Increasing Regulatory Scrutiny

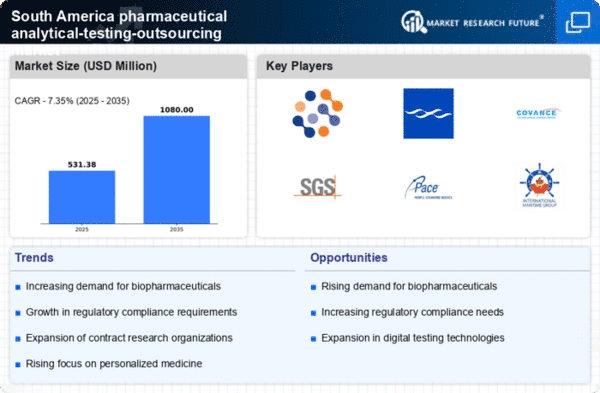

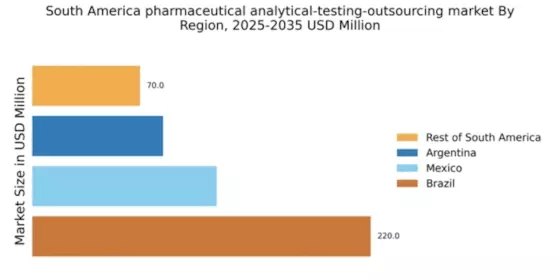

The pharmaceutical analytical-testing-outsourcing market in South America is experiencing heightened regulatory scrutiny, which is driving demand for compliance testing services. Regulatory bodies are enforcing stricter guidelines to ensure drug safety and efficacy, compelling pharmaceutical companies to outsource analytical testing to specialized firms. This trend is particularly evident in Brazil and Argentina, where regulatory frameworks are evolving rapidly. As a result, the market for analytical testing services is projected to grow at a CAGR of approximately 8% over the next five years. Companies are increasingly seeking outsourcing partners that can navigate complex regulatory landscapes, thereby enhancing the overall quality and reliability of their products.

Expansion of Pharmaceutical R&D

The pharmaceutical analytical-testing-outsourcing market in South America is significantly influenced by the expansion of research and development (R&D) activities. With an increasing number of pharmaceutical companies investing in R&D, there is a growing need for specialized analytical testing services to support drug development processes. In 2025, it is estimated that R&D expenditures in the region will reach approximately $5 billion, reflecting a robust growth trajectory. This surge in investment is likely to create opportunities for outsourcing analytical testing, as companies seek to leverage external expertise to accelerate their product development timelines and reduce costs.

Growing Focus on Quality Assurance

Quality assurance is becoming a paramount concern within the pharmaceutical analytical-testing-outsourcing market in South America. As competition intensifies, companies are prioritizing the need for reliable and accurate testing services to ensure product integrity. This focus on quality is driving pharmaceutical firms to partner with outsourcing providers that adhere to stringent quality standards and certifications. In 2025, it is anticipated that the demand for quality assurance testing will account for approximately 40% of the total analytical testing market in the region. This trend highlights the critical role of outsourcing in maintaining high-quality standards in pharmaceutical products.

Emergence of Biologics and Biosimilars

The rise of biologics and biosimilars is reshaping the pharmaceutical analytical-testing-outsourcing market in South America. As the demand for these complex therapies increases, pharmaceutical companies are turning to outsourcing partners for specialized analytical testing services that can ensure the quality and safety of these products. The market for biosimilars in South America is projected to grow at a CAGR of 15% through 2027, indicating a substantial opportunity for analytical testing firms. This trend underscores the necessity for advanced testing methodologies and regulatory compliance, further driving the outsourcing of analytical services.

Cost Efficiency and Resource Optimization

Cost efficiency remains a critical driver for the pharmaceutical analytical-testing-outsourcing market in South America. Companies are increasingly recognizing the financial benefits of outsourcing analytical testing services rather than maintaining in-house capabilities. By leveraging external expertise, pharmaceutical firms can optimize their resources and focus on core competencies, ultimately enhancing their operational efficiency. It is estimated that outsourcing can reduce testing costs by up to 30%, making it an attractive option for companies looking to streamline their operations. This trend is likely to continue as firms seek to balance quality with cost-effectiveness in their analytical testing strategies.