Market Trends

Key Emerging Trends in the Gas Separation Membrane Market

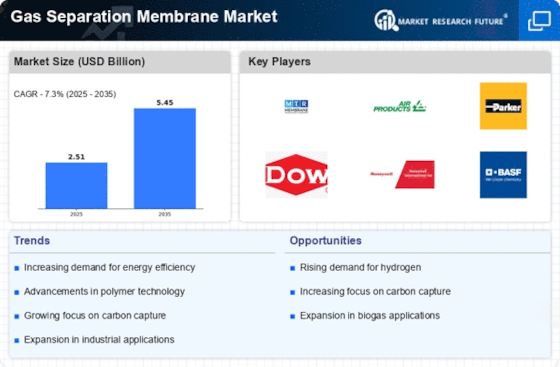

The market for gas separation membranes is exhibiting significant trends that are influenced by the growing need for effective gas separation technologies in a variety of sectors. In order to make wise decisions and maintain their competitiveness in this changing market, industry participants must have a thorough understanding of these developments. Growing Uses in Industry: Demand for Gas Separation Membranes is rising in a number of different industrial areas. Gas separation membrane technologies are being progressively used by industries including petrochemicals, chemical manufacture, and natural gas processing in order to improve process efficiency. Gas separation membranes are widely used in industrial applications because of their capacity to filter and separate gases in a selective manner. This ability is crucial for processes like nitrogen production and gas sweetening. Growing Emphasis on Green technology: The gas separation membrane market is seeing a trend toward green technology as a result of a global push toward sustainable practices. When compared to conventional separation techniques, membrane-based gas separation is seen to be a more ecologically friendly option. The adoption of these technologies is fueled by the lower energy consumption and greenhouse gas emissions linked to gas separation membranes, which are in line with the sustainability goals of many companies. Progress in Membrane Substances: The performance and durability of membrane materials are being improved by ongoing research and development initiatives. A key advancement in the gas separation membrane industry is the creation of new materials with enhanced permeability and selectivity. The endurance of composite materials and polymer-based membranes under challenging working circumstances is drawing notice because it enhances the dependability and durability of gas separation systems. Growing Need for Biogas Upgrades: Gas separation membranes are becoming more and more necessary in biogas upgrading procedures as the world turns its attention to renewable energy sources, especially biogas. Membrane technologies are essential for purging contaminants and improving biogas to fulfill quality requirements. Applications for biogas upgrading and purification are expected to drive further expansion in the gas separation membrane market as long as governments and businesses continue to invest in renewable energy sources.

Leave a Comment