Rising Compliance Requirements

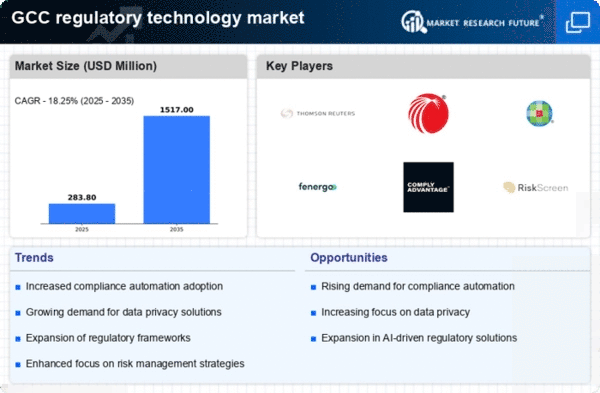

The regulatory technology market is experiencing a surge in demand due to the increasing complexity of compliance requirements across various sectors in the GCC. Governments are implementing stricter regulations to ensure transparency and accountability, which necessitates advanced technological solutions. For instance, the financial sector is witnessing a notable rise in compliance costs, estimated to reach $10 billion by 2026. This trend compels organizations to invest in regulatory technology to streamline compliance processes and mitigate risks associated with non-compliance. As a result, the regulatory technology market is poised for substantial growth, driven by the need for efficient compliance management solutions.

Growing Demand for Transparency

The regulatory technology market is increasingly influenced by the growing demand for transparency from stakeholders, including consumers, investors, and regulatory bodies. In the GCC, there is a heightened expectation for organizations to demonstrate accountability and ethical practices. This demand is prompting businesses to adopt regulatory technology solutions that enhance transparency in their operations. The market for transparency-focused compliance solutions is projected to grow by 20% over the next few years. As organizations strive to meet these expectations, the regulatory technology market is likely to expand, driven by the need for tools that facilitate transparent reporting and compliance.

Emergence of Fintech Innovations

The emergence of fintech innovations is reshaping the regulatory technology market in the GCC. As fintech companies proliferate, they are introducing novel business models that challenge traditional regulatory frameworks. This dynamic environment necessitates the development of regulatory technology solutions that can adapt to the unique challenges posed by fintech. The regulatory technology market is expected to witness a growth rate of 15% annually, driven by the need for compliance solutions tailored to the fintech sector. This trend highlights the importance of regulatory technology in ensuring that innovative financial services operate within established regulatory boundaries.

Digital Transformation Initiatives

The ongoing digital transformation initiatives across the GCC are significantly impacting the regulatory technology market. Organizations are increasingly adopting digital solutions to enhance operational efficiency and improve regulatory compliance. The GCC region is projected to invest approximately $30 billion in digital transformation by 2025, which includes investments in regulatory technology. This shift towards digitalization is fostering innovation in compliance solutions, enabling businesses to adapt to evolving regulations more effectively. Consequently, the regulatory technology market is likely to expand as companies seek to leverage technology to navigate the complexities of regulatory frameworks.

Increased Focus on Risk Management

The regulatory technology market is benefiting from an intensified focus on risk management within organizations in the GCC. As businesses face growing uncertainties and potential regulatory penalties, there is a pressing need for robust risk assessment and management tools. The market for risk management solutions is expected to grow at a CAGR of 12% over the next five years. This trend indicates that organizations are prioritizing the implementation of regulatory technology to enhance their risk management capabilities. By adopting advanced analytics and reporting tools, companies can better identify, assess, and mitigate risks associated with regulatory compliance.

Leave a Comment