellness goals.

Growing E-commerce Channels

The rise of e-commerce has transformed the Frozen Novelty Market, providing consumers with greater access to a wide range of products. Online grocery shopping has gained popularity, allowing consumers to conveniently order frozen novelties from the comfort of their homes. Recent statistics reveal that online grocery sales have increased by over 30%, indicating a shift in shopping behavior. This trend presents opportunities for manufacturers to expand their distribution channels and reach a broader audience. Furthermore, e-commerce platforms often facilitate the introduction of niche products that may not be available in traditional retail settings. As the Frozen Novelty Market adapts to this digital landscape, it is likely to see continued growth driven by the convenience and accessibility of online shopping.

Seasonal Demand Fluctuations

The Frozen Novelty Market is subject to seasonal demand fluctuations, which can significantly impact sales and inventory management. During warmer months, the demand for frozen treats typically peaks, as consumers seek refreshing options to combat the heat. Data indicates that sales of frozen novelties can increase by as much as 30% during summer months compared to winter. This seasonal trend necessitates strategic planning by manufacturers and retailers to ensure adequate supply during peak periods. Additionally, holiday seasons often see spikes in demand for specialty frozen novelties, such as festive ice cream flavors. Understanding these seasonal patterns is essential for stakeholders in the Frozen Novelty Market to optimize their offerings and maximize revenue.

Innovative Product Development

Innovation plays a crucial role in the Frozen Novelty Market, as manufacturers continuously strive to introduce new and exciting products. The introduction of unique flavors, textures, and formats has the potential to attract a diverse consumer base. For instance, the emergence of plant-based frozen novelties has gained traction, appealing to health-conscious consumers and those with dietary restrictions. Market data suggests that the plant-based segment is expected to grow by over 20% in the coming years, reflecting a shift in consumer preferences. This focus on innovative product development not only enhances the variety available in the Frozen Novelty Market but also encourages brand loyalty as consumers seek out the latest offerings.

Rising Demand for Convenience Foods

The Frozen Novelty Market experiences a notable surge in demand for convenience foods, driven by the fast-paced lifestyles of consumers. As individuals seek quick and easy meal solutions, frozen novelties, such as ice cream bars and frozen desserts, become increasingly appealing. According to recent data, the convenience food sector has shown a growth rate of approximately 4.5% annually, indicating a strong consumer preference for ready-to-eat options. This trend is particularly pronounced among busy families and working professionals who prioritize time-saving products. The Frozen Novelty Market is thus positioned to capitalize on this demand, offering a variety of frozen treats that cater to the need for convenience without compromising on taste or quality.