Aging Population

The demographic shift towards an aging population in the GCC is likely to bolster the compression therapy market. As individuals age, they become more susceptible to various health issues, including venous disorders and circulatory problems. The World Health Organization estimates that by 2030, the number of people aged 60 and above in the GCC will double, leading to an increased demand for healthcare services, including compression therapy. This demographic trend suggests that healthcare providers will need to focus on offering specialized compression solutions to cater to the unique needs of older adults, thereby driving market growth.

Rising Healthcare Expenditure

The increasing healthcare expenditure in the GCC countries is a significant driver for the compression therapy market. Governments in the region are investing heavily in healthcare infrastructure and services, with spending projected to reach $100 billion by 2025. This investment is likely to enhance access to advanced medical treatments, including compression therapy. As healthcare facilities expand and improve, the availability of compression therapy products is expected to rise, facilitating greater adoption among patients. This trend indicates a positive outlook for the compression therapy market, as more individuals gain access to necessary therapeutic options.

Increasing Incidence of Chronic Diseases

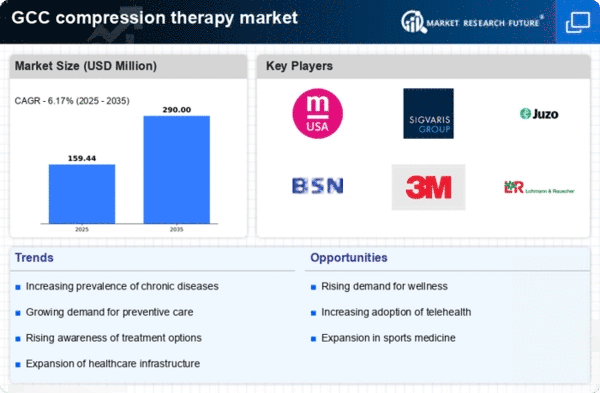

The rising prevalence of chronic diseases such as diabetes and cardiovascular disorders in the GCC region is a notable driver for the compression therapy market. As these conditions often lead to complications like venous insufficiency and lymphedema, the demand for effective treatment options is escalating. According to health statistics, the incidence of diabetes in the GCC is projected to reach 20% by 2030, which may significantly increase the need for compression therapy solutions. This trend indicates a growing market for compression garments and devices designed to alleviate symptoms associated with these chronic conditions, thereby enhancing the overall market landscape.

Growing Awareness of Preventive Healthcare

There is a noticeable shift towards preventive healthcare in the GCC, which is influencing the compression therapy market. As individuals become more health-conscious, they are increasingly seeking preventive measures to avoid chronic conditions. Compression therapy is recognized for its role in preventing venous disorders and improving circulation, making it an attractive option for health-conscious consumers. This growing awareness is likely to drive demand for compression products, as more people incorporate them into their wellness routines. The compression therapy market stands to benefit from this trend, as it aligns with the broader movement towards proactive health management.

Technological Innovations in Compression Products

Technological advancements in the design and functionality of compression therapy products are propelling the market forward. Innovations such as smart textiles and adjustable compression levels are enhancing the effectiveness and comfort of these products. The introduction of wearable technology that monitors health metrics is also gaining traction, potentially revolutionizing the way compression therapy is administered. As manufacturers invest in research and development, the compression therapy market is expected to see a surge in new and improved products. This trend indicates a dynamic market landscape, where innovation plays a crucial role in meeting the evolving needs of consumers.