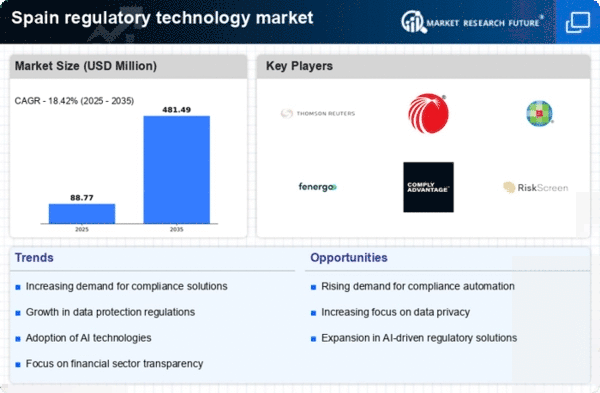

The regulatory technology market in Spain is characterized by a dynamic competitive landscape, driven by increasing regulatory complexities and the demand for compliance solutions. Key players such as Thomson Reuters (CA), LexisNexis (US), and Wolters Kluwer (NL) are at the forefront, leveraging their extensive resources to innovate and expand their offerings. Thomson Reuters (CA) focuses on integrating advanced analytics into its compliance solutions, enhancing user experience and operational efficiency. Meanwhile, LexisNexis (US) emphasizes partnerships with local firms to tailor its services to the unique regulatory environment in Spain, thereby strengthening its market position. Wolters Kluwer (NL) adopts a strategy of continuous digital transformation, investing in AI-driven tools to streamline compliance processes, which collectively shapes a competitive environment that is increasingly reliant on technological advancement.

The market structure appears moderately fragmented, with a mix of established players and emerging startups. Key business tactics include localizing services to meet regional regulatory requirements and optimizing supply chains to enhance service delivery. The influence of major players is significant, as they set industry standards and drive innovation, while smaller firms often focus on niche markets or specialized solutions, creating a diverse competitive landscape.

In September 2025, Thomson Reuters (CA) announced a strategic partnership with a leading Spanish fintech firm to develop a new compliance platform tailored for the local market. This collaboration is likely to enhance Thomson Reuters' ability to provide customized solutions, thereby increasing its competitive edge in Spain. The partnership underscores the importance of local insights in developing effective regulatory technology solutions.

In October 2025, LexisNexis (US) launched a new AI-powered compliance tool designed specifically for the Spanish banking sector. This tool aims to automate the monitoring of regulatory changes and streamline reporting processes. The introduction of this tool indicates LexisNexis' commitment to leveraging technology to address the evolving needs of its clients, potentially positioning it as a leader in compliance automation within the region.

In August 2025, Wolters Kluwer (NL) expanded its operations in Spain by acquiring a local compliance software provider. This acquisition is expected to enhance Wolters Kluwer's product offerings and market reach, allowing it to better serve its clients with localized solutions. The move reflects a broader trend of consolidation in the regulatory technology market, as companies seek to strengthen their portfolios and enhance their competitive positioning.

As of November 2025, current trends in the regulatory technology market include a strong emphasis on digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the competitive landscape, enabling companies to pool resources and expertise to deliver more comprehensive solutions. Looking ahead, competitive differentiation is likely to evolve, with a shift from price-based competition to a focus on innovation, technological advancement, and supply chain reliability. This transition suggests that companies that prioritize these aspects will be better positioned to thrive in an increasingly complex regulatory environment.

Leave a Comment