Expansion of Smart Infrastructure

The expansion of smart infrastructure in the GCC is significantly influencing the satellite enabled-iot-software market. As cities evolve into smart urban environments, the integration of satellite technology becomes essential for managing resources efficiently. This includes applications in traffic management, waste management, and energy distribution, where satellite-enabled IoT software can provide real-time data and analytics. The GCC region is investing heavily in smart city projects, with expenditures expected to reach $100 billion by 2025. Such investments are likely to drive demand for satellite-enabled solutions that can support the complex needs of urban management and enhance the quality of life for residents.

Rising Demand for Remote Monitoring

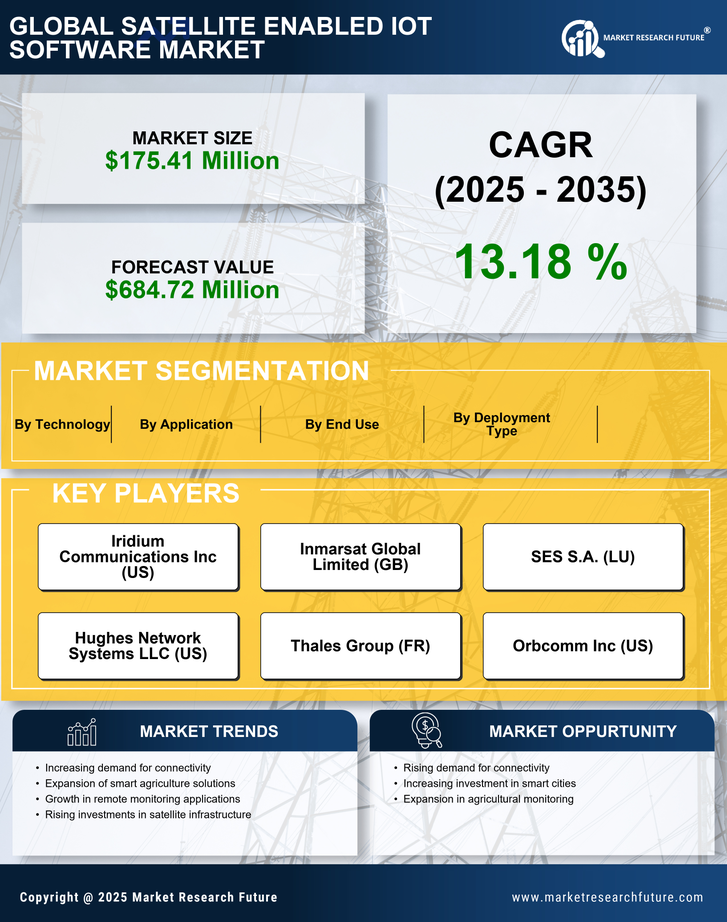

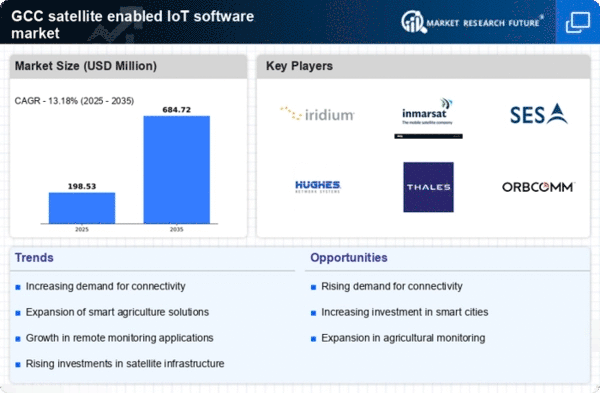

The satellite enabled-iot-software market is experiencing a surge in demand for remote monitoring solutions across various sectors in the GCC. Industries such as agriculture, oil and gas, and logistics are increasingly adopting these technologies to enhance operational efficiency and ensure real-time data access. For instance, the agricultural sector is leveraging satellite-enabled IoT software to monitor crop health and soil conditions, which can lead to improved yields. According to recent estimates, the market for remote monitoring solutions in the GCC is projected to grow at a CAGR of approximately 15% over the next five years. This trend indicates a robust appetite for innovative solutions that can provide critical insights and facilitate better decision-making in remote and challenging environments.

Advancements in Satellite Technology

Advancements in satellite technology are significantly shaping the satellite enabled-iot-software market. Innovations such as miniaturized satellites and improved data transmission capabilities are enabling more efficient and cost-effective solutions. The emergence of low Earth orbit (LEO) satellite constellations is particularly noteworthy, as they promise to enhance connectivity and reduce latency for IoT applications. In the GCC, the adoption of these technologies is expected to accelerate, with investments in satellite infrastructure projected to exceed $5 billion by 2027. This technological evolution is likely to create new opportunities for businesses to leverage satellite-enabled IoT solutions, thereby driving market growth and expanding the range of applications available.

Government Initiatives and Investments

Government initiatives in the GCC are playing a pivotal role in the growth of the satellite enabled-iot-software market. Various national strategies emphasize the importance of digital transformation and smart technologies, which include substantial investments in satellite communications infrastructure. For example, the UAE's Vision 2021 aims to enhance the country's technological capabilities, thereby fostering an environment conducive to the adoption of satellite-enabled IoT solutions. Furthermore, funding for research and development in this sector is expected to increase, potentially leading to advancements in software capabilities and applications. This supportive regulatory framework is likely to stimulate market growth, as public and private sectors collaborate to harness the benefits of satellite technology.

Increased Focus on Security and Surveillance

The satellite enabled-iot-software market is witnessing an increased focus on security and surveillance applications, particularly in the GCC. With rising concerns over safety and security, governments and businesses are seeking advanced solutions to monitor critical infrastructure and public spaces. Satellite technology offers unique advantages in this regard, providing extensive coverage and real-time data transmission capabilities. The market for security applications is projected to grow by approximately 20% annually, as organizations invest in satellite-enabled IoT solutions to enhance their surveillance capabilities. This trend indicates a growing recognition of the importance of integrating satellite technology into security frameworks to ensure comprehensive monitoring and response strategies.