Rising Consumer Awareness

Consumer awareness regarding drug safety and efficacy is on the rise in the GCC, influencing the pharmaceutical analytical-testing-outsourcing market. As patients become more informed about their treatment options, they demand transparency and assurance regarding the quality of pharmaceuticals. This trend is prompting pharmaceutical companies to invest in comprehensive testing and validation processes, often outsourcing these functions to specialized laboratories. In 2025, it is estimated that consumer-driven demand for quality assurance will lead to a 20% increase in the utilization of analytical testing services. Consequently, the pharmaceutical analytical-testing-outsourcing market is likely to expand as companies respond to heightened consumer expectations.

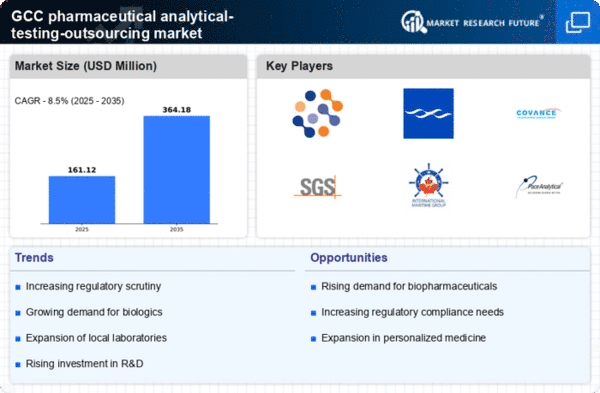

Increasing Investment in R&D

The pharmaceutical analytical-testing-outsourcing market is experiencing a surge in investment directed towards research and development (R&D). This trend is particularly pronounced in the GCC region, where governments and private entities are allocating substantial funds to enhance pharmaceutical innovation. In 2025, R&D spending in the GCC is projected to reach approximately $5 billion, reflecting a growing commitment to developing new drugs and therapies. This influx of capital is likely to drive demand for analytical testing services, as companies seek to ensure the efficacy and safety of their products. Consequently, the pharmaceutical analytical-testing-outsourcing market is poised for growth, as outsourcing testing services becomes a strategic approach for firms aiming to optimize their R&D processes while managing costs effectively.

Growing Regulatory Frameworks

The evolving regulatory landscape in the GCC is a key driver for the pharmaceutical analytical-testing-outsourcing market. Regulatory bodies are increasingly implementing stringent guidelines to ensure the safety and efficacy of pharmaceutical products. In 2025, it is anticipated that compliance costs for pharmaceutical companies will rise by approximately 15%, prompting many to outsource analytical testing to specialized firms. This shift allows companies to focus on core competencies while ensuring adherence to regulatory requirements. As a result, the demand for analytical testing services is likely to increase, positioning the pharmaceutical analytical-testing-outsourcing market for sustained growth in the face of evolving compliance challenges.

Technological Integration in Testing

The integration of advanced technologies in analytical testing processes is transforming the pharmaceutical analytical-testing-outsourcing market. Innovations such as artificial intelligence, machine learning, and automation are enhancing the efficiency and accuracy of testing procedures. In 2025, it is projected that the adoption of these technologies will increase by 25% among testing laboratories in the GCC. This technological advancement not only streamlines operations but also reduces turnaround times for testing results, making outsourcing an attractive option for pharmaceutical companies. As a result, the pharmaceutical analytical-testing-outsourcing market is expected to grow, driven by the demand for faster and more reliable testing solutions.

Expansion of Biopharmaceutical Sector

The biopharmaceutical sector is expanding rapidly within the GCC, contributing significantly to the pharmaceutical analytical-testing-outsourcing market. As biopharmaceutical companies emerge and grow, the need for specialized analytical testing services becomes increasingly critical. In 2025, the biopharmaceutical market in the GCC is expected to account for over 30% of the total pharmaceutical market, necessitating advanced testing capabilities to meet regulatory standards. This expansion is likely to drive outsourcing as companies seek to leverage the expertise of specialized testing laboratories. The pharmaceutical analytical-testing-outsourcing market is thus positioned to benefit from this trend, as firms look to ensure compliance and quality in their biopharmaceutical products.