Expansion of Healthcare Infrastructure

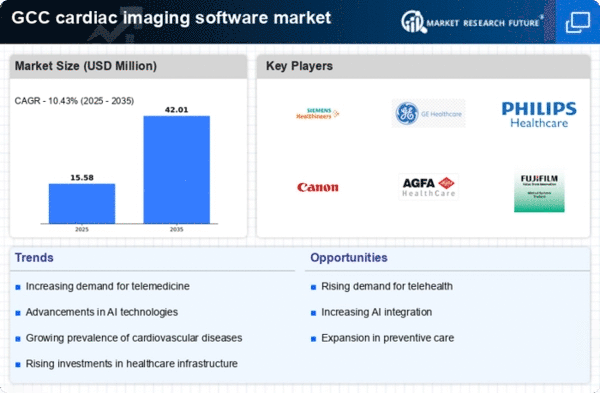

The expansion of healthcare infrastructure across the GCC is a crucial driver for the cardiac imaging-software market. Governments in the region are investing heavily in healthcare facilities, aiming to enhance service delivery and accessibility. This expansion includes the establishment of advanced diagnostic centers equipped with state-of-the-art imaging technologies. As new healthcare facilities emerge, the demand for cardiac imaging software is likely to increase, as these institutions seek to implement cutting-edge solutions to improve patient care. The GCC healthcare market is projected to reach $104 billion by 2025, indicating a robust growth environment for cardiac imaging technologies. This infrastructure development is expected to create numerous opportunities for software providers in the cardiac imaging sector.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into cardiac imaging software is transforming the landscape of diagnostics in the GCC. AI algorithms enhance image analysis, enabling faster and more accurate interpretations of cardiac conditions. This technological advancement is expected to drive the cardiac imaging-software market significantly, as healthcare providers increasingly recognize the potential of AI to improve patient outcomes. The market for AI in healthcare is projected to reach $36.1 billion by 2025, indicating a robust growth trajectory. As hospitals and clinics in the GCC adopt AI-driven solutions, the demand for sophisticated cardiac imaging software is likely to surge, reflecting a shift towards more efficient and precise healthcare delivery.

Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare in the GCC is a significant driver for the cardiac imaging-software market. As healthcare policies shift towards prevention rather than treatment, there is a heightened need for advanced imaging technologies that can identify cardiovascular risks early. This proactive approach is likely to lead to increased adoption of cardiac imaging software, as healthcare providers seek tools that facilitate routine screenings and risk assessments. The GCC governments are investing in public health initiatives aimed at reducing the burden of cardiovascular diseases, which may further stimulate demand for innovative imaging solutions. Consequently, the cardiac imaging-software market is poised for growth as preventive healthcare becomes a priority.

Growing Demand for Telemedicine Solutions

The rising demand for telemedicine solutions in the GCC is influencing the cardiac imaging-software market positively. As healthcare systems adapt to remote care models, the need for software that supports remote diagnostics and consultations is becoming critical. Telemedicine facilitates access to specialized cardiac care, particularly in underserved areas, thereby increasing the utilization of cardiac imaging software. The market for telehealth services is expected to grow at a CAGR of 25% from 2021 to 2026, highlighting the potential for cardiac imaging software to play a pivotal role in this evolving landscape. This shift towards telemedicine is likely to drive innovation and investment in cardiac imaging technologies.

Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases in the GCC region is a primary driver for the cardiac imaging-software market. As lifestyle-related health issues become more prevalent, healthcare providers are compelled to adopt advanced imaging technologies to enhance diagnostic accuracy. Reports indicate that cardiovascular diseases account for approximately 30% of all deaths in the GCC, necessitating improved imaging solutions. This trend is likely to propel investments in cardiac imaging software, as healthcare facilities seek to integrate innovative solutions that facilitate early detection and treatment. The growing awareness among the population regarding heart health further fuels demand for advanced imaging technologies, thereby expanding the cardiac imaging-software market.