Growing Aesthetic Dentistry

The increasing focus on aesthetic dentistry is influencing the dental suture market positively. As more individuals seek cosmetic dental procedures, the need for sutures that provide optimal healing and minimal scarring becomes paramount. The aesthetic dentistry segment is anticipated to grow at a notable rate, with a projected increase of around 8% in the coming years. This trend is likely to drive demand for high-quality sutures that meet the specific requirements of cosmetic procedures. Consequently, manufacturers in the dental suture market are expected to innovate and develop products that align with the evolving preferences of both dental professionals and patients.

Rising Geriatric Population

The growing geriatric population in the GCC region is a significant driver for the dental suture market. Older adults often require various dental procedures due to age-related dental issues, which increases the demand for effective suturing solutions. It is estimated that the geriatric population in GCC will reach approximately 20% of the total population by 2030. This demographic shift is likely to create a sustained demand for dental services, thereby boosting the dental suture market. As dental practitioners cater to the unique needs of older patients, the focus on high-quality sutures that promote healing and reduce complications will become increasingly important.

Increasing Dental Procedures

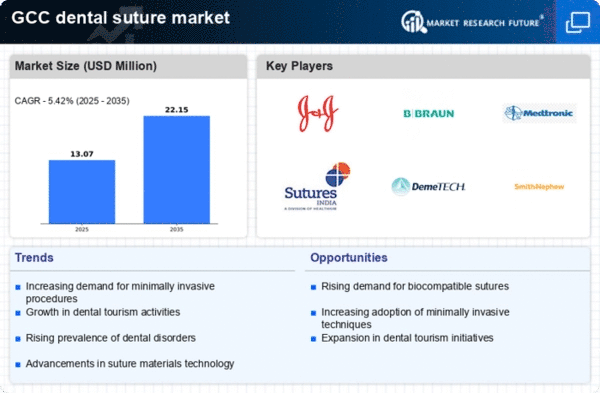

The rising number of dental procedures performed in the GCC region is driving growth.. Factors such as an increase in dental awareness and the prevalence of dental diseases contribute to this trend. According to recent data, the dental industry in GCC is projected to grow at a CAGR of approximately 7% over the next few years. This surge in dental procedures necessitates the use of effective suturing materials, thereby driving demand in the dental suture market. As dental professionals seek reliable and efficient sutures for various surgical applications, the market is likely to expand further, reflecting the growing need for quality dental care.

Advancements in Surgical Techniques

Innovations in surgical techniques are significantly impacting the dental suture market. As dental practitioners adopt minimally invasive procedures, the demand for specialized sutures that cater to these techniques is increasing. The introduction of advanced suturing materials, such as those with enhanced tensile strength and biocompatibility, is becoming more prevalent. This shift towards sophisticated surgical methods is expected to propel the dental suture market forward. Furthermore, the GCC region is witnessing a rise in dental clinics equipped with state-of-the-art technology, which may further enhance the adoption of advanced suturing solutions.

Regulatory Support for Dental Innovations

Regulatory bodies in the GCC region are increasingly supporting innovations in dental products, including sutures. This support is crucial for the dental suture market, as it encourages manufacturers to invest in research and development. The introduction of new materials and technologies is often facilitated by favorable regulations, which can expedite the approval process for new suturing products. As a result, the market is likely to see a surge in innovative sutures that enhance patient outcomes. This regulatory environment may also foster collaboration between dental professionals and manufacturers, further driving advancements in the dental suture market.

Leave a Comment