Advancements in Satellite Technology

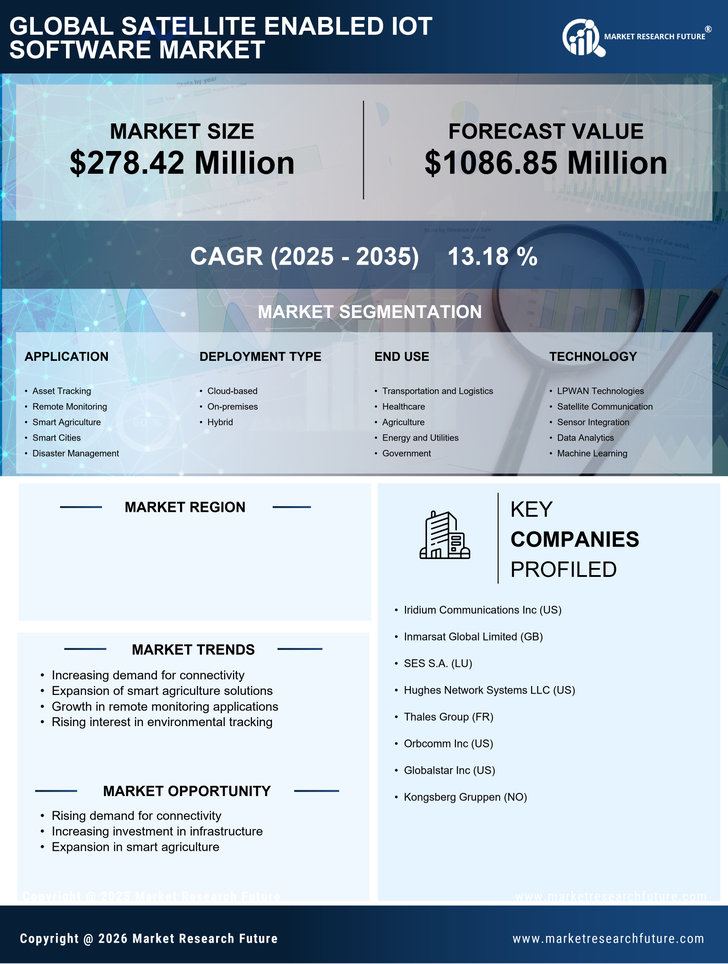

Technological advancements in satellite systems are significantly influencing the satellite enabled-iot-software market in Germany. Innovations such as miniaturized satellites and enhanced data transmission capabilities are enabling more efficient and cost-effective solutions. These advancements allow for improved connectivity in remote areas, which is particularly beneficial for industries like maritime and transportation. The introduction of low Earth orbit (LEO) satellites is expected to revolutionize the market by providing lower latency and higher bandwidth, thus enhancing the performance of IoT applications. As a result, the satellite enabled-iot-software market is projected to grow at a compound annual growth rate (CAGR) of around 12% over the next five years, driven by these technological improvements.

Rising Interest in Smart City Initiatives

The satellite enabled-iot-software market is poised to benefit from the rising interest in smart city initiatives across Germany. Urban areas are increasingly leveraging satellite technology to enhance infrastructure management, traffic monitoring, and public safety. For example, satellite-enabled IoT solutions can facilitate real-time data collection for smart traffic systems, thereby reducing congestion and improving urban mobility. The German government has allocated substantial funding for smart city projects, which is likely to stimulate demand for satellite enabled-iot-software solutions. As cities strive to become more efficient and sustainable, the market is expected to witness a growth rate of approximately 10% annually, reflecting the potential of satellite technologies in urban development.

Increased Focus on Security and Data Privacy

As the satellite enabled-iot-software market expands in Germany, there is a heightened focus on security and data privacy. With the proliferation of IoT devices, concerns regarding data breaches and unauthorized access have become paramount. Companies are increasingly investing in robust security measures to protect sensitive information transmitted via satellite networks. This trend is likely to drive the development of advanced encryption technologies and secure communication protocols within the satellite enabled-iot-software market. Furthermore, regulatory bodies are expected to impose stricter guidelines on data protection, compelling businesses to adopt comprehensive security frameworks. This emphasis on security could potentially enhance consumer trust and drive market growth, as organizations prioritize safeguarding their data.

Regulatory Support for Satellite Technologies

In Germany, regulatory frameworks are evolving to support the adoption of satellite technologies, which is positively impacting the satellite enabled-iot-software market. The government has implemented policies that encourage the use of satellite communications for various applications, including disaster management and environmental monitoring. This regulatory support is crucial as it not only facilitates the deployment of satellite infrastructure but also fosters collaboration between public and private sectors. As a result, companies in the satellite enabled-iot-software market are likely to benefit from increased funding and resources, enabling them to develop innovative solutions that comply with regulatory standards. The anticipated growth in this sector could reach €1 billion by 2027, reflecting the potential of regulatory initiatives to stimulate market expansion.

Growing Demand for Remote Monitoring Solutions

The satellite enabled-iot-software market in Germany is experiencing a surge in demand for remote monitoring solutions. Industries such as agriculture, logistics, and energy are increasingly adopting these technologies to enhance operational efficiency. For instance, the agricultural sector utilizes satellite-enabled IoT software to monitor crop health and soil conditions in real-time, leading to improved yield and resource management. According to recent data, the market for remote monitoring solutions is projected to grow by approximately 15% annually, indicating a robust trend towards the integration of satellite technology in various sectors. This growing demand is likely to drive innovation and investment in the satellite enabled-iot-software market, as companies seek to leverage satellite capabilities for enhanced data collection and analysis.