Emergence of Insurtech Startups

The blockchain insurance market is witnessing the emergence of insurtech startups that leverage blockchain technology to disrupt traditional insurance models. These startups are introducing innovative solutions that cater to the unique needs of consumers in the GCC. By offering personalized products and streamlined processes, they are challenging established insurers to adapt or risk losing market share. The influx of insurtech firms is expected to drive competition, potentially leading to a 35% increase in product offerings within the blockchain insurance market. This dynamic environment encourages traditional insurers to collaborate with startups, fostering a culture of innovation. As a result, the blockchain insurance market is likely to evolve rapidly, with new entrants reshaping the landscape.

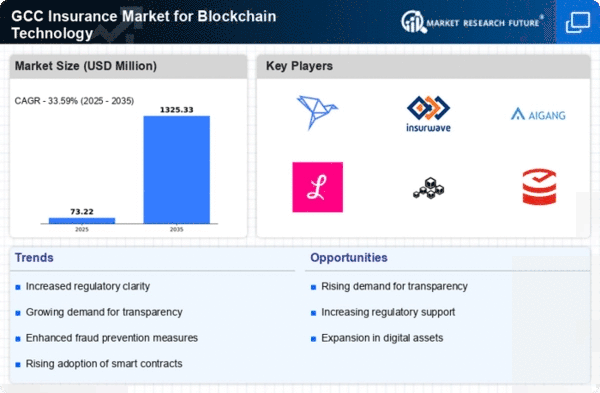

Growing Demand for Transparency

In the blockchain insurance market, there is a growing demand for transparency among consumers and businesses alike. Stakeholders are increasingly seeking solutions that provide clear visibility into policy terms, claims processes, and payouts. This demand is particularly pronounced in the GCC, where consumers are becoming more educated about their rights and the products they purchase. The blockchain's inherent characteristics, such as immutability and traceability, align well with this demand, potentially leading to a 25% increase in customer satisfaction levels. Insurers that leverage blockchain technology to enhance transparency may gain a competitive edge, as trust becomes a critical factor in consumer decision-making. Consequently, the blockchain insurance market is likely to expand as more companies adopt these technologies to meet consumer expectations.

Increased Focus on Cybersecurity

As the blockchain insurance market expands, the focus on cybersecurity becomes paramount. Insurers are increasingly aware of the risks associated with data breaches and cyberattacks, which can undermine consumer trust. The GCC region has seen a rise in cyber threats, prompting insurers to adopt blockchain technology as a means of enhancing data security. By utilizing decentralized systems, insurers can protect sensitive information and reduce the likelihood of fraud. This emphasis on cybersecurity may lead to a 15% increase in the adoption of blockchain solutions among insurers. Consequently, the blockchain insurance market is likely to benefit from heightened security measures, which could attract more customers seeking reliable insurance products.

Regulatory Evolution and Compliance

The blockchain insurance market is influenced by the evolving regulatory landscape in the GCC. Governments are increasingly recognizing the potential of blockchain technology to enhance compliance and reduce fraud. As regulations become more favorable, insurers are likely to invest in blockchain solutions to ensure adherence to legal requirements. This shift could lead to a 20% increase in market participation from new entrants, as regulatory clarity fosters innovation. Moreover, the establishment of regulatory frameworks specifically for blockchain applications in insurance may encourage traditional insurers to adopt these technologies. As a result, the blockchain insurance market is poised for growth, driven by a more supportive regulatory environment that encourages the integration of blockchain solutions.

Technological Advancements in Blockchain

The blockchain insurance market is experiencing a surge in technological advancements that enhance operational efficiency and transparency. Innovations such as decentralized ledgers and smart contracts are streamlining claims processing and underwriting. In the GCC, the market is projected to grow at a CAGR of 30% from 2025 to 2030, driven by these technological improvements. Insurers are increasingly adopting blockchain solutions to reduce fraud and improve customer trust. The integration of artificial intelligence with blockchain technology further enhances data analysis capabilities, allowing for more accurate risk assessments. As a result, the blockchain insurance market is likely to witness a significant transformation, enabling insurers to offer more tailored products and services to their clients.