Rising Demand for Customization

Customization is becoming a pivotal driver in the computer aided-design market, particularly within the GCC. As industries evolve, there is a growing need for tailored design solutions that meet specific client requirements. This trend is particularly evident in sectors such as automotive and consumer electronics, where personalized products are increasingly sought after. The ability to quickly adapt designs to meet unique specifications not only enhances customer satisfaction but also fosters innovation. Companies that leverage CAD tools to offer customized solutions are likely to capture a larger market share. The demand for customization is expected to contribute to a market growth rate of around 7% annually, reflecting the shift towards more personalized design approaches.

Government Initiatives and Investments

Government initiatives in the GCC are playing a crucial role in propelling the computer aided-design market forward. Various countries in the region are investing heavily in infrastructure and urban development projects, which necessitate advanced design capabilities. For instance, initiatives aimed at diversifying economies and promoting technological innovation are leading to increased funding for CAD-related projects. The UAE and Saudi Arabia, in particular, have launched several programs to enhance their construction and engineering sectors, which are heavily reliant on CAD technologies. This influx of investment is expected to drive market growth, with projections indicating a potential increase in market size by 10% over the next five years as these initiatives take effect.

Technological Advancements in CAD Software

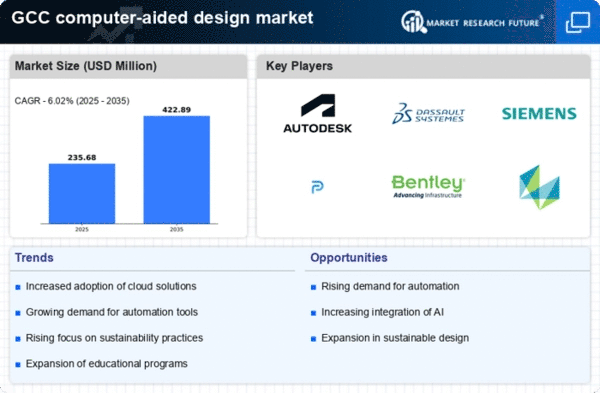

The computer aided-design market is experiencing a surge in technological advancements, particularly in the GCC region. Innovations such as 3D modeling, parametric design, and virtual reality integration are enhancing the capabilities of CAD software. These advancements allow designers to create more complex and accurate models, thereby improving efficiency and reducing errors. The market for CAD software in the GCC is projected to grow at a CAGR of approximately 8% from 2025 to 2030. This growth is driven by the increasing demand for sophisticated design tools across various industries, including architecture, engineering, and manufacturing. As companies seek to optimize their design processes, the adoption of advanced CAD solutions is likely to become a critical factor in maintaining competitive advantage.

Integration of Sustainable Practices in Design

Sustainability is increasingly influencing the computer aided-design market, particularly in the GCC. As environmental concerns gain prominence, designers are seeking ways to incorporate sustainable practices into their workflows. This includes using CAD tools to optimize resource usage, minimize waste, and create energy-efficient designs. The push for sustainability is not only driven by regulatory requirements but also by consumer demand for eco-friendly products. Companies that adopt sustainable design practices are likely to enhance their market position and appeal to a broader audience. The integration of sustainability in design is projected to contribute to a market growth rate of around 5% over the next few years. This is due to more organizations recognizing the importance of environmentally responsible design.

Increased Focus on Training and Skill Development

The computer aided-design market is witnessing an increased focus on training and skill development, particularly in the GCC region. As the demand for skilled CAD professionals rises, educational institutions and companies are investing in training programs to equip individuals with the necessary skills. This emphasis on education is crucial, as the effectiveness of CAD tools is heavily dependent on the proficiency of the users. Enhanced training programs are likely to lead to a more competent workforce, which in turn can drive innovation and efficiency in design processes. The market for CAD training services is expected to grow by approximately 6% annually, reflecting the ongoing commitment to developing talent in this field.