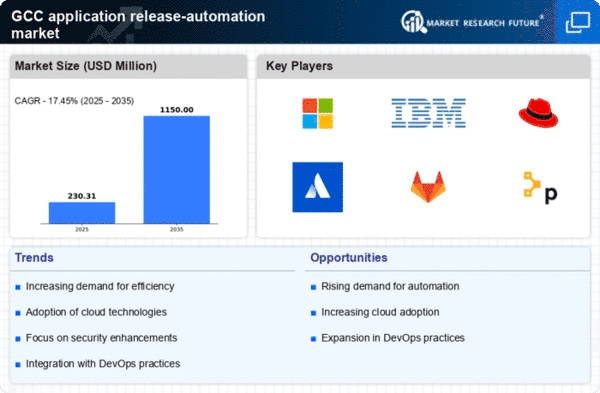

The application release-automation market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for faster and more efficient software delivery processes. Key players such as Microsoft (US), IBM (US), and Atlassian (AU) are strategically positioning themselves through innovation and partnerships. Microsoft (US) focuses on integrating its Azure DevOps services with advanced AI capabilities, enhancing automation and streamlining workflows. IBM (US) emphasizes its hybrid cloud solutions, which facilitate seamless application deployment across various environments, thereby appealing to enterprises seeking flexibility. Atlassian (AU) continues to enhance its collaboration tools, integrating them with release automation features to foster team productivity and efficiency. Collectively, these strategies shape a competitive environment that prioritizes technological advancement and customer-centric solutions.

In terms of business tactics, companies are increasingly localizing their operations to better serve regional markets, optimizing supply chains to reduce costs and improve service delivery. The market appears moderately fragmented, with several players vying for market share, yet the influence of major companies remains substantial. This competitive structure allows for innovation to flourish, as smaller firms often drive niche advancements that larger players may adopt.

In October 2025, Microsoft (US) announced a significant upgrade to its Azure DevOps platform, incorporating machine learning algorithms to enhance predictive analytics for release management. This strategic move is likely to position Microsoft (US) as a leader in the automation space, as it enables organizations to anticipate potential deployment issues and optimize their release cycles accordingly. The integration of AI into their platform not only enhances user experience but also aligns with the broader trend of digital transformation across industries.

In September 2025, IBM (US) launched a new suite of tools aimed at automating the deployment of applications in hybrid cloud environments. This initiative underscores IBM's commitment to providing flexible solutions that cater to the diverse needs of modern enterprises. By facilitating smoother transitions between on-premises and cloud-based applications, IBM (US) strengthens its competitive edge, particularly among businesses navigating complex IT landscapes.

In August 2025, Atlassian (AU) expanded its partnership with GitLab (US) to integrate their respective platforms more deeply, allowing for enhanced collaboration between development and operations teams. This collaboration is strategically significant as it not only broadens Atlassian's market reach but also enhances GitLab's capabilities in release automation, creating a more cohesive ecosystem for users. Such partnerships are indicative of a trend where companies are increasingly recognizing the value of interoperability in driving customer satisfaction and operational efficiency.

As of November 2025, the competitive trends in the application release-automation market are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies seek to leverage each other's strengths to enhance their offerings. The competitive differentiation is likely to evolve from traditional price-based competition towards a focus on innovation, technological advancements, and supply chain reliability. This shift suggests that companies that prioritize these aspects will be better positioned to thrive in an increasingly complex market.